/home/grassnews/public_html/wp-content/themes/zox-news/parts/post-single.php on line 153

">

Warning: Undefined array key 0 in /home/grassnews/public_html/wp-content/themes/zox-news/parts/post-single.php on line 153

Warning: Attempt to read property "cat_name" on null in /home/grassnews/public_html/wp-content/themes/zox-news/parts/post-single.php on line 153

Tyler Technologies Reports Earnings for First Quarter 2019

Reading Time: 11 minutes

Reading Time: 11 minutes

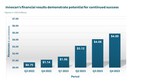

Subscription revenues grew 37% as bookings rose 17%

PLANO, Texas–(BUSINESS WIRE)–lt;a href=”https://twitter.com/search?q=%24TYL&src=ctag” target=”_blank”gt;$TYLlt;/agt; lt;a href=”https://twitter.com/hashtag/earnings?src=hash” target=”_blank”gt;#earningslt;/agt;–Tyler

Technologies, Inc. (NYSE: TYL) today announced financial results for

the first quarter ended March 31, 2019.

First Quarter 2019 Financial Highlights:

-

Total revenues were $247.1 million, up 11.7% from $221.2 million for

the first quarter of 2018. Organic revenue growth was 5.5%. Non-GAAP

total revenues were $248.8 million, up 12.4% from $221.4 million for

the first quarter of 2018. Non-GAAP organic revenue growth was 5.4%. -

Recurring revenues from maintenance and subscriptions were $167.4

million, an increase of 17.1% compared to the first quarter of 2018,

and comprised 67.8% of first quarter 2019 revenue. -

Operating income was $34.5 million, down 11.2% from $38.8 million for

the first quarter of 2018. Non-GAAP operating income was $63.0

million, up 7.4% from $58.6 million for the first quarter of 2018. -

Net income was $27.3 million, or $0.69 per diluted share, down 27.7%

compared to $37.8 million, or $0.95 per diluted share, for the first

quarter of 2018. Non-GAAP net income was $48.3 million, or $1.22 per

diluted share, up 7.3% compared to $45.0 million, or $1.13 per diluted

share, for the first quarter of 2018. -

Cash flows from operations were $24.0 million, down 46.3% compared to

$44.6 million for the first quarter of 2018. -

Adjusted EBITDA was $69.5 million, up 8.0% compared to $64.4 million

for the first quarter of 2018. -

Tyler repurchased 71,793 shares of its common stock during the quarter

at an average price of $199.03. -

Software subscription arrangements comprised approximately 54% of the

total new software contract value in the first quarter. -

Software subscription bookings in the first quarter added $11.4

million in annual recurring revenue. -

Total backlog was $1.26 billion, up 4.9% from $1.20 billion at

March 31, 2018. Software-related backlog (excluding appraisal

services) was $1.22 billion, up 4.8% from $1.16 billion at March 31,

2018. -

During the quarter, Tyler completed the acquisitions of MyCivic and

MicroPact, Inc., for a total of $199.1 million in cash, net of cash

acquired. -

Effective January 1, 2019, Tyler adopted the requirements of ASU No.

2016-02, Leases (Topic 842), utilizing the modified retrospective

method of transition.

“Our first quarter results provided a solid start to 2019 in line with

our expectations,” said Lynn Moore Jr., Tyler’s president and chief

executive officer. “Total non-GAAP revenues grew more than 12%, once

again fueled by strong subscription revenue growth, which grew 38.5% on

a non-GAAP basis. Subscription agreements made up the majority of our

new software contracts in the quarter, and our four largest software

contracts signed in the quarter were all subscription arrangements,

which put pressure on short-term top-line growth but is a long-term

positive trend for Tyler. Our non-GAAP gross margin rose 130 basis

points while our non-GAAP operating margin fell 120 basis points.

Research and development expense rose 45%, reflecting a continued high

level of investment in products across the company, including heightened

investments in recent acquisitions.

“This was a good quarter for bookings, which increased 17% over the

first quarter of 2018, and contributed to our backlog growth of 5%.

Contract signings were particularly strong for our public safety, ERP,

and appraisal and tax products, and our new business pipeline remains

active.

“We are pleased with the continued integration of our 2018 acquisitions

into Tyler and their results were in line with our expectations. We’re

also excited about the February acquisitions of MyCivic and MicroPact.

MyCivic will elevate Tyler’s current citizen-facing applications by

enabling clients to provide a single app for citizens to interact with

their local government in multiple ways. MicroPact is the second largest

acquisition in the company’s history and augments our product solutions,

positions us in new practice areas such as health and human services,

and presents opportunities to expand our business across new and

complementary markets, including the federal market,” added Moore.

Guidance for 2019

As of May 1, 2019, Tyler Technologies is providing the following

guidance for the full year 2019:

-

GAAP total revenues are expected to be in the range of $1.08 billion

to $1.10 billion. Non-GAAP total revenues are expected to be in the

range of $1.09 billion to $1.11 billion. -

GAAP diluted earnings per share are expected to be in the range of

$3.45 to $3.60 and may vary significantly due to the impact of stock

option exercises on the GAAP effective tax rate, as well as final

valuation of acquired intangibles. -

Non-GAAP diluted earnings per share are expected to be in the range of

$5.20 to $5.35. -

Pretax non-cash, share-based compensation expense is expected to be

approximately $62 million. -

Research and development expense is expected to be in the range of $82

million to $84 million. -

Fully diluted shares for the year are expected to be in the range of

40.0 million to 41.0 million shares. -

GAAP earnings per share assumes an estimated annual effective tax rate

of approximately 10% after discrete tax items and includes

approximately $27 million of discrete tax benefits related to

share-based compensation. - The non-GAAP annual effective tax rate is expected to be 24%.

