/home/grassnews/public_html/wp-content/themes/zox-news/parts/post-single.php on line 153

">

Warning: Undefined array key 0 in /home/grassnews/public_html/wp-content/themes/zox-news/parts/post-single.php on line 153

Warning: Attempt to read property "cat_name" on null in /home/grassnews/public_html/wp-content/themes/zox-news/parts/post-single.php on line 153

PGTI Reports 2019 First Quarter Results

Reading Time: 9 minutes

Reading Time: 9 minutes

First Quarter Sales Growth of $33 Million Driven by Inclusion of

Western Window Systems and Growth in Legacy New Construction Channel

VENICE, Fla.–(BUSINESS WIRE)–PGT Innovations, Inc. (NYSE: PGTI), a national leader in premium windows

and doors, including impact-resistant products and products designed to

unify indoor/outdoor living spaces, today announced financial results

for its first quarter ended March 30, 2019.

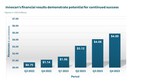

Financial Highlights for First Quarter 2019 versus First Quarter 2018

-

Net sales for the first quarter increased 24 percent, to $174 million,

including $32 million from Western Window Systems - Gross profit grew 37 percent, to $61.3 million

- Net income for the quarter grew 13 percent, to $8.3 million

-

Net income per diluted share was flat at $0.14, and adjusted net

income per diluted share of $0.16, decreased $0.03 from the prior

year; both affected by the higher number of shares outstanding,

resulting from the 2018 equity offering - Adjusted EBITDA grew 30 percent, to $28.3 million

“In the first quarter, PGT Innovations’ significant growth in sales and

EBITDA was driven by the inclusion of Western Window Systems and the

strength in our new construction channel. In our legacy markets, our

corporate builder program grew significantly versus the prior year

quarter as adoption of our impact products continues to accelerate,”

stated Jeff Jackson, President and Chief Executive Officer of PGT

Innovations.

“First quarter sales for Western Window Systems grew versus the

prior-year quarter as its penetration continued to increase in the

indoor/outdoor living market. Integration continues to remain on track,

as expected cost synergies began to be realized in the first quarter and

meaningful progress was achieved in building the infrastructure to begin

selling Western products in our legacy markets,” added Jackson.

“Despite the slight decline in the repair and remodel market overlapping

significant growth in the prior year period, we were able to deliver

solid results in the first quarter of 2019, including the growth of

Western Window Systems’ sales and EBITDA compared to its pre-acquisition

prior year period. As we enter hurricane season, we are reaffirming full

year guidance for 2019,” stated Sherri Baker, Senior Vice President and

Chief Financial Officer of PGT Innovations. “Our balance sheet remained

strong at the end of the first quarter, with cash of $45 million and a

net debt-to-adjusted EBITDA ratio, adjusted for the Western Window

Systems acquisition, of 2.2 times,” concluded Baker.

Conference Call

PGT Innovations will host a conference call on Thursday, May 2, 2019, at

10:30 a.m. The conference call will be available at the same time

through the Investor Relations section of the PGT Innovations, Inc.

website, http://ir.pgtinnovations.com/events.cfm.

To participate in the teleconference, kindly dial into the call a few

minutes before the start time: 888-205-6786 (U.S. and Canada) and

786-789-4840 (U.S.). The conference ID is 987008. Please note that these

are new dial-in phone numbers. A replay of the call will be available

within approximately two hours after the scheduled end of the call on

May 2, 2019, through 1:30 p.m. on May 9, 2019. To access the replay,

dial 888-203-1112 (U.S. and Canada) and 719-457-0820 (U.S.) and refer to

pass code 2132984.

You may also join the conference online by using the following link: https://services.choruscall.com/links/pgti190502D1RN8jkQ.html.

The webcast will also be available through the Investors section of the

PGT Innovations, Inc. website: http://ir.pgtinnovations.com/events.cfm.

About PGT Innovations, Inc.

PGT Innovations manufactures and supplies premium windows and doors. Its

highly-engineered and technically-advanced products can withstand some

of the toughest weather conditions on earth and unify indoor/outdoor

living spaces.

PGT Innovations creates value through deep customer relationships,

understanding the unstated needs of the markets it serves and a drive to

develop category-defining products. PGT Innovations is also the nation’s

largest manufacturer of impact-resistant windows and doors, holds the

leadership position in its primary markets, and is part of the S&P

SmallCap 400 Index.

