Cannabis

Lawsuit Filed by Michel & Associates Against Terra Tech on Behalf of Alleged Former Partner Forced Out of Santa Ana Cannabis Shops

Reading Time: 3 minutes

Reading Time: 3 minutes

Santa Ana cannabis businessman Wojciech Smolenski, through his counsel at Michel & Associates, PC, has filed a complaint in a Santa Ana court against his former employer, Terra Tech Corp., and alleged former partners contending that Terra Tech and other defendants defrauded him of profits from development of Santa Ana cannabis businesses. Terra Tech, a publicly-traded company specializing in cannabis operations, entered the Orange County cannabis market in 2017 when it acquired The Reserve retail cannabis store in Santa Ana and rebranded it as a Blüm store. Terra Tech later acquired an ownership stake in another Santa Ana cannabis operation, The Healing Tree Collective.

In addition to Terra Tech, Smolenski’s suit names affiliated companies and officers of Terra Tech as defendants. Smolenski claims that Terra Tech and two company officers used false promises of a partnership in developing several Santa Ana properties into cannabis businesses to induce him to allow Terra Tech to take over lucrative real estate deals on those properties to which Smolenski had exclusive rights.

Smolenski’s July 20, 2019 cross-complaint claims that Terra Tech fêted him to join Terra Tech and several others as a partner in developing Santa Ana cannabis businesses. Terra Tech brought him on board as a company executive. Smolenski then alleges in his lawsuit that once Terra Tech gained his trust, Terra Tech and its officers terminated his employment and forced him out of their partnership in two other cannabis businesses. Smolenski’s complaint against Terra Tech, its subsidiaries Medifarm So Cal and 55 OC Collective, and Terra Tech officers Michael Nahass and Derek Peterson, alleges causes of action for fraud, contractual breaches, and employment law violations.

According to Smolenski’s complaint, Terra Tech sought to expand its cannabis business into Orange County in 2017 by purchasing an existing cannabis business in Santa Ana with which Smolenski was affiliated, The Reserve. Smolenski’s suit alleges that after Terra Tech acquired The Reserve, Nahass and Peterson then began actively recruiting Smolenski to partner with them and Terra Tech to grow the acquired California operations as well as develop new retail, manufacturing, and cultivation businesses at other Santa Ana properties. Smolenski claims that in exchange for partnering with Terra Tech on developing new businesses at Santa Ana “Green Zone” locations Smolenski was already in escrow to purchase, Peterson and Nahass agreed that Terra Tech would front capital costs on the businesses and share profits from those businesses with Smolenski. Smolenski claims they also agreed to employ him with a lucrative salary and benefits as a high-level employee of Terra Tech.

Smolenski claims that these promises were shams to get control of the two Green Zone properties Smolenski was already in the process of purchasing. Specifically, his lawsuit alleges that once Smolenski transferred the purchase rights over to Terra Tech, and secured city cannabis licenses for the properties, Peterson and Nahass came up with pretextual reasons to fire Smolenski from his Terra Tech job and repudiate the existence of the partnership. Smolenski also claims that Terra Tech failed to provide him stock options and pay bonuses he had earned at the time of his termination from his employment.

Smolenski’s complaint also claims that Terra Tech has a practice of going into new markets, finding investors or local cannabis operations, and then purporting to partner with them only to later force them out. Smolenski’s claims are similar to claims in a lawsuit settled earlier this year between Terra Tech and a Nevada investor. In November 2018, Terra Tech and other affiliated companies and officers, including Nahass and Peterson, were sued in a Reno court in Medifarm I, LLC, v. Terra Tech, Inc.

That lawsuit claimed that local Reno businesswoman Heidi Loeb Hegerich was solicited by Nahass, Peterson, and others to contribute capital and other assets to a joint venture with Terra Tech to open Reno-area cannabis businesses. That lawsuit alleged that after Hegerich contributed capital and joined the venture, Terra Tech and other partners improperly diverted assets from the venture, attempted to lock Hegerich out of the operations and the books, and began working with a competing cannabis business.

That lawsuit was settled within three months after it was filed, with Terra Tech paying the plaintiffs $6.3 million but disclaiming liability. Terra Tech has recently decided to sell the Reno dispensary that was part of that lawsuit—Blüm Reno—for $15 million.