-

Capital expenditures are expected to be in the range of $48 million to

$50 million, including approximately $22 million related to real

estate and approximately $6 million of capitalized software

development. Total depreciation and amortization expense is expected

to be approximately $77 million, including approximately $51 million

from amortization of acquisition intangibles.

GAAP to non-GAAP guidance reconciliation

Non-GAAP total revenues is derived from adding back the estimated full

year impact of write-downs of acquisition-related deferred revenue and

amortization of acquired leases of approximately $10 million. Non-GAAP

diluted earnings per share excludes the estimated full year impact of

non-cash share-based compensation expense and employer portion of

payroll tax related to employee stock transactions of approximately $62

million, and amortization of acquired software and intangible assets of

approximately $51 million. Additionally, the non-GAAP tax rate of 24% is

estimated periodically as described below under “Non-GAAP Financial

Measures” and excludes approximately $27 million of estimated discrete

tax benefits that are included in the GAAP estimated annual effective

tax rate.

Conference Call

Tyler Technologies will hold a conference call on Thursday, May 2, at

10:00 a.m. EDT to discuss the company’s results. The company is offering

participants the opportunity to register in advance for the conference

through the following link: http://dpregister.com/10130477.

Registered participants will receive an email with a calendar reminder

and a dial-in number and PIN that will allow them immediate access to

the call on May 2.

Participants who do not wish to pre-register for the call may dial in

using 844-861-5506 (U.S. callers) or 412-317-6587 (international

callers) or 866-450-4696 (Canada callers) and ask for the “Tyler

Technologies” call. A replay will be available two hours after

completion of the call through May 30, 2019. To access the replay,

please dial 877-344-7529 (U.S. callers), 412-317-0088 (international

callers) and 855-669-9658 (Canada callers) and reference passcode

10130477.

The live webcast and archived replay can also be accessed at https://tylertech.irpass.com/presentations.

About Tyler Technologies, Inc.

Tyler Technologies (NYSE: TYL) is the largest and most established

provider of integrated software and technology services focused on the

public sector. Tyler’s end-to-end solutions empower local, state, and

federal government entities to operate more efficiently and connect more

transparently with their constituents and with each other. By connecting

data and processes across disparate systems, Tyler’s solutions are

transforming how clients gain actionable insights that solve problems in

their communities. Tyler has more than 21,000 successful installations

across 10,000 sites, with clients in all 50 states, Canada, the

Caribbean, Australia, and other international locations. A financially

strong company, Tyler has achieved double-digit revenue growth every

quarter since 2012. It was also named to Forbes’ “Best Midsize

Employers” list in 2018 and recognized twice on its “Most Innovative

Growth Companies” list. More information about Tyler Technologies,

headquartered in Plano, Texas, can be found at tylertech.com.

Non-GAAP Financial Measures

Tyler Technologies has provided in this press release financial measures

that have not been prepared in accordance with generally accepted

accounting principles (GAAP) and are therefore considered non-GAAP

financial measures. This information includes non-GAAP revenues,

non-GAAP gross profit, non-GAAP gross margin, non-GAAP operating income,

non-GAAP operating margin, non-GAAP net income, non-GAAP earnings per

diluted share, EBITDA, and adjusted EBITDA. We use these non-GAAP

financial measures internally in analyzing our financial results and

believe they are useful to investors, as a supplement to GAAP measures,

in evaluating Tyler’s ongoing operational performance because they

provide additional insight in comparing results from period to period.

Tyler believes the use of these non-GAAP financial measures provides an

additional tool for investors to use in evaluating ongoing operating

results and trends and in comparing our financial results with other

companies in our industry, many of which present similar non-GAAP

financial measures. Non-GAAP financial measures discussed above exclude

write-downs of acquisition-related deferred revenue and acquired leases,

share-based compensation expense, employer portion of payroll taxes on

employee stock transactions, expenses associated with amortization of

intangibles arising from business combinations, and acquisition-related

expenses.

Tyler currently uses a non-GAAP tax rate of 24%. This rate is based on

Tyler’s estimated annual GAAP income tax rate forecast, adjusted to

account for items excluded from GAAP income in calculating Tyler’s

non-GAAP income, as well as significant non-recurring tax adjustments.

The non-GAAP tax rate used in future periods will be reviewed

periodically to determine whether it remains appropriate in

consideration of factors including Tyler’s periodic effective tax rate

calculated in accordance with GAAP, changes resulting from tax

legislation, changes in the geographic mix of revenues and expenses, and

other factors deemed significant. Due to differences in tax treatment of

items excluded from non-GAAP earnings, as well as the methodology

applied to Tyler’s estimated annual tax rate as described above, the

estimated tax rate on non-GAAP income may differ from the GAAP tax rate

and from Tyler’s actual tax liabilities.

Non-GAAP financial measures should be considered in addition to, and not

as a substitute for, or superior to, financial information prepared in

accordance with GAAP. The non-GAAP measures used by Tyler Technologies

may be different from non-GAAP measures used by other companies.

