Latest News

BillingTree Adds Proven Chief Operating Officer Terri Harwood to Executive Leadership Team

Reading Time: 1 minute

Reading Time: 1 minute

BillingTree®, the payment problem solvers , today announced Terri Harwood has been appointed Chief Operating Officer. In this newly created position, Ms. Harwood will lead BillingTree Operations during a period of rapid growth. Her experience and extensive expertise complement the company’s continued success in the target verticals of Accounts Receivable Management (ARM), Healthcare, Financial Institutions and Business-to-Business (B2B) payments.

, today announced Terri Harwood has been appointed Chief Operating Officer. In this newly created position, Ms. Harwood will lead BillingTree Operations during a period of rapid growth. Her experience and extensive expertise complement the company’s continued success in the target verticals of Accounts Receivable Management (ARM), Healthcare, Financial Institutions and Business-to-Business (B2B) payments.

Ms. Harwood brings over 25 years of experience in the payments industry, having previously occupied a COO position at North American Bancard for over five years. Her responsibilities spanned operations, service, compliance, sales and marketing. Prior to this, Ms. Harwood served as the Senior Vice President at Global Payments for over 10 years. She oversaw the customer experience for all lines of business, including ISO, Premier merchant and bank relationships.

“I’m really pleased Terri has joined BillingTree, accepting this important leadership role. She has such an impressive track record in the payments industry, which will be key to supporting our strong growth plans in current and future target verticals,” said BillingTree CEO, Chris Lee. “Additionally, the skills she brings are critical to supporting future BillingTree technology development as well as continued customer demand for our current solutions, Payrazr and CareView.”

“This is an exciting time to join BillingTree, a proven payment technology company with almost 20 years of sustained innovation and client service excellence,” said Terri Harwood, BillingTree COO. “The proprietary BillingTree Payrazr and CareView payment solutions are both extremely customer centric, allowing the operations and support teams to concentrate on process efficiency, new service and technology introductions and reducing costs for clients and the company.”

SOURCE BillingTree

Latest News

Gen Z’s Engagement in the Sober Curious Movement Surges by 53% from 2023 to 2024, Reveals Latest NCSolutions Analysis

- Over one-third of Gen Zers (34%) say they’ll try a new beverage product if it’s marketed as aligning with the sober curious lifestyle.

- Nearly half (45%) of Gen Z say social media is the most effective advertising channel to inform them about new nonalcoholic options.

- The most popular month to purchase alcohol in 2023 was December (up 16% over November), and the least popular was January (down 24% compared to December 2022)

The share of Gen Zers born between 1997 and 2002 who say they plan to drink less alcohol in 2024 jumped 53% year over year. Sixty-one percent say they plan to cut back on their alcohol consumption, compared to 40% who said they planned to drink less in 2023.

The findings are from the latest consumer sentiment survey about the sober curious movement, a follow-up to a similar survey conducted in January 2023. Both surveys were commissioned by NCSolutions (NCS). The findings also include an analysis of NCS’ proprietary consumer purchase data. NCS is the leading company for improving advertising effectiveness for the consumer packaged goods (CPG) ecosystem.

More millennials (born between 1981 and 1996) said they’d drink less in 2024 (49%), an increase of 26% from those surveyed a year before. Overall, 41% of all Americans plan to drink less in 2024, up from 34% the year before. Together, these findings indicate the sober curious movement gained strength over the last year, largely due to interest from younger generations.

“Nonalcoholic alternatives, once a niche category, are becoming more mainstream,” said Alan Miles, chief executive officer, NCSolutions. “Younger consumers are increasingly expressing a growing interest in healthier options for social drinking. Beverage brands have a real opportunity to engage and build brand loyalty with the next generation of consumers by focusing on the right combination of creative, product, placement, and timing.”

Tap into Gen Z with sober curious lifestyle messages

Younger consumers say saving money and improving physical health are the top reasons they switch to a sober lifestyle. More than one-third (36%) of Gen Z say they’re going alcohol-free for their mental health.

This impacts the type of advertising most likely to influence purchases: over one-third of Gen Zers (34%) say they’re more likely to try a new beverage product if it’s aligned with the sober curious lifestyle, compared to 17% of all Americans. The finding adds further nuance to the marketing preferences of Gen Z, who are known to have an affinity for brands whose missions align with their values.

Nearly half (45%) of Gen Zers say social media is the most effective advertising channel to help them learn about new nonalcoholic beverage options, followed by internet searches (16%) and streaming TV (15%). In addition, nearly one in four (24%) have tried a nonalcoholic beverage because a celebrity or influencer endorsed it.