Smolenski’s complaint comes in response to Terra Tech’s own lawsuit against Smolenski, Smolenki’s wife, and an affiliated company that was filed earlier this year. Among the allegations in that complaint, Terra Tech claims that Smolenski stole money from the company, damaged a company computer, and sold cannabis products for Terra Tech but failed to remit the proceeds to Terra Tech. Smolenski filed an answer to Terra Tech’s lawsuit in July denying the claims. Terra Tech has not yet answered Smolenski’s suit.

SOURCE Michel & Associates, PC

Cannabis

Investing into the creation of low-cost, solvent-free canola & hemp proteins

Cannabis

IM Cannabis Closes Convertible Debenture Offering to Support Accelerated Growth in Germany

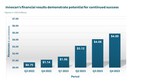

Through continuous, active cost management, IMC reduced its annual G&A costs by 49% in 2023 and is now looking to significantly reduce its financial costs.

TORONTO and GLIL YAM, Israel, May 29, 2024 /PRNewswire/ — IM Cannabis Corp. (CSE: IMCC) (NASDAQ: IMCC) (the “Company“, “IM Cannabis“, or “IMC“), a leading medical cannabis company with operations in Israel and Germany, is pleased to announce that in order to preserve its cash for to support accelerated growth in Germany it has closed a non-brokered private placement (the “Offering“) of secured convertible debentures of the Company (each, a “Debenture“) for aggregate proceeds of $2,091,977. The Debentures are being issued to holders of short-term loans and obligations owed by the Company or its wholly owned subsidiaries. The Debentures will mature on May 26, 2025, and will not incur interest except in the event of default. The Debentures may be converted into common shares in the Company (each, a “Share“) at a conversion price of $0.85 per Share.

“Active cost management has been our focus since the beginning of 2023. Last year we concentrated on reducing our operating expenses, reducing our 2023 G&A expenses -49% vs 2022,” said Oren Shuster, CEO of IMC. “This year we looked at our financial costs. By renegotiating our debt, we expect a significant reduction in our financing costs. Our goal is to free resources to drive accelerated growth in Germany, where we currently see the biggest potential following the April 1st legalization.”

RELATED PARTY TRANSACTIONS

Oren Shuster, a director and the Chief Executive Officer of the Company (the “Insider“) has subscribed for an aggregate of $237,214 of Debentures in the Offering. The Insider’s participation in the Offering (the “Insider Transaction“) is a “related party transaction” within the meaning of Multilateral Instrument 61-101 Protection of Minority Security Holders in Special Transactions (“MI 61-101“). The Company intends to rely on the exemptions from the formal valuation and minority shareholder approval requirements of MI 61-101 under sections 5.5(a) and 5.7(1)(a) of MI 61-101 as the fair market value of the Insider Transaction does not exceed 25% of the Company’s market capitalization. As the material change report disclosing the Insider Transaction is being filed less than 21 days before the transaction, there is a requirement under MI 61–101 to explain why the shorter period was reasonable or necessary in the circumstances. In the view of the Company, it is necessary to immediately close the Insider Transaction and therefore, such shorter period is reasonable and necessary in the circumstances to improve the Company’s financial position.

EARLY WARNING REPORT

Oren Shuster will file an early warning report in accordance with National Instrument 62-104 Take-Over Bids and Issuer Bids (“NI 62-104“) and National Instrument 62-103 The Early Warning System and Related Take-Over Bid and Insider Reporting Issues (“NI 62-103“). On May 26, 2024, Mr. Shuster acquired a Debenture in the principal amount of CAD$237,214 pursuant to the Offering (the “Acquisition“), which was issued in full satisfaction of CAD$237,214 of debt owed by the Company to him.

Immediately prior to the Acquisition, Mr. Shuster beneficially owned or controlled 1,872,870 Shares, 856,704 Warrants and 131,250 Stock Options of the Company, which represented approximately 13.98% of the then outstanding shares of the Company on a non-diluted basis and 19.89% on a partially diluted basis if Mr. Shuster converted all of the convertible securities held by him. As a result of the Acquisition, Mr. Shuster now beneficially owns or controls an aggregate of 1,872,870 Shares, 856,704 Warrants, 131,250 Stock Options and a Debenture in the principal amount of CAD$237,214 of the Company (the Debenture is convertible into up to 279,075 Shares at $0.85 per Share) which represented approximately 1.8% of the Company’s issued and outstanding Shares on a non-diluted basis (based on 13,394,136 Shares issued and outstanding as of the date hereof), and 23.44% on a partially diluted basis if Mr. Shuster converted all of the convertible securities held by him.