The PGT Innovations’ family of brands include CGI®, PGT® Custom Windows

& Doors, WinDoor®, Western Window Systems®, CGI Commercial® and

Eze-Breeze®. The Company’s brands, in their respective markets, are a

preferred choice of architects, builders, and homeowners throughout

North America and the Caribbean. The Company’s high-quality products are

available in custom and standard sizes with multiple dimensions that

allow for greater design possibilities in residential, multi-family, and

commercial projects. For additional information, visit www.pgtinnovations.com.

Forward-Looking Statements

Statements in this press release regarding our business that are not

historical facts are “forward-looking statements” that involve risks and

uncertainties which could cause actual results to differ materially from

those contained in the forward-looking statements. Such forward-looking

statements generally can be identified by the use of forward-looking

terminology, such as “may,” “expect,” “expectations,” “outlook,”

“forecast,” “guidance,” “intend,” “believe,” “could,” “project,”

“estimate,” “anticipate,” “should,” “plan” and similar terminology.

These risks and uncertainties include factors such as:

-

adverse changes in new home starts and home repair and remodeling

trends, especially in the state of Florida, where the substantial

portion of our sales are currently generated, and in the western

United States, where the substantial portion of the sales of Western

Window Systems’ operations are generated, and in the U.S. generally; -

macroeconomic conditions in Florida, where the substantial portion of

our sales are generated, and in California, Texas, Arizona, Nevada,

Colorado, Oregon, Washington and Hawaii, where the substantial portion

of the sales of Western Window Systems are currently generated, and in

the U.S. generally; -

our level of indebtedness, which increased in connection with our

acquisition of Western Window Systems; -

the effects of increased expenses or unanticipated liabilities

incurred as a result of, or due to activities related to, the Western

Window Systems acquisition; -

the risk that the anticipated cost savings, synergies, revenue

enhancement strategies and other benefits expected from the Western

Window Systems acquisition may not be fully realized or may take

longer to realize than expected or that our actual integration costs

may exceed our estimates; -

raw material prices, especially for aluminum, glass and vinyl,

including, price increases due to the implementation of tariffs and

other trade-related restrictions; -

our dependence on a limited number of suppliers for certain of our key

materials; -

sales fluctuations to and changes in our relationships with key

customers; -

increases in bad debt owed to us by our customers in the event of a

downturn in the home repair and remodeling or new home construction

channels in our core markets and our inability to collect such debt; -

in addition to the Western Window Systems acquisition, our ability to

successfully integrate businesses we may acquire, or that any business

we acquire may not perform as we expected at the time we acquired it; -

increases in transportation costs, including due to increases in fuel

prices; -

our dependence on our impact-resistant product lines and contemporary

indoor/outdoor window and door systems, and on consumer preferences

for those types and styles of products; - product liability and warranty claims brought against us;

-

federal, state and local laws and regulations, including unfavorable

changes in local building codes and environmental and energy code

regulations; -

our dependence on our limited number of geographically concentrated

manufacturing facilities; -

risks associated with our information technology systems, including

cybersecurity-related risks, such as unauthorized intrusions into our

systems by “hackers” and theft of data and information from our

systems, and the risks that our information technology systems do not

function as intended or experience temporary or long-term failures to

perform as intended; and -

the risks and uncertainties discussed under Part I, Item 1A, “Risk

Factors” in the Company’s Annual Report on Form 10-K for the year

ended December 29, 2018.

Statements in this press release that are forward-looking statements

include, without limitation, our expectations regarding: (1) demand for

our products going forward, including the demand for our

impact-resistant products and the products of Western Window Systems;

(2) our ability to gain market share in 2019 and beyond; (3) the

Company’s ability to continue to grow its sales and earnings in 2019 and

going forward; (4) our ability to position ourselves as a national

leader in the premium window and door market, and our performance in

that market; (5) our integration of Western Windows Systems and

achievement of synergies related thereto; and (6) our financial and

operational performance for our 2019 fiscal year, including our 2019

fiscal year outlook reaffirmed and set forth in this press release. You

are cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date of this press release.

Except as required by law, the Company undertakes no obligation to

update these forward-looking statements to reflect subsequent events or

circumstances from the date of this press release.