Mocktails are twice as popular as nonalcoholic beer

Sober curious consumers surveyed are twice as likely to choose a mocktail than a nonalcoholic beer. One in five (19%) Americans said they drank a mocktail in 2023, compared to one in 10 who drank nonalcoholic beer. More than one-third (37%) said they drank mocktails most often.

Mocktails were especially popular among younger generations in 2023. Thirty-seven percent of Gen Z said they drank mocktails last year, compared to 16% who said they had nonalcoholic beer and 10% who said they drank nonalcoholic wine.

Among millennials, 30% said they drank mocktails in 2023, compared to 15% who drank nonalcoholic beer and 9% who had nonalcoholic wine.

Seventeen percent of both millennials and Gen Z said they had tried THC and CBD-infused drinks in 2023.

December leads for nonalcoholic beverage sales

Interest in Dry and Damp January continues to expand. Consumers purchased the least amount of alcoholic beverages in January 2023 (down 24% from December 2022) and August 2023 (down 10% from July 2023), according to NCS purchase data. This follows a 19% drop in January 2022 compared to December 2021.

December was the most popular month of the year to buy alcohol in 2023, followed by May and March. Month-over-month purchases of alcohol in December increased 16% over November. This increase was two times higher than the 8% month-over-month increase in December 2022 and rose 8% in May, compared to April. By contrast, in 2022, the summer and winter holidays saw the highest increase in purchases of alcoholic beverages.

“Alcohol consumption is traditionally seasonal. Consumers purchase significantly more during December in preparation for the holidays,” Miles said. “In the past, we’ve seen alcohol sales rise during summer months, but now the peak is as early as May. Beverage brands have the opportunity to leverage the sober curious trend beyond January and into the summer months, targeting younger consumers with new summer-focused nonalcoholic products and health-oriented creative.”

Additional results are available on our website.

About NCS

NCSolutions (NCS) makes advertising work better. Our unrivaled data resources powered by leading providers combine with scientific rigor and leading-edge technology to empower the CPG ecosystem to create and deliver more effective advertising. With NCS’s proven approach, brands are achieving continuous optimization everywhere ads appear, through purchase-based audience targeting and sales measurement solutions that have impacted over $25 billion in media spend for our customers. Visit us at ncsolutions.com to learn more.

About the NCS Consumer Sentiment Survey

The consumer sentiment survey of 1,062 Americans was commissioned by NCS in December 2023 and was made up of U.S. adults ages 21+, who were asked about their drinking habits and preferences. Results were weighted to be representative of the U.S. population by age, gender, region, ethnicity, marital status, education level, and household income.

About NCS Purchase Data

NCS provides purchase insights to brands to help them target, optimize, measure, and enable sales-based outcomes. NCS’s representative and balanced consumer CPG purchase data set consists of the industry’s preeminent and comprehensive sources. It includes actual purchase data (transaction information) from big-box retailers, supermarkets, drug stores, convenience stores, and other retail channels at which American households buy CPG products spanning 340+ grocery categories. The NCSolutions purchase data was analyzed in January 2024.

Fair Use

When using this data and research, please attribute by linking to this study and citing NCSolutions.

SOURCE NCSolutions

Editor opinion:

The hemp, CBD, and related industries are likely to experience significant growth shortly, especially considering the increasing interest in soberness among Gen Z. The survey indicates that over one-third of Gen Zers (34%) are inclined to try new beverage products aligned with the sober curious lifestyle. This trend suggests a growing market for nonalcoholic alternatives, showcasing a shift towards healthier options for social drinking, including for sure hemp, and infused beverages.

Latest News

High Tide’s Raj Grover Clinches Spot on Grow Up’s 2024 Top 50 Cannabis Leaders in Canada List

High Tide Inc. (“High Tide” or the “Company“) (NASDAQ: HITI) (TSXV: HITI) (FSE: 2LYA), the high-impact, retail-forward enterprise built to deliver real-world value across every component of cannabis, is pleased to announce that its Founder and CEO, Raj Grover, has made Grow Up’s 2024 Top 50 Cannabis Leaders in Canada list. The list, which was hand-selected by Grow Up’s industry advisory committee, recognizes influential leaders in the cannabis industry who are trailblazers in the growth, development, and innovation of the cannabis industry and celebrates their relentless, courageous, and innovative dedication to elevate the industry. The full list is available at Grow Up Top 50.

“I am honored to be included in this list. This would not have been possible without the continuous hard work and dedication of the High Tide team. Our innovative mindset has resulted in our ability to achieve significant milestones in the five years since Canadian legalization, despite broader industry challenges that have seen some of our peers fall by the wayside. Our success is also due to the loyalty and commitment of our customers, who continue to support our business in Canada and internationally,” said Raj Grover, Founder and Chief Executive Officer of High Tide.