Mr. Shuster acquired the securities for general investment purposes only. Mr. Shuster may in the future take such actions in respect of his holdings in IMC as he may deem appropriate based on his assessment of market conditions and any other conditions he considers relevant at the time, including the purchase of additional Shares through open market or privately negotiated transactions or the sale of all or a portion of his holdings in the open market or in privately negotiated transactions to one or more purchasers, subject in each case to applicable securities laws.

Since the previous early warning report filed by Mr. Shuster in respect of the Company, Mr. Shuster’s Share ownership position increased by more than 2% and Mr. Shuster acquired securities convertible into more than 2% of the issued and outstanding Shares, which triggered the requirement to file an early warning report under applicable Canadian Securities legislation (the “Early Warning Report“).

A copy of the Early Warning Report may be found at SEDAR+ at www.sedarplus.ca under IMC’s profile. For further information, or to obtain a copy of the early warning report, please contact Oren Shuster at +972-77-3603504.

About IM Cannabis Corp.

IMC (Nasdaq: IMCC) (CSE: IMCC) is an international cannabis company that provides premium cannabis products to medical patients in Israel and Germany, two of the largest medical cannabis markets. The Company has recently exited operations in Canada to pivot its focus and resources to achieve sustainable and profitable growth in its highest value markets, Israel and Germany. The Company leverages a transnational ecosystem powered by a unique data-driven approach and a globally sourced product supply chain. With an unwavering commitment to responsible growth and compliance with the strictest regulatory environments, the Company strives to amplify its commercial and brand power to become a global high-quality cannabis player.

The IMC ecosystem operates in Israel through its commercial relationship with Focus Medical Herbs Ltd., which imports and distributes cannabis to medical patients, leveraging years of proprietary data and patient insights. The Company also operates medical cannabis retail pharmacies, online platforms, distribution center, and logistical hubs in Israel that enable the safe delivery and quality control of IMC products throughout the entire value chain. In Germany, the IMC ecosystem operates through Adjupharm GmbH, where it distributes cannabis to pharmacies for medical cannabis patients. Until recently, the Company also actively operated in Canada through Trichome Financial Corp and its wholly owned subsidiaries. The Company has exited operations in Canada and considers these operations discontinued.The securities to be offered pursuant to the Offering have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act“) or any United States state securities laws, and may not be offered or sold in the United States or to, or for the account or benefit of, United States persons absent registration or any applicable exemption from the registration requirements of the U.S. Securities Act and applicable United States state securities laws. This news release shall not constitute an offer to sell or the solicitation of an offer to buy securities in the United States, nor shall there be any sale of these securities in any jurisdiction in which such offer, solicitation or sale would be unlawful.

Company Contact:

Anna Taranko, Director Investor & Public Relations

IM Cannabis Corp.

+49 157 80554338

[email protected]

Oren Shuster, CEO

IM Cannabis Corp.

+972-77-3603504

[email protected]

Forward-Looking Information and Cautionary Statements

This press release contains forward-looking information or forward-looking statements under applicable Canadian and United States securities laws (collectively, “forward-looking statements”). All information that addresses activities or developments that we expect to occur in the future are forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as “seek”, “anticipate”, “believe”, “plan”, “estimate”, “expect”, “likely” and “intend” and statements that an event or result “may”, “will”, “should”, “could” or “might” occur or be achieved and other similar expressions. Forward-looking statements are based on the estimates and opinions of management on the date the statements are made. In the press release, such forward-looking statements include, but are not limited to, statements relating to: significant reduction in our financing costs; the timing and impact of the legalization of medicinal cannabis in Germany; and the Company’s accelerated growth in Germany.