Use of Non-GAAP Financial Measures

This press release and the financial schedules include financial

measures and terms not calculated in accordance with U.S. generally

accepted accounting principles (GAAP). We believe that presentation of

non-GAAP measures such as adjusted net income, adjusted net income per

share, and adjusted EBITDA provides investors and analysts with an

alternative method for assessing our operating results in a manner that

enables investors and analysts to more thoroughly evaluate our current

performance compared to past performance. We also believe these non-GAAP

measures provide investors with a better baseline for assessing our

future earnings potential. The non-GAAP measures included in this press

release are provided to give investors access to types of measures that

we use in analyzing our results.

Adjusted net income consists of GAAP net income adjusted for the items

included in the accompanying reconciliation. Adjusted net income per

share consists of GAAP net income per share adjusted for the items

included in the accompanying reconciliation. We believe these measures

enable investors and analysts to more thoroughly evaluate our current

performance as compared to the past performance and provide a better

baseline for assessing the Company’s future earnings potential. However,

these measures do not provide a complete picture of our operations.

Adjusted EBITDA consists of net income, adjusted for the items included

in the accompanying reconciliation. We believe that adjusted EBITDA

provides useful information to investors and analysts about the

Company’s performance because they eliminate the effects of

period-to-period changes in taxes, costs associated with capital

investments and interest expense. Adjusted EBITDA does not give effect

to the cash the Company must use to service its debt or pay its income

taxes and thus does not reflect the actual funds generated from

operations or available for capital investments.

Our calculation of adjusted net income, adjusted net income per share,

and adjusted EBITDA are not necessarily comparable to calculations

performed by other companies and reported as similarly titled measures.

These non-GAAP measures should be considered in addition to results

prepared in accordance with GAAP but should not be considered a

substitute for or superior to GAAP measures. Schedules that reconcile

adjusted net income, adjusted net income per share, and adjusted EBITDA

to GAAP net income are included in the financial schedules accompanying

this release.

Adjusted EBITDA as used in the calculation of the net debt-to-Adjusted

EBITDA ratio, consists of our adjusted EBITDA as described above, but

for the trailing twelve-month period, adjusted pursuant to the covenants

contained in the 2016 Credit Agreement due 2022 for the acquisition of

Western Window Systems.