“I also want to congratulate all the other industry trailblazers recognized on this list who are all leaders helping to shape and grow our industry. As we look to solidify our strength in Canada while exploring emerging markets in 2024, I know that our industry-leading team will continue delivering results for our customers and shareholders alike,” added Mr. Grover.

ABOUT RAJ GROVER

Raj Grover is one of Canada’s foremost business strategists and deal-makers who founded High Tide and its subsidiaries, Valiant Distribution, and Canna Cabana, and also co-founded Famous Brandz. Under his leadership, High Tide has grown from a small shop of 2 employees into Canada’s largest non-franchised cannabis retailer with over 160 locations and 1,500 team members globally. Raj has also expanded High Tide’s online reach in the ancillary cannabis space across North America and Europe. He is committed to giving back to the global community and has spearheaded High Tide’s support of World Vision, sponsoring over 300 children across 101 communities in 33 countries.

ABOUT HIGH TIDE

High Tide, Inc. is the leading community-grown, retail-forward cannabis enterprise engineered to unleash the full value of the world’s most powerful plant. High Tide (HITI) is uniquely built around the cannabis consumer, with wholly diversified and fully integrated operations across all components of cannabis, including:

Bricks & Mortar Retail: Canna Cabana™ is the largest non-franchised cannabis retail chain in Canada, with 162 current locations spanning British Columbia, Alberta, Saskatchewan, Manitoba, and Ontario and growing. In 2021, Canna Cabana became the first cannabis discount club retailer in North America.

Retail Innovation: Fastendr™ is a unique and fully automated technology that integrates retail kiosks and smart lockers to facilitate a better buying experience through browsing, ordering, and pickup.

E-commerce Platforms: High Tide operates a suite of leading accessory sites across the world, including Grasscity.com, Smokecartel.com, Dailyhighclub.com, and Dankstop.com.

CBD: High Tide continues to cultivate the possibilities of consumer CBD through Nuleafnaturals.com, FABCBD.com, blessedcbd.de and blessedcbd.co.uk.

Wholesale Distribution: High Tide keeps that cannabis category stocked with wholesale solutions via Valiant™.

Licensing: High Tide continues to push cannabis culture forward through fresh partnerships and license agreements under the Famous Brandz™ name.

High Tide consistently moves ahead of the currents, having been named one of Canada’s Top Growing Companies in 2021, 2022 and 2023 by the Globe and Mail’s Report on Business Magazine and was ranked number one in the retail category on the Financial Times list of Americas’ Fastest Growing Companies for 2023. To discover the full impact of High Tide, visit www.hightideinc.com. For investment performance, don’t miss the High Tide profile pages on SEDAR+ and EDGAR.

ABOUT GROW UP

Since its inception in 2017, Grow Up Conference & Expo has become a benchmark event in the Canadian cannabis industry, known for its high-profile speakers, diverse programming, and commitment to bringing together forward-thinkers and experts. For more information, visit Grow Up Conference & Expo.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

SOURCE High Tide Inc.

Latest News

Kona Gold Beverages, Inc. Indicates Strategic Expansion Through $5 Million Non-Dilutive Credit Line

Kona Gold Beverages, Inc. (OTCPK: KGKG), a dynamic holding company specializing in product development within the better-for-you and functional beverage sector, is proud to announce the company has successfully secured a $5 million line of credit that will be dedicated to driving production growth, expanding market share, and exploring potential acquisitions.

Under the visionary leadership of the new management team, Kona Gold Beverages, Inc. is taking a bold step toward sustained growth. The $5 million credit line is non-dilutive, meaning it does not have the option to convert into shares of the company. This strategic move emphasizes the management’s commitment to preserving shareholder value and ensuring responsible financial stewardship.

“This non-dilutive credit line marks a significant milestone for Kona Gold Beverages, Inc. as we strategically position ourselves for growth without compromising the interests of our valued shareholders,” said Brandon White, President and Chairman of Kona Gold Beverages, Inc., “We understand the importance of responsible expansion, and this credit line will play a pivotal role in driving our production capabilities, expanding our market presence, and exploring potential acquisitions that align with our vision.”

Management acknowledges the challenge of a bloated share structure inherited from previous funding sources, including the issuance of shares, warrants, and conversion abilities. While some conversion possibilities may be beyond our control, the new management team is fully committed to transparency and will keep shareholders informed of any developments.