Investors are encouraged to review the reconciliation of these non-GAAP

measures to their most directly comparable GAAP financial measures,

which has been provided in the financial statement tables included below

in this press release.

Forward-looking Statements

This document contains “forward-looking statements” within the meaning

of Section 27A of the Securities Act of 1933 and Section 21E of the

Securities Exchange Act of 1934 that are not historical in nature and

typically address future or anticipated events, trends, expectations or

beliefs with respect to our financial condition, results of operations

or business. Forward-looking statements often contain words such as

“believes,” “expects,” “anticipates,” “foresees,” “forecasts,”

“estimates,” “plans,” “intends,” “continues,” “may,” “will,” “should,”

“projects,” “might,” “could” or other similar words or phrases.

Similarly, statements that describe our business strategy, outlook,

objectives, plans, intentions or goals also are forward-looking

statements. We believe there is a reasonable basis for our

forward-looking statements, but they are inherently subject to risks and

uncertainties and actual results could differ materially from the

expectations and beliefs reflected in the forward-looking statements. We

presently consider the following to be among the important factors that

could cause actual results to differ materially from our expectations

and beliefs: (1) changes in the budgets or regulatory environments of

our clients, primarily local and state governments, that could

negatively impact information technology spending; (2) our ability to

protect client information from security breaches and provide

uninterrupted operations of data centers; (3) our ability to achieve

growth or operational synergies through the integration of acquired

businesses, while avoiding unanticipated costs and disruptions to

existing operations; (4) material portions of our business require the

Internet infrastructure to be adequately maintained; (5) our ability to

achieve our financial forecasts due to various factors, including

project delays by our clients, reductions in transaction size, fewer

transactions, delays in delivery of new products or releases or a

decline in our renewal rates for service agreements; (6) general

economic, political and market conditions; (7) technological and market

risks associated with the development of new products or services or of

new versions of existing or acquired products or services; (8)

competition in the industry in which we conduct business and the impact

of competition on pricing, client retention and pressure for new

products or services; (9) the ability to attract and retain qualified

personnel and dealing with the loss or retirement of key members of

management or other key personnel; and (10) costs of compliance and any

failure to comply with government and stock exchange regulations. A

detailed discussion of these factors and other risks that affect our

business are described in our filings with the Securities and Exchange

Commission, including the detailed “Risk Factors” contained in our most

recent annual report on Form 10-K. We expressly disclaim any obligation

to publicly update or revise our forward-looking statements.

| TYLER TECHNOLOGIES, INC. | ||||||

| CONDENSED CONSOLIDATED STATEMENTS OF INCOME | ||||||

| (Amounts in thousands, except per share data) | ||||||

| (Unaudited) | ||||||

| Three Months Ended March 31, | ||||||

| 2019 | 2018 | |||||

| Revenues: | ||||||

| Software licenses and royalties | $ | 21,793 | $ | 22,776 | ||

| Subscriptions | 67,275 | 49,028 | ||||

| Software services | 48,443 | 45,939 | ||||

| Maintenance | 100,152 | 93,897 | ||||

| Appraisal services | 5,214 | 5,394 | ||||

| Hardware and other | 4,189 | 4,140 | ||||

| Total revenues | 247,066 | 221,174 | ||||

| Cost of revenues: | ||||||

| Software licenses and royalties | 818 | 778 | ||||

| Acquired software | 6,682 | 5,382 | ||||

| Software services, maintenance and subscriptions | 117,160 | 106,085 | ||||

| Appraisal services | 3,452 | 3,781 | ||||

| Hardware and other | 2,906 | 2,343 | ||||

| Total cost of revenues | 131,018 | 118,369 | ||||

| Gross profit | 116,048 | 102,805 | ||||

| Selling, general and administrative expenses | 57,766 | 47,604 | ||||

| Research and development expense | 18,941 | 13,048 | ||||

| Amortization of customer and trade name intangibles | 4,850 | 3,315 | ||||

| Operating income | 34,491 | 38,838 | ||||

| Other income, net | 586 | 599 | ||||

| Income before income taxes | 35,077 | 39,437 | ||||

| Income tax provision | 7,729 | 1,612 | ||||

| Net income | $ | 27,348 | $ | 37,825 | ||

| Earnings per common share: | ||||||

| Basic | $ | 0.71 | $ | 1.00 | ||

| Diluted | $ | 0.69 | $ | 0.95 | ||

| Weighted average common shares outstanding: | ||||||

| Basic | 38,308 | 38,002 | ||||

| Diluted | 39,585 | 39,836 | ||||

| TYLER TECHNOLOGIES, INC. | ||||||||

| RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES | ||||||||

| (Amounts in thousands, except per share data) | ||||||||

| (Unaudited) | ||||||||

| Three Months Ended March 31, | ||||||||

| 2019 | 2018 | |||||||

|

Reconciliation of non-GAAP total revenues |

||||||||

| GAAP total revenues | $ | 247,066 | $ | 221,174 | ||||

| Non-GAAP adjustments: | ||||||||

| Add: Write-downs of acquisition-related deferred revenue | 1,597 | 100 | ||||||