| PGT INNOVATIONS, INC. | ||||

| CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS | ||||

| (unaudited – in thousands, except per share amounts) | ||||

| Three Months Ended | ||||

| March 30, | March 31, | |||

| 2019 | 2018 | |||

| Net sales | $ 173,737 | $ 140,253 | ||

| Cost of sales | 112,467 | 95,480 | ||

| Gross profit | 61,270 | 44,773 | ||

| Selling, general and administrative expenses | 44,014 | 28,657 | ||

| Income from operations | 17,256 | 16,116 | ||

| Interest expense, net | 6,714 | 4,043 | ||

| Debt extinguishment costs | – | 3,079 | ||

| Income before income taxes | 10,542 | 8,994 | ||

| Income tax expense | 2,285 | 1,654 | ||

| Net income | $ 8,257 | $ 7,340 | ||

| Basic net income per common share | $ 0.14 | $ 0.15 | ||

| Diluted net income per common share | $ 0.14 | $ 0.14 | ||

| Weighted average common shares outstanding: | ||||

| Basic | 58,134 | 49,858 | ||

| Diluted | 59,220 | 51,998 | ||

| PGT INNOVATIONS, INC. | |||||

| CONDENSED CONSOLIDATED BALANCE SHEETS | |||||

| (unaudited – in thousands) | |||||

| March 30, | December 29, | ||||

| 2019 | 2018 | ||||

| ASSETS | |||||

| Current assets: | |||||

| Cash and cash equivalents | $ 44,936 | $ 52,650 | |||

| Accounts receivable, net | 76,035 | 80,717 | |||

| Inventories | 47,962 | 44,666 | |||

| Contract assets, net | 9,375 | 6,757 | |||

| Prepaid expenses and other current assets | 15,812 | 10,771 | |||

| Total current assets | 194,120 | 195,561 | |||

| Property, plant and equipment, net | 120,238 | 115,707 | |||

| Operating lease right-of-use asset, net | 29,568 | – | |||

| Intangible assets, net | 267,803 | 271,818 | |||

| Goodwill | 277,827 | 277,827 | |||

| Other assets, net | 1,192 | 1,240 | |||

| Total assets | $ 890,748 | $ 862,153 | |||

| LIABILITIES AND SHAREHOLDERS’ EQUITY | |||||

| Current liabilities: | |||||

| Accounts payable and accrued expenses | $ 56,963 | $ 68,557 | |||

| Current portion of long-term debt | 87 | 163 | |||

| Current portion of operating lease liability | 7,016 | – | |||

| Total current liabilities | 64,066 | 68,720 | |||

| Long-term debt, less current portion | 367,041 | 366,614 | |||

| Operating lease liability, less current portion | 25,510 | – | |||

| Deferred income taxes, net | 23,144 | 22,758 | |||

| Other liabilities | 15,139 | 18,517 | |||

| Total liabilities | 494,900 | 476,609 | |||

| Total shareholders’ equity | 395,848 | 385,544 | |||

| Total liabilities and shareholders’ equity | $ 890,748 | $ 862,153 | |||

| PGT INNOVATIONS, INC. | ||||

|

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES TO THEIR GAAP EQUIVALENTS |

||||

|

(unaudited – in thousands, except per share amounts and percentages) |

||||

| Three Months Ended | ||||

| March 30, | March 31, | |||

| 2019 | 2018 | |||

| Reconciliation to Adjusted Net Income and | ||||

| Adjusted Net Income per share (1): | ||||

| Net income | $ 8,257 | $ 7,340 | ||

| Reconciling items: | ||||

| Product line transition costs (2) | 641 | – | ||

| Acquisition costs (3) | 650 | – | ||

| Debt extinguishment costs (4) | – | 3,079 | ||

| Facility and equipment relocation costs (5) | – | 435 | ||

| Tax effect of reconciling items | (332) | (906) | ||

| Adjusted net income | $ 9,216 | $ 9,948 | ||

| Weighted-average diluted shares | 59,220 | 51,998 | ||

| Adjusted net income per share – diluted | $0.16 | $0.19 | ||

| Reconciliation to Adjusted EBITDA (1): | ||||

| Depreciation and amortization expense | $ 8,512 | $ 4,620 | ||

| Interest expense, net | 6,714 | 4,043 | ||

| Income tax expense | 2,285 | 1,654 | ||

| Reversal of tax effect of reconciling items for | ||||

| adjusted net income above | 332 | 906 | ||

| Stock-based compensation expense | 1,198 | 514 | ||

| Adjusted EBITDA | $ 28,257 | $ 21,685 | ||

| Adjusted EBITDA as percentage of net sales | 16.3% | 15.5% | ||

|

Net debt-to-Adjusted EBITDA ratio as adjusted for Western Window |

2.2x |

|||

|

(1) The Company’s non-GAAP financial measures were explained in its Form 8-K filed May 2, 2019. |

|

(2) Represents costs relating to product line transitions, classified within cost of sales for the three months ended March 30, 2019. |

|

(3) Represents costs relating to the Western Window Systems acquisition, classified within selling, general and administrative expenses for the three months ended March 30, 2019. |

|

(4) Represents debt extinguishment costs for the three months |

|

(5) Represents costs associated with planned relocation of the CGI Windows & Doors manufacturing operations to its new facility in Miami, FL, and costs associated with machinery and equipment relocations within our glass plant operations in Venice, FL as the result of our planned disposal of certain glass manufacturing assets to Cardinal Glass Industries. Of the $435 thousand, $416 thousand is classified within cost of sales during the three months ended March 31, 2018, with the remainder classified within selling, general and administrative expenses. |

|

(6) Calculated in accordance with the covenants pursuant to the |

Contacts

Investor Relations:

Sherri Baker, 941-480-1600

Senior

Vice President and CFO

[email protected]

Media Relations:

Brent Boydston, 941-480-1600

Senior

Vice President, Corporate Sales and Marketing

[email protected]

Warning: Undefined array key 0 in /home/grassnews/public_html/wp-content/themes/zox-news/parts/post-single.php on line 493

Warning: Attempt to read property "cat_ID" on null in /home/grassnews/public_html/wp-content/themes/zox-news/parts/post-single.php on line 493

Cannabis

Investing into the creation of low-cost, solvent-free canola & hemp proteins

Cannabis

IM Cannabis Closes Convertible Debenture Offering to Support Accelerated Growth in Germany

Through continuous, active cost management, IMC reduced its annual G&A costs by 49% in 2023 and is now looking to significantly reduce its financial costs.