The company is actively taking steps to eliminate conversion possibilities within its control, recognizing the significance of growing the company without diluting shareholder value. Additionally, Kona Gold Beverages, Inc. remains dedicated to seeking funding sources that not only align with the company’s growth objectives but also prioritize the best interests of its shareholders and their value.

Key Highlights:

- Strategic Credit Line: The $5 million non-dilutive credit line will be used for production growth, market share expansion, and potential acquisitions.

- Preserving Shareholder Value: The credit line is structured to safeguard shareholder value by preventing conversion into shares of the company.

- Transparency Commitment: Management is fully committed to transparency and will keep shareholders informed regarding the share structure and any potential conversion developments.

- Responsible Financial Stewardship: The new management team is focused on eliminating conversion possibilities within its control and seeking funding sources aligned with shareholder interests.

Kona Gold Beverages, Inc. is poised for an exciting phase of growth, and this strategic financial move underlines the company’s dedication to responsible expansion and shareholder value.

The Company recently announced it has eliminated $1.3 Million in debt and has reduced its authorized shares by 4.386 Billion shares.

For more information regarding Kona Gold Beverage, please visit: https://konagoldbeverage.com/

About Kona Gold Beverage, Inc.

Kona Gold Beverage, Inc., a Delaware corporation, operates its wholly-owned subsidiary, Kona Gold LLC. Kona Gold, LLC has developed a premium Hemp-Infused Energy Drink line; please visit its website at www.konagoldhemp.com. Kona Gold is located on the east coast of Florida in Rockledge.

Safe Harbor Statement:

The information posted in this release may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. You can identify these statements by use of the words “may,” “will,” “should,” “plans,” “expects,” “anticipates,” “continue,” “estimate,” “project,” “intend,” and similar expressions. The Company may also make written or oral forward-looking statements in its filings with the U.S. Securities and Exchange Commission, in press releases and other written materials, and in oral statements made by its officers, directors, or employees to third parties. There can be no assurance that such statements will prove to be accurate. The Company cautions that these forward-looking statements are further qualified by other factors including, but not limited to, those outlined in the Company’s Annual Reports on Form 10-K and its other filings with the Securities and Exchange Commission. Forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those projected or anticipated. These risks and uncertainties include but are not limited to, general economic and business conditions, effects of continued geopolitical unrest and regional conflicts, competition, changes in technology and methods of marketing, delays in completing various engineering and manufacturing programs, changes in customer order patterns, changes in product mix, continued success in technological advances and delivering technological innovations, shortages in components, production delays due to performance quality issues with outsourced components, and various other factors beyond the Company’s control. The Company does not undertake any obligation to update publicly or to revise any statements in this release, whether as a result of new information, future events, or otherwise.

Investor Relations Contact:

844-714-2224

investorrelations@konagoldbeverage.com

SOURCE Kona Gold Beverage, Inc.

-

Cannabis2 weeks ago

Cannabis2 weeks agoIM Cannabis Shares Commence Trading on 6:1 Consolidated Basis

-

Cannabis2 weeks ago

Cannabis2 weeks agoFractional Flow Reserve Market growing at a CAGR of 15.56% during the forecast period [2024-2030] – Exactitude Consultancy

-

Cannabis1 week ago

Cannabis1 week agoBlank Rome Bolsters Energy Industry Team in Houston and Pittsburgh with Leading Transactional Group

-

Cannabis1 week ago

Cannabis1 week agoManitoba Harvest Hemp Foods and Brightseed® Introduce New Coffee and Chocolate Flavors in Organic Bioactive Fiber Supplement for Gut Health

-

Cannabis5 days ago

Cannabis5 days agoEurope Medical Cannabis Oil Market Set to Reach Valuation of USD 2,395.83 Million by 2032 | Astute Analytica

-

Cannabis4 days ago

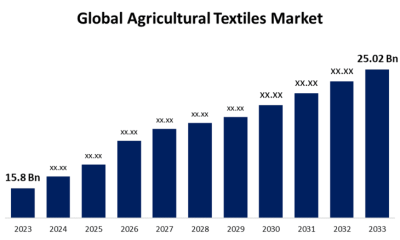

Cannabis4 days agoGlobal Agricultural Textiles Market Size To Worth USD 25.02 Billion By 2033 | CAGR of 4.70%

-

Cannabis2 days ago

Cannabis2 days agoUnlocking New Horizons in Health: TNR, The Niche Research Reveals the Transformative Power of Minor Cannabinoids

-

Cannabis19 hours ago

Cannabis19 hours agoVerano Announces the Opening of Zen Leaf Fairless Hills, the Company’s Newest Affiliated Dispensary in Pennsylvania, in Prime New Location