| Add: Amortization of acquired leases | 100 | 111 | ||||||

| Non-GAAP total revenues | $ | 248,763 | $ | 221,385 | ||||

|

Reconciliation of non-GAAP gross profit and |

||||||||

| GAAP gross profit | $ | 116,048 | $ | 102,805 | ||||

| Non-GAAP adjustments: | ||||||||

| Add: Write-downs of acquisition-related deferred revenue | 1,597 | 100 | ||||||

| Add: Amortization of acquired leases | 100 | 111 | ||||||

| Add: Share-based compensation expense included in cost of revenues | 3,798 | 2,776 | ||||||

| Add: Amortization of acquired software | 6,682 | 5,382 | ||||||

| Non-GAAP gross profit | $ | 128,225 | $ | 111,174 | ||||

| GAAP gross margin | 47.0 | % | 46.5 | % | ||||

| Non-GAAP gross margin | 51.5 | % | 50.2 | % | ||||

|

Reconciliation of non-GAAP operating income |

||||||||

| GAAP operating income | $ | 34,491 | $ | 38,838 | ||||

| Non-GAAP adjustments: | ||||||||

| Add: Write-downs of acquisition-related deferred revenue | 1,597 | 100 | ||||||

| Add: Amortization of acquired leases | 100 | 111 | ||||||

| Add: Share-based compensation expense | 14,416 | 10,557 | ||||||

|

Add: Employer portion of payroll tax related to employee stock transactions |

123 | 320 | ||||||

| Add: Acquisition related costs | 695 | — | ||||||

| Add: Amortization of acquired software | 6,682 | 5,382 | ||||||

| Add: Amortization of customer and trade name intangibles | 4,850 | 3,315 | ||||||

| Non-GAAP adjustments subtotal | 28,463 | 19,785 | ||||||

| Non-GAAP operating income | $ | 62,954 | $ | 58,623 | ||||

| GAAP operating margin | 14.0 | % | 17.6 | % | ||||

| Non-GAAP operating margin | 25.3 | % | 26.5 | % | ||||

| TYLER TECHNOLOGIES, INC. | |||||||||

| RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES | |||||||||

| (Amounts in thousands, except per share data) | |||||||||

| (Unaudited) | |||||||||

| Three Months Ended March 31, | |||||||||

| 2019 | 2018 | ||||||||

|

Reconciliation of non-GAAP net income and |

|||||||||

| GAAP net income |

$ |

27,348 |

$ | 37,825 | |||||

| Non-GAAP adjustments: | |||||||||

| Add: Total non-GAAP adjustments to operating income |

|

28,463 |

19,785 | ||||||

| Less: Tax impact related to non-GAAP adjustments |

|

(7,521 |

) | (12,601 | ) | ||||

| Non-GAAP net income |

$ |

48,290 |

$ | 45,009 | |||||

| GAAP earnings per diluted share |

$ |

0.69 |

$ | 0.95 | |||||

| Non-GAAP earnings per diluted share |

$ |

1.22 |

$ | 1.13 | |||||

|

Detail of share-based compensation expense |

|||||||||

| Cost of software services, maintenance and subscriptions |

$ |

3,798 |

$ | 2,776 | |||||

| Selling, general and administrative expenses |

|

10,618 |

7,781 | ||||||

| Total share-based compensation expense |

$ |

14,416 |

$ | 10,557 | |||||

|

Reconciliation of EBITDA and adjusted EBITDA |

|||||||||

| GAAP net income | $ | 27,348 | $ | 37,825 | |||||

| Amortization of customer and trade name intangibles | 4,850 | 3,315 | |||||||

| Depreciation and amortization included in | |||||||||

| cost of revenues, SG&A and other expenses |

12,426 |

10,797 | |||||||

| Interest expense included in other income, net | 464 | 189 | |||||||

| Income tax provision | 7,729 | 1,612 | |||||||

| EBITDA | $ |

52,817 |

$ | 53,738 | |||||

| Write-downs of acquisition-related deferred revenue | 1,597 | 100 | |||||||

| Share-based compensation expense | 14,416 | 10,557 | |||||||

| Acquisition related costs | 695 | — | |||||||

| Adjusted EBITDA | $ |

69,525 |

$ | 64,395 | |||||

| TYLER TECHNOLOGIES, INC. | ||||||

| CONDENSED CONSOLIDATED BALANCE SHEETS | ||||||

| (Amounts in thousands) | ||||||

| (Unaudited) | ||||||

| March 31, 2019 | December 31, 2018 | |||||

| ASSETS | ||||||

| Current assets: | ||||||

| Cash and cash equivalents | $ | 39,437 | $ | 134,279 | ||

| Accounts receivable, net | 298,980 | 298,912 | ||||

| Current investments and other assets | 63,857 | 80,970 | ||||

| Income tax receivable | — | 4,697 | ||||

| Total current assets | 402,274 | 518,858 | ||||

| Accounts receivable, long-term portion | 22,821 | 16,020 | ||||

| Operating lease right-of-use assets | 20,067 | — | ||||

| Property and equipment, net | 164,617 | 155,177 | ||||

| Other assets: | ||||||

| Goodwill | 834,572 | 753,718 | ||||

| Other intangibles, net | 389,633 | 276,852 | ||||

| Non-current investments and other assets | 75,318 | 70,338 | ||||

| Total assets | $ | 1,909,302 | $ | 1,790,963 | ||

| LIABILITIES AND SHAREHOLDERS’ EQUITY | ||||||

| Current liabilities: | ||||||

| Accounts payable and accrued liabilities | $ | 69,835 | $ | 73,390 | ||

| Current income tax payable | 7,868 | — | ||||

| Operating lease liabilities | 5,777 | — | ||||

| Deferred revenue | 319,900 | 350,512 | ||||

| Total current liabilities | 403,380 | 423,902 | ||||

| Revolving line of credit | 85,000 | — | ||||

| Deferred revenue, long-term | 442 | 424 | ||||

| Deferred income taxes | 42,779 | 41,791 | ||||

| Operating lease liabilities, long-term | 18,956 | — | ||||

| Shareholders’ equity | 1,358,745 | 1,324,846 | ||||

| Total liabilities and shareholders’ equity | $ | 1,909,302 | $ | 1,790,963 | ||