Forward-looking statements are based on assumptions that may prove to be incorrect, including but not limited to: the Company’s ability significant reduction in our financing costs; the Company’s ability to focus and resources to achieve sustainable and profitable growth in its highest value markets; the Company’s ability to mitigate the impact of the Israel-Hamas war on the Company; the Company’s ability to take advantage of the legalization of medicinal cannabis in Germany; the Company’s ability to host a teleconference meeting as stated; and the Company’s ability to carry out its stated goals, scope, and nature of operations in Germany, Israel, and other jurisdictions the Company may operate. The above lists of forward-looking statements and assumptions are not exhaustive. Since forward-looking statements address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated or implied by such forward looking statements due to a number of factors and risks. These include: the failure of the Company to comply with applicable regulatory requirements in a highly regulated industry; unexpected changes in governmental policies and regulations in the jurisdictions in which the Company operates; the Company’s ability to continue to meet the listing requirements of the Canadian Securities Exchange and the NASDAQ Capital Market; any unexpected failure to maintain in good standing or renew its licenses; the ability of the Company and its subsidiaries (collectively, the “Group”) to deliver on their sales commitments or growth objectives; the reliance of the Group on third-party supply agreements to provide sufficient quantities of medical cannabis to fulfil the Group’s obligations; the Group’s possible exposure to liability, the perceived level of risk related thereto, and the anticipated results of any litigation or other similar disputes or legal proceedings involving the Group; the impact of increasing competition; any lack of merger and acquisition opportunities; adverse market conditions; the inherent uncertainty of production quantities, qualities and cost estimates and the potential for unexpected costs and expenses; risks of product liability and other safety-related liability from the usage of the Group’s cannabis products; supply chain constraints; reliance on key personnel; the risk of defaulting on existing debt; risks surrounding war, conflict and civil unrest in Eastern Europe and the Middle East, including the impact of the Israel-Hamas war on the Company, its operations and the medical cannabis industry in Israel; risks associated with the Company focusing on the Israel and Germany markets; the inability of the Company to achieve sustainable profitability and/or increase shareholder value; the inability of the Company to actively manage costs and/or improve margins; the inability of the company to grow and/or maintain sales; the inability of the Company to meet its goals and/or strategic plans; the inability of the Company to reduce costs and/or maintain revenues; the Company’s inability to take advantage of the legalization of medicinal cannabis in Germany; and the Company’s inability to host a teleconference meeting as stated. Please see the other risks, uncertainties and factors set out under the heading “Risk Factors” in the Company’s annual report dated March 28, 2024, which is available on the Company’s issuer profile on SEDAR+ at www.sedarplus.ca and Edgar at www.sec.gov/edgar. Any forward-looking statement included in this press release is made as of the date of this press release and is based on the beliefs, estimates, expectations and opinions of management on the date such forward looking information is made. The Company does not undertake any obligation to update forward-looking statements except as required by applicable securities laws. Investors should not place undue reliance on forward-looking statements. Forward looking statements contained in this press release are expressly qualified by this cautionary statement.

Logo – https://mma.prnewswire.com/media/1742228/IM_Cannabis_Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/im-cannabis-closes-convertible-debenture-offering-to-support-accelerated-growth-in-germany-302157901.html

View original content:https://www.prnewswire.co.uk/news-releases/im-cannabis-closes-convertible-debenture-offering-to-support-accelerated-growth-in-germany-302157901.html

Cannabis

Global Hemp Protein Market Forecasts 2024-2029: Growing Vegan Population Boosts Hemp Protein Demand – CAGR of 15% Forecast During 2022-2029

-

Cannabis2 weeks ago

Medical Cannabis Market Report 2024-2030: Asia-Pacific Set to Witness Robust Growth, Driven by R&D Discovery Initiatives

-

StickIt2 weeks ago

StickIt2 weeks agoStickIt Technologies Announces Investment into Ripco Processing Inc.

-

Granted1 week ago

Granted1 week agoFDA Has Granted Innocan Pharma a Meeting Date for LPT-CBD for Chronic Pain

-

Cannabis1 week ago

Solei Brand Introduces New Cannabis-Infused ‘Warming Deep Tissue Stick’

-

Cannabis1 week ago

Cannabis1 week agoCannabis Testing Market Worth $4.0 billion | MarketsandMarkets™

-

Innocan4 days ago

Innocan4 days agoInnocan Pharma Reports First Quarter 2024 Results with Revenue Growth of over 4X to $6.8 Million

-

Cannabis5 days ago

Cannabis5 days agoGlobal Hemp Protein Market Forecasts 2024-2029: Growing Vegan Population Boosts Hemp Protein Demand – CAGR of 15% Forecast During 2022-2029

-

Announces4 days ago

IMC announces the termination of a preliminary term sheet with Kadimastem Ltd., a public company traded on the Tel Aviv Stock Exchange to fully focus on the recently legalized German market