TORONTO and GLIL YAM, Israel, May 29, 2024 /PRNewswire/ — IM Cannabis Corp. (CSE: IMCC) (NASDAQ: IMCC) (the “Company“, “IM Cannabis“, or “IMC“), a leading medical cannabis company with operations in Israel and Germany, is pleased to announce that in order to preserve its cash for to support accelerated growth in Germany it has closed a non-brokered private placement (the “Offering“) of secured convertible debentures of the Company (each, a “Debenture“) for aggregate proceeds of $2,091,977. The Debentures are being issued to holders of short-term loans and obligations owed by the Company or its wholly owned subsidiaries. The Debentures will mature on May 26, 2025, and will not incur interest except in the event of default. The Debentures may be converted into common shares in the Company (each, a “Share“) at a conversion price of $0.85 per Share.

“Active cost management has been our focus since the beginning of 2023. Last year we concentrated on reducing our operating expenses, reducing our 2023 G&A expenses -49% vs 2022,” said Oren Shuster, CEO of IMC. “This year we looked at our financial costs. By renegotiating our debt, we expect a significant reduction in our financing costs. Our goal is to free resources to drive accelerated growth in Germany, where we currently see the biggest potential following the April 1st legalization.”

RELATED PARTY TRANSACTIONS

Oren Shuster, a director and the Chief Executive Officer of the Company (the “Insider“) has subscribed for an aggregate of $237,214 of Debentures in the Offering. The Insider’s participation in the Offering (the “Insider Transaction“) is a “related party transaction” within the meaning of Multilateral Instrument 61-101 Protection of Minority Security Holders in Special Transactions (“MI 61-101“). The Company intends to rely on the exemptions from the formal valuation and minority shareholder approval requirements of MI 61-101 under sections 5.5(a) and 5.7(1)(a) of MI 61-101 as the fair market value of the Insider Transaction does not exceed 25% of the Company’s market capitalization. As the material change report disclosing the Insider Transaction is being filed less than 21 days before the transaction, there is a requirement under MI 61–101 to explain why the shorter period was reasonable or necessary in the circumstances. In the view of the Company, it is necessary to immediately close the Insider Transaction and therefore, such shorter period is reasonable and necessary in the circumstances to improve the Company’s financial position.

EARLY WARNING REPORT

Oren Shuster will file an early warning report in accordance with National Instrument 62-104 Take-Over Bids and Issuer Bids (“NI 62-104“) and National Instrument 62-103 The Early Warning System and Related Take-Over Bid and Insider Reporting Issues (“NI 62-103“). On May 26, 2024, Mr. Shuster acquired a Debenture in the principal amount of CAD$237,214 pursuant to the Offering (the “Acquisition“), which was issued in full satisfaction of CAD$237,214 of debt owed by the Company to him.

Immediately prior to the Acquisition, Mr. Shuster beneficially owned or controlled 1,872,870 Shares, 856,704 Warrants and 131,250 Stock Options of the Company, which represented approximately 13.98% of the then outstanding shares of the Company on a non-diluted basis and 19.89% on a partially diluted basis if Mr. Shuster converted all of the convertible securities held by him. As a result of the Acquisition, Mr. Shuster now beneficially owns or controls an aggregate of 1,872,870 Shares, 856,704 Warrants, 131,250 Stock Options and a Debenture in the principal amount of CAD$237,214 of the Company (the Debenture is convertible into up to 279,075 Shares at $0.85 per Share) which represented approximately 1.8% of the Company’s issued and outstanding Shares on a non-diluted basis (based on 13,394,136 Shares issued and outstanding as of the date hereof), and 23.44% on a partially diluted basis if Mr. Shuster converted all of the convertible securities held by him.

Mr. Shuster acquired the securities for general investment purposes only. Mr. Shuster may in the future take such actions in respect of his holdings in IMC as he may deem appropriate based on his assessment of market conditions and any other conditions he considers relevant at the time, including the purchase of additional Shares through open market or privately negotiated transactions or the sale of all or a portion of his holdings in the open market or in privately negotiated transactions to one or more purchasers, subject in each case to applicable securities laws.

Since the previous early warning report filed by Mr. Shuster in respect of the Company, Mr. Shuster’s Share ownership position increased by more than 2% and Mr. Shuster acquired securities convertible into more than 2% of the issued and outstanding Shares, which triggered the requirement to file an early warning report under applicable Canadian Securities legislation (the “Early Warning Report“).

A copy of the Early Warning Report may be found at SEDAR+ at www.sedarplus.ca under IMC’s profile. For further information, or to obtain a copy of the early warning report, please contact Oren Shuster at +972-77-3603504.