| TYLER TECHNOLOGIES, INC. | ||||||||

| CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS | ||||||||

| (Amounts in thousands) | ||||||||

| (Unaudited) | ||||||||

| Three Months Ended March 31, | ||||||||

| 2019 | 2018 | |||||||

| Cash flows from operating activities: | ||||||||

| Net income | $ | 27,348 | $ | 37,825 | ||||

| Adjustments to reconcile net income to cash | ||||||||

| provided by operations: | ||||||||

| Depreciation and amortization | 17,308 | 14,112 | ||||||

| Share-based compensation expense | 14,416 | 10,557 | ||||||

| Deferred income tax benefit | (4,785 | ) | (2,658 | ) | ||||

| Changes in operating assets and liabilities, | ||||||||

| exclusive of effects of acquired companies | (30,330 | ) | (15,205 | ) | ||||

| Net cash provided by operating activities | 23,957 | 44,631 | ||||||

| Cash flows from investing activities: | ||||||||

| Additions to property and equipment | (12,320 | ) | (8,895 | ) | ||||

| Purchase of marketable security investments | (3,590 | ) | (43,962 | ) | ||||

| Proceeds from marketable security investments | 20,276 | 11,077 | ||||||

| Investment in software | (690 | ) | — | |||||

| Cost of acquisitions, net of cash acquired | (199,130 | ) | — | |||||

| Decrease in other | 564 | 743 | ||||||

| Net cash used by investing activities | (194,890 | ) | (41,037 | ) | ||||

| Cash flows from financing activities: | ||||||||

| Increase in net borrowings on revolving line of credit | 85,000 | — | ||||||

| Purchase of treasury shares | (17,786 | ) | — | |||||

| Proceeds from exercise of stock options | 6,528 | 19,298 | ||||||

| Contributions from employee stock purchase plan | 2,349 | 1,798 | ||||||

| Net cash provided by financing activities | 76,091 | 21,096 | ||||||

| Net (decrease) increase in cash and cash equivalents | (94,842 | ) | 24,690 | |||||

| Cash and cash equivalents at beginning of period | 134,279 | 185,926 | ||||||

| Cash and cash equivalents at end of period | $ | 39,437 | $ | 210,616 | ||||

Contacts

Brian K. Miller

Executive Vice President & CFO

Tyler

Technologies, Inc.

972-713-3720

[email protected]

Warning: Undefined array key 0 in /home/grassnews/public_html/wp-content/themes/zox-news/parts/post-single.php on line 493

Warning: Attempt to read property "cat_ID" on null in /home/grassnews/public_html/wp-content/themes/zox-news/parts/post-single.php on line 493

Cannabis

Investing into the creation of low-cost, solvent-free canola & hemp proteins

Cannabis

IM Cannabis Closes Convertible Debenture Offering to Support Accelerated Growth in Germany

Through continuous, active cost management, IMC reduced its annual G&A costs by 49% in 2023 and is now looking to significantly reduce its financial costs.

TORONTO and GLIL YAM, Israel, May 29, 2024 /PRNewswire/ — IM Cannabis Corp. (CSE: IMCC) (NASDAQ: IMCC) (the “Company“, “IM Cannabis“, or “IMC“), a leading medical cannabis company with operations in Israel and Germany, is pleased to announce that in order to preserve its cash for to support accelerated growth in Germany it has closed a non-brokered private placement (the “Offering“) of secured convertible debentures of the Company (each, a “Debenture“) for aggregate proceeds of $2,091,977. The Debentures are being issued to holders of short-term loans and obligations owed by the Company or its wholly owned subsidiaries. The Debentures will mature on May 26, 2025, and will not incur interest except in the event of default. The Debentures may be converted into common shares in the Company (each, a “Share“) at a conversion price of $0.85 per Share.

“Active cost management has been our focus since the beginning of 2023. Last year we concentrated on reducing our operating expenses, reducing our 2023 G&A expenses -49% vs 2022,” said Oren Shuster, CEO of IMC. “This year we looked at our financial costs. By renegotiating our debt, we expect a significant reduction in our financing costs. Our goal is to free resources to drive accelerated growth in Germany, where we currently see the biggest potential following the April 1st legalization.”

RELATED PARTY TRANSACTIONS

Oren Shuster, a director and the Chief Executive Officer of the Company (the “Insider“) has subscribed for an aggregate of $237,214 of Debentures in the Offering. The Insider’s participation in the Offering (the “Insider Transaction“) is a “related party transaction” within the meaning of Multilateral Instrument 61-101 Protection of Minority Security Holders in Special Transactions (“MI 61-101“). The Company intends to rely on the exemptions from the formal valuation and minority shareholder approval requirements of MI 61-101 under sections 5.5(a) and 5.7(1)(a) of MI 61-101 as the fair market value of the Insider Transaction does not exceed 25% of the Company’s market capitalization. As the material change report disclosing the Insider Transaction is being filed less than 21 days before the transaction, there is a requirement under MI 61–101 to explain why the shorter period was reasonable or necessary in the circumstances. In the view of the Company, it is necessary to immediately close the Insider Transaction and therefore, such shorter period is reasonable and necessary in the circumstances to improve the Company’s financial position.

EARLY WARNING REPORT

Oren Shuster will file an early warning report in accordance with National Instrument 62-104 Take-Over Bids and Issuer Bids (“NI 62-104“) and National Instrument 62-103 The Early Warning System and Related Take-Over Bid and Insider Reporting Issues (“NI 62-103“). On May 26, 2024, Mr. Shuster acquired a Debenture in the principal amount of CAD$237,214 pursuant to the Offering (the “Acquisition“), which was issued in full satisfaction of CAD$237,214 of debt owed by the Company to him.

Immediately prior to the Acquisition, Mr. Shuster beneficially owned or controlled 1,872,870 Shares, 856,704 Warrants and 131,250 Stock Options of the Company, which represented approximately 13.98% of the then outstanding shares of the Company on a non-diluted basis and 19.89% on a partially diluted basis if Mr. Shuster converted all of the convertible securities held by him. As a result of the Acquisition, Mr. Shuster now beneficially owns or controls an aggregate of 1,872,870 Shares, 856,704 Warrants, 131,250 Stock Options and a Debenture in the principal amount of CAD$237,214 of the Company (the Debenture is convertible into up to 279,075 Shares at $0.85 per Share) which represented approximately 1.8% of the Company’s issued and outstanding Shares on a non-diluted basis (based on 13,394,136 Shares issued and outstanding as of the date hereof), and 23.44% on a partially diluted basis if Mr. Shuster converted all of the convertible securities held by him.

Mr. Shuster acquired the securities for general investment purposes only. Mr. Shuster may in the future take such actions in respect of his holdings in IMC as he may deem appropriate based on his assessment of market conditions and any other conditions he considers relevant at the time, including the purchase of additional Shares through open market or privately negotiated transactions or the sale of all or a portion of his holdings in the open market or in privately negotiated transactions to one or more purchasers, subject in each case to applicable securities laws.

Since the previous early warning report filed by Mr. Shuster in respect of the Company, Mr. Shuster’s Share ownership position increased by more than 2% and Mr. Shuster acquired securities convertible into more than 2% of the issued and outstanding Shares, which triggered the requirement to file an early warning report under applicable Canadian Securities legislation (the “Early Warning Report“).

A copy of the Early Warning Report may be found at SEDAR+ at www.sedarplus.ca under IMC’s profile. For further information, or to obtain a copy of the early warning report, please contact Oren Shuster at +972-77-3603504.

About IM Cannabis Corp.

IMC (Nasdaq: IMCC) (CSE: IMCC) is an international cannabis company that provides premium cannabis products to medical patients in Israel and Germany, two of the largest medical cannabis markets. The Company has recently exited operations in Canada to pivot its focus and resources to achieve sustainable and profitable growth in its highest value markets, Israel and Germany. The Company leverages a transnational ecosystem powered by a unique data-driven approach and a globally sourced product supply chain. With an unwavering commitment to responsible growth and compliance with the strictest regulatory environments, the Company strives to amplify its commercial and brand power to become a global high-quality cannabis player.

The IMC ecosystem operates in Israel through its commercial relationship with Focus Medical Herbs Ltd., which imports and distributes cannabis to medical patients, leveraging years of proprietary data and patient insights. The Company also operates medical cannabis retail pharmacies, online platforms, distribution center, and logistical hubs in Israel that enable the safe delivery and quality control of IMC products throughout the entire value chain. In Germany, the IMC ecosystem operates through Adjupharm GmbH, where it distributes cannabis to pharmacies for medical cannabis patients. Until recently, the Company also actively operated in Canada through Trichome Financial Corp and its wholly owned subsidiaries. The Company has exited operations in Canada and considers these operations discontinued.The securities to be offered pursuant to the Offering have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act“) or any United States state securities laws, and may not be offered or sold in the United States or to, or for the account or benefit of, United States persons absent registration or any applicable exemption from the registration requirements of the U.S. Securities Act and applicable United States state securities laws. This news release shall not constitute an offer to sell or the solicitation of an offer to buy securities in the United States, nor shall there be any sale of these securities in any jurisdiction in which such offer, solicitation or sale would be unlawful.

Company Contact:

Anna Taranko, Director Investor & Public Relations

IM Cannabis Corp.

+49 157 80554338

[email protected]

Oren Shuster, CEO

IM Cannabis Corp.

+972-77-3603504

[email protected]

Forward-Looking Information and Cautionary Statements

This press release contains forward-looking information or forward-looking statements under applicable Canadian and United States securities laws (collectively, “forward-looking statements”). All information that addresses activities or developments that we expect to occur in the future are forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as “seek”, “anticipate”, “believe”, “plan”, “estimate”, “expect”, “likely” and “intend” and statements that an event or result “may”, “will”, “should”, “could” or “might” occur or be achieved and other similar expressions. Forward-looking statements are based on the estimates and opinions of management on the date the statements are made. In the press release, such forward-looking statements include, but are not limited to, statements relating to: significant reduction in our financing costs; the timing and impact of the legalization of medicinal cannabis in Germany; and the Company’s accelerated growth in Germany.