About IM Cannabis Corp.

IMC (Nasdaq: IMCC) (CSE: IMCC) is an international cannabis company that provides premium cannabis products to medical patients in Israel and Germany, two of the largest medical cannabis markets. The Company has recently exited operations in Canada to pivot its focus and resources to achieve sustainable and profitable growth in its highest value markets, Israel and Germany. The Company leverages a transnational ecosystem powered by a unique data-driven approach and a globally sourced product supply chain. With an unwavering commitment to responsible growth and compliance with the strictest regulatory environments, the Company strives to amplify its commercial and brand power to become a global high-quality cannabis player.

The IMC ecosystem operates in Israel through its commercial relationship with Focus Medical Herbs Ltd., which imports and distributes cannabis to medical patients, leveraging years of proprietary data and patient insights. The Company also operates medical cannabis retail pharmacies, online platforms, distribution center, and logistical hubs in Israel that enable the safe delivery and quality control of IMC products throughout the entire value chain. In Germany, the IMC ecosystem operates through Adjupharm GmbH, where it distributes cannabis to pharmacies for medical cannabis patients. Until recently, the Company also actively operated in Canada through Trichome Financial Corp and its wholly owned subsidiaries. The Company has exited operations in Canada and considers these operations discontinued.The securities to be offered pursuant to the Offering have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act“) or any United States state securities laws, and may not be offered or sold in the United States or to, or for the account or benefit of, United States persons absent registration or any applicable exemption from the registration requirements of the U.S. Securities Act and applicable United States state securities laws. This news release shall not constitute an offer to sell or the solicitation of an offer to buy securities in the United States, nor shall there be any sale of these securities in any jurisdiction in which such offer, solicitation or sale would be unlawful.

Company Contact:

Anna Taranko, Director Investor & Public Relations

IM Cannabis Corp.

+49 157 80554338

[email protected]

Oren Shuster, CEO

IM Cannabis Corp.

+972-77-3603504

[email protected]

Forward-Looking Information and Cautionary Statements

This press release contains forward-looking information or forward-looking statements under applicable Canadian and United States securities laws (collectively, “forward-looking statements”). All information that addresses activities or developments that we expect to occur in the future are forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as “seek”, “anticipate”, “believe”, “plan”, “estimate”, “expect”, “likely” and “intend” and statements that an event or result “may”, “will”, “should”, “could” or “might” occur or be achieved and other similar expressions. Forward-looking statements are based on the estimates and opinions of management on the date the statements are made. In the press release, such forward-looking statements include, but are not limited to, statements relating to: significant reduction in our financing costs; the timing and impact of the legalization of medicinal cannabis in Germany; and the Company’s accelerated growth in Germany.

Forward-looking statements are based on assumptions that may prove to be incorrect, including but not limited to: the Company’s ability significant reduction in our financing costs; the Company’s ability to focus and resources to achieve sustainable and profitable growth in its highest value markets; the Company’s ability to mitigate the impact of the Israel-Hamas war on the Company; the Company’s ability to take advantage of the legalization of medicinal cannabis in Germany; the Company’s ability to host a teleconference meeting as stated; and the Company’s ability to carry out its stated goals, scope, and nature of operations in Germany, Israel, and other jurisdictions the Company may operate. The above lists of forward-looking statements and assumptions are not exhaustive. Since forward-looking statements address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated or implied by such forward looking statements due to a number of factors and risks. These include: the failure of the Company to comply with applicable regulatory requirements in a highly regulated industry; unexpected changes in governmental policies and regulations in the jurisdictions in which the Company operates; the Company’s ability to continue to meet the listing requirements of the Canadian Securities Exchange and the NASDAQ Capital Market; any unexpected failure to maintain in good standing or renew its licenses; the ability of the Company and its subsidiaries (collectively, the “Group”) to deliver on their sales commitments or growth objectives; the reliance of the Group on third-party supply agreements to provide sufficient quantities of medical cannabis to fulfil the Group’s obligations; the Group’s possible exposure to liability, the perceived level of risk related thereto, and the anticipated results of any litigation or other similar disputes or legal proceedings involving the Group; the impact of increasing competition; any lack of merger and acquisition opportunities; adverse market conditions; the inherent uncertainty of production quantities, qualities and cost estimates and the potential for unexpected costs and expenses; risks of product liability and other safety-related liability from the usage of the Group’s cannabis products; supply chain constraints; reliance on key personnel; the risk of defaulting on existing debt; risks surrounding war, conflict and civil unrest in Eastern Europe and the Middle East, including the impact of the Israel-Hamas war on the Company, its operations and the medical cannabis industry in Israel; risks associated with the Company focusing on the Israel and Germany markets; the inability of the Company to achieve sustainable profitability and/or increase shareholder value; the inability of the Company to actively manage costs and/or improve margins; the inability of the company to grow and/or maintain sales; the inability of the Company to meet its goals and/or strategic plans; the inability of the Company to reduce costs and/or maintain revenues; the Company’s inability to take advantage of the legalization of medicinal cannabis in Germany; and the Company’s inability to host a teleconference meeting as stated. Please see the other risks, uncertainties and factors set out under the heading “Risk Factors” in the Company’s annual report dated March 28, 2024, which is available on the Company’s issuer profile on SEDAR+ at www.sedarplus.ca and Edgar at www.sec.gov/edgar. Any forward-looking statement included in this press release is made as of the date of this press release and is based on the beliefs, estimates, expectations and opinions of management on the date such forward looking information is made. The Company does not undertake any obligation to update forward-looking statements except as required by applicable securities laws. Investors should not place undue reliance on forward-looking statements. Forward looking statements contained in this press release are expressly qualified by this cautionary statement.