Forward-looking statements are based on assumptions that may prove to be incorrect, including but not limited to: the Company’s ability significant reduction in our financing costs; the Company’s ability to focus and resources to achieve sustainable and profitable growth in its highest value markets; the Company’s ability to mitigate the impact of the Israel-Hamas war on the Company; the Company’s ability to take advantage of the legalization of medicinal cannabis in Germany; the Company’s ability to host a teleconference meeting as stated; and the Company’s ability to carry out its stated goals, scope, and nature of operations in Germany, Israel, and other jurisdictions the Company may operate. The above lists of forward-looking statements and assumptions are not exhaustive. Since forward-looking statements address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated or implied by such forward looking statements due to a number of factors and risks. These include: the failure of the Company to comply with applicable regulatory requirements in a highly regulated industry; unexpected changes in governmental policies and regulations in the jurisdictions in which the Company operates; the Company’s ability to continue to meet the listing requirements of the Canadian Securities Exchange and the NASDAQ Capital Market; any unexpected failure to maintain in good standing or renew its licenses; the ability of the Company and its subsidiaries (collectively, the “Group”) to deliver on their sales commitments or growth objectives; the reliance of the Group on third-party supply agreements to provide sufficient quantities of medical cannabis to fulfil the Group’s obligations; the Group’s possible exposure to liability, the perceived level of risk related thereto, and the anticipated results of any litigation or other similar disputes or legal proceedings involving the Group; the impact of increasing competition; any lack of merger and acquisition opportunities; adverse market conditions; the inherent uncertainty of production quantities, qualities and cost estimates and the potential for unexpected costs and expenses; risks of product liability and other safety-related liability from the usage of the Group’s cannabis products; supply chain constraints; reliance on key personnel; the risk of defaulting on existing debt; risks surrounding war, conflict and civil unrest in Eastern Europe and the Middle East, including the impact of the Israel-Hamas war on the Company, its operations and the medical cannabis industry in Israel; risks associated with the Company focusing on the Israel and Germany markets; the inability of the Company to achieve sustainable profitability and/or increase shareholder value; the inability of the Company to actively manage costs and/or improve margins; the inability of the company to grow and/or maintain sales; the inability of the Company to meet its goals and/or strategic plans; the inability of the Company to reduce costs and/or maintain revenues; the Company’s inability to take advantage of the legalization of medicinal cannabis in Germany; and the Company’s inability to host a teleconference meeting as stated. Please see the other risks, uncertainties and factors set out under the heading “Risk Factors” in the Company’s annual report dated March 28, 2024, which is available on the Company’s issuer profile on SEDAR+ at www.sedarplus.ca and Edgar at www.sec.gov/edgar. Any forward-looking statement included in this press release is made as of the date of this press release and is based on the beliefs, estimates, expectations and opinions of management on the date such forward looking information is made. The Company does not undertake any obligation to update forward-looking statements except as required by applicable securities laws. Investors should not place undue reliance on forward-looking statements. Forward looking statements contained in this press release are expressly qualified by this cautionary statement.

Logo – https://mma.prnewswire.com/media/1742228/IM_Cannabis_Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/im-cannabis-closes-convertible-debenture-offering-to-support-accelerated-growth-in-germany-302157901.html

View original content:https://www.prnewswire.co.uk/news-releases/im-cannabis-closes-convertible-debenture-offering-to-support-accelerated-growth-in-germany-302157901.html

Announces

IMC announces the termination of a preliminary term sheet with Kadimastem Ltd., a public company traded on the Tel Aviv Stock Exchange to fully focus on the recently legalized German market

With Germany delivering accelerated growth after legalization, IMC is keeping all options open to maximize shareholder value

TORONTO and GLIL YAM, Israel, May 28, 2024 /PRNewswire/ — IM Cannabis Corp. (CSE: IMCC) (NASDAQ: IMCC) (the “Company” or “IMC“), a leading medical cannabis company with operations in Israel and Germany, announces the termination of the preliminary term sheet signed on February 13, 2024 with Kadimastem Ltd a public company traded on the Tel Aviv Stock Exchange under the symbol (TASE:KDST) (“Kadimastem“).

“After the April 1st legalization in Germany, we are seeing that the accelerated growth in April is continuing through May. We believe this is just the beginning, as we anticipate that Germany could become one of the most significant legal markets in the world,” said Oren Shuster, Chief Executive Officer of IMC. “We are continuing to explore all options, focusing on providing the best value for our shareholders.”

According to the separation agreement signed with Kadimastem, as a result of this termination, the loan provided to IMC Holdings Ltd (the “Holding Company“) by Kadimastem in a total amount of 300,000$ will be repaid together with 9% annual interest accrued thereon, in three installments by July 31st, 2024.

About IM Cannabis Corp.

IMC (Nasdaq: IMCC) (CSE: IMCC) is an international cannabis company that provides premium cannabis products to medical patients in Israel and Germany, two of the largest medical cannabis markets. The Company has recently exited operations in Canada to pivot its focus and resources to achieve sustainable and profitable growth in its highest value markets, Israel and Germany. The Company leverages a transnational ecosystem powered by a unique data-driven approach and a globally sourced product supply chain. With an unwavering commitment to responsible growth and compliance with the strictest regulatory environments, the Company strives to amplify its commercial and brand power to become a global high-quality cannabis player.