Logo – https://mma.prnewswire.com/media/1742228/IM_Cannabis_Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/im-cannabis-closes-convertible-debenture-offering-to-support-accelerated-growth-in-germany-302157901.html

View original content:https://www.prnewswire.co.uk/news-releases/im-cannabis-closes-convertible-debenture-offering-to-support-accelerated-growth-in-germany-302157901.html

Announces

IMC announces the termination of a preliminary term sheet with Kadimastem Ltd., a public company traded on the Tel Aviv Stock Exchange to fully focus on the recently legalized German market

With Germany delivering accelerated growth after legalization, IMC is keeping all options open to maximize shareholder value

TORONTO and GLIL YAM, Israel, May 28, 2024 /PRNewswire/ — IM Cannabis Corp. (CSE: IMCC) (NASDAQ: IMCC) (the “Company” or “IMC“), a leading medical cannabis company with operations in Israel and Germany, announces the termination of the preliminary term sheet signed on February 13, 2024 with Kadimastem Ltd a public company traded on the Tel Aviv Stock Exchange under the symbol (TASE:KDST) (“Kadimastem“).

“After the April 1st legalization in Germany, we are seeing that the accelerated growth in April is continuing through May. We believe this is just the beginning, as we anticipate that Germany could become one of the most significant legal markets in the world,” said Oren Shuster, Chief Executive Officer of IMC. “We are continuing to explore all options, focusing on providing the best value for our shareholders.”

According to the separation agreement signed with Kadimastem, as a result of this termination, the loan provided to IMC Holdings Ltd (the “Holding Company“) by Kadimastem in a total amount of 300,000$ will be repaid together with 9% annual interest accrued thereon, in three installments by July 31st, 2024.

About IM Cannabis Corp.

IMC (Nasdaq: IMCC) (CSE: IMCC) is an international cannabis company that provides premium cannabis products to medical patients in Israel and Germany, two of the largest medical cannabis markets. The Company has recently exited operations in Canada to pivot its focus and resources to achieve sustainable and profitable growth in its highest value markets, Israel and Germany. The Company leverages a transnational ecosystem powered by a unique data-driven approach and a globally sourced product supply chain. With an unwavering commitment to responsible growth and compliance with the strictest regulatory environments, the Company strives to amplify its commercial and brand power to become a global high-quality cannabis player.

The IMC ecosystem operates in Israel through its commercial relationship with Focus Medical Herbs Ltd., which imports and distributes cannabis to medical patients, leveraging years of proprietary data and patient insights. The Company also operates medical cannabis retail pharmacies, online platforms, distribution centers, and logistical hubs in Israel that enable the safe delivery and quality control of IMC’s products throughout the entire value chain. In Germany, the IMC ecosystem operates through Adjupharm GmbH, where it distributes cannabis to pharmacies for medical cannabis patients.

Disclaimer for Forward-Looking Statements

This press release contains forward-looking information or forward-looking statements under applicable Canadian and U.S. securities laws (collectively, “forward-looking statements”). All information that addresses activities or developments that we expect to occur in the future are forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as “seek”, “anticipate”, “believe”, “plan”, “estimate”, “expect”, “likely” and “intend” and statements that an event or result “may”, “will”, “should”, “could” or “might” occur or be achieved and other similar expressions. Forward-looking statements are based on the estimates and opinions of management on the date the statements are made. In the press release, such forward-looking statements include, but are not limited to, statements relating to the allegations against the Company by MYM Shareholder Plaintiffs and the likelihood of the complaint and its resolution.

Forward-looking statements are based on assumptions that may prove to be incorrect, including but not limited to: the development and introduction of new products; continuing demand for medical and adult-use recreational cannabis in the markets in which the Company operates; the Company’s ability to reach patients through both e-commerce and brick and mortar retail operations; the Company’s ability to maintain and renew or obtain required licenses; the effectiveness of its products for medical cannabis patients and recreational consumers; and the Company’s ability to market its brands and services successfully to its anticipated customers and medical cannabis patients.

The above lists of forward-looking statements and assumptions are not exhaustive. Since forward-looking statements address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated or implied by such forward looking statements due to a number of factors and risks. These include: any failure of the Company to maintain “de facto” control over Focus Medical in accordance with IFRS 10; the failure of the Company to comply with applicable regulatory requirements in a highly regulated industry; unexpected changes in governmental policies and regulations in the jurisdictions in which the Company operates; the effect of the reform on the Company; the Company’s ability to continue to meet the listing requirements of the Canadian Securities Exchange and the NASDAQ Capital Market; any unexpected failure to maintain in good standing or renew its licenses; the ability of the Company and Focus Medical (collectively, the “Group”) to deliver on their sales commitments or growth objectives; the reliance of the Group on third-party supply agreements to provide sufficient quantities of medical cannabis to fulfil the Group’s obligations; the Group’s possible exposure to liability, the perceived level of risk related thereto, and the anticipated results of any litigation or other similar disputes or legal proceedings involving the Group; the impact of increasing competition; any lack of merger and acquisition opportunities; adverse market conditions; the inherent uncertainty of production quantities, qualities and cost estimates and the potential for unexpected costs and expenses; risks of product liability and other safety-related liability from the usage of the Group’s cannabis products; supply chain constraints; reliance on key personnel; the risk of defaulting on existing debt and war, conflict and civil unrest in Eastern Europe and the Middle East

Any forward-looking statement included in this press release is made as of the date of this press release and is based on the beliefs, estimates, expectations and opinions of management on the date such forward-looking information is made.

The Company does not undertake any obligation to update forward-looking statements except as required by applicable securities laws. Investors should not place undue reliance on forward-looking statements. Forward-looking statements contained in this press release are expressly qualified by this cautionary statement.

Company Contacts:

Anna Taranko, Director Investor & Public Relations

IM Cannabis Corp.

+49 157 80554338

[email protected]

Oren Shuster, Chief Executive Officer

IM Cannabis Corp.

[email protected]

Logo: https://mma.prnewswire.com/media/1742228/IM_Cannabis_Logo.jpg

-

StickIt2 weeks ago

StickIt2 weeks agoStickIt Technologies Announces Investment into Ripco Processing Inc.

-

Granted2 weeks ago

Granted2 weeks agoFDA Has Granted Innocan Pharma a Meeting Date for LPT-CBD for Chronic Pain

-

Cannabis1 week ago

Solei Brand Introduces New Cannabis-Infused ‘Warming Deep Tissue Stick’

-

Cannabis1 week ago

Cannabis1 week agoCannabis Testing Market Worth $4.0 billion | MarketsandMarkets™

-

Innocan5 days ago

Innocan5 days agoInnocan Pharma Reports First Quarter 2024 Results with Revenue Growth of over 4X to $6.8 Million

-

Cannabis5 days ago

Cannabis5 days agoGlobal Hemp Protein Market Forecasts 2024-2029: Growing Vegan Population Boosts Hemp Protein Demand – CAGR of 15% Forecast During 2022-2029

-

Announces4 days ago

IMC announces the termination of a preliminary term sheet with Kadimastem Ltd., a public company traded on the Tel Aviv Stock Exchange to fully focus on the recently legalized German market

-

Cannabis3 days ago

Cannabis3 days agoIM Cannabis Closes Convertible Debenture Offering to Support Accelerated Growth in Germany