The IMC ecosystem operates in Israel through its commercial relationship with Focus Medical Herbs Ltd., which imports and distributes cannabis to medical patients, leveraging years of proprietary data and patient insights. The Company also operates medical cannabis retail pharmacies, online platforms, distribution centers, and logistical hubs in Israel that enable the safe delivery and quality control of IMC’s products throughout the entire value chain. In Germany, the IMC ecosystem operates through Adjupharm GmbH, where it distributes cannabis to pharmacies for medical cannabis patients.

Disclaimer for Forward-Looking Statements

This press release contains forward-looking information or forward-looking statements under applicable Canadian and U.S. securities laws (collectively, “forward-looking statements”). All information that addresses activities or developments that we expect to occur in the future are forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as “seek”, “anticipate”, “believe”, “plan”, “estimate”, “expect”, “likely” and “intend” and statements that an event or result “may”, “will”, “should”, “could” or “might” occur or be achieved and other similar expressions. Forward-looking statements are based on the estimates and opinions of management on the date the statements are made. In the press release, such forward-looking statements include, but are not limited to, statements relating to the allegations against the Company by MYM Shareholder Plaintiffs and the likelihood of the complaint and its resolution.

Forward-looking statements are based on assumptions that may prove to be incorrect, including but not limited to: the development and introduction of new products; continuing demand for medical and adult-use recreational cannabis in the markets in which the Company operates; the Company’s ability to reach patients through both e-commerce and brick and mortar retail operations; the Company’s ability to maintain and renew or obtain required licenses; the effectiveness of its products for medical cannabis patients and recreational consumers; and the Company’s ability to market its brands and services successfully to its anticipated customers and medical cannabis patients.

The above lists of forward-looking statements and assumptions are not exhaustive. Since forward-looking statements address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated or implied by such forward looking statements due to a number of factors and risks. These include: any failure of the Company to maintain “de facto” control over Focus Medical in accordance with IFRS 10; the failure of the Company to comply with applicable regulatory requirements in a highly regulated industry; unexpected changes in governmental policies and regulations in the jurisdictions in which the Company operates; the effect of the reform on the Company; the Company’s ability to continue to meet the listing requirements of the Canadian Securities Exchange and the NASDAQ Capital Market; any unexpected failure to maintain in good standing or renew its licenses; the ability of the Company and Focus Medical (collectively, the “Group”) to deliver on their sales commitments or growth objectives; the reliance of the Group on third-party supply agreements to provide sufficient quantities of medical cannabis to fulfil the Group’s obligations; the Group’s possible exposure to liability, the perceived level of risk related thereto, and the anticipated results of any litigation or other similar disputes or legal proceedings involving the Group; the impact of increasing competition; any lack of merger and acquisition opportunities; adverse market conditions; the inherent uncertainty of production quantities, qualities and cost estimates and the potential for unexpected costs and expenses; risks of product liability and other safety-related liability from the usage of the Group’s cannabis products; supply chain constraints; reliance on key personnel; the risk of defaulting on existing debt and war, conflict and civil unrest in Eastern Europe and the Middle East

Any forward-looking statement included in this press release is made as of the date of this press release and is based on the beliefs, estimates, expectations and opinions of management on the date such forward-looking information is made.

The Company does not undertake any obligation to update forward-looking statements except as required by applicable securities laws. Investors should not place undue reliance on forward-looking statements. Forward-looking statements contained in this press release are expressly qualified by this cautionary statement.

Company Contacts:

Anna Taranko, Director Investor & Public Relations

IM Cannabis Corp.

+49 157 80554338

[email protected]

Oren Shuster, Chief Executive Officer

IM Cannabis Corp.

[email protected]

Logo: https://mma.prnewswire.com/media/1742228/IM_Cannabis_Logo.jpg

-

Cannabis2 weeks ago

Medical Cannabis Market Report 2024-2030: Asia-Pacific Set to Witness Robust Growth, Driven by R&D Discovery Initiatives

-

StickIt2 weeks ago

StickIt2 weeks agoStickIt Technologies Announces Investment into Ripco Processing Inc.

-

Granted1 week ago

Granted1 week agoFDA Has Granted Innocan Pharma a Meeting Date for LPT-CBD for Chronic Pain

-

Cannabis1 week ago

Solei Brand Introduces New Cannabis-Infused ‘Warming Deep Tissue Stick’

-

Cannabis1 week ago

Cannabis1 week agoCannabis Testing Market Worth $4.0 billion | MarketsandMarkets™

-

Innocan4 days ago

Innocan4 days agoInnocan Pharma Reports First Quarter 2024 Results with Revenue Growth of over 4X to $6.8 Million

-

Cannabis5 days ago

Cannabis5 days agoGlobal Hemp Protein Market Forecasts 2024-2029: Growing Vegan Population Boosts Hemp Protein Demand – CAGR of 15% Forecast During 2022-2029

-

Announces4 days ago

IMC announces the termination of a preliminary term sheet with Kadimastem Ltd., a public company traded on the Tel Aviv Stock Exchange to fully focus on the recently legalized German market