/home/grassnews/public_html/wp-content/themes/zox-news/parts/post-single.php on line 153

">

Warning: Undefined array key 0 in /home/grassnews/public_html/wp-content/themes/zox-news/parts/post-single.php on line 153

Warning: Attempt to read property "cat_name" on null in /home/grassnews/public_html/wp-content/themes/zox-news/parts/post-single.php on line 153

DATA Communications Management Corp. Announces First Quarter Financial Results for 2019

Reading Time: 14 minutes

Reading Time: 14 minutes

HIGHLIGHTS

FIRST QUARTER 2019

-

Revenues of $78.5 million compared with $88.5 million in the prior

year; the prior period included significantly higher volume from one

particular customer -

Gross margin as a percentage of revenue improved to 26.4% from 24.3%

in the prior year comparative period -

Reduction in selling, general & administrative expenses by $0.5

million versus the same quarter last year -

Adjusted EBITDA of $7.9 million, compared to $6.4 million in the prior

year (See Table 2 and “Non-IFRS Measures” below). Excluding the

effects of adopting IFRS 16 Leases (“IFRS 16”), Adjusted EBITDA

was $5.4 million -

Net loss of $0.3 million, including restructuring expenses of $1.7

million compared to net income of $1.8 million, including

restructuring expenses of $0.1 million in the prior comparative period -

Adjusted net income of $1.2 million, compared to $2.1 million in the

prior comparative period (See Table 3 and “Non-IFRS Measures” below).

Excluding the effects of adopting IFRS 16, Adjusted net income was

$1.7 million -

Adopts new accounting standard IFRS 16 Leases effective January

1, 2019

RECENT EVENTS

-

DCM announces it has entered into a significant multi-year agreement

to provide innovative technology solutions to a large provincial

health services network -

Sale of loose-leaf binders and index tab business to Southwest

Business Products Ltd (“Southwest”) and long-term supply agreement

with Southwest -

Strategic decision to outsource Brossard, Quebec stationery production

and expand existing tier two supplier agreement for the provision of

stationery

BRAMPTON, Ontario–(BUSINESS WIRE)–DATA Communications Management Corp. (TSX:DCM) (“DCM” or the “Company”),

a leading provider of marketing and business communication solutions to

companies across North America, announces its consolidated financial

results for the three months ended March 31, 2019.

“We continue to focus your Company’s efforts on providing additional

products and services to our core client base. In addition, with the

enhanced retail and consumer insight capabilities Perennial brings to

DCM, we are capturing new client business due to the innovative ideas

and exceptional executional capabilities we are presenting to clients.

Our “pitched and pending” sales pipeline is at historic highs with both

current and new clients,” said Gregory J. Cochrane, CEO.

CONTINUING THE PIVOT

DCM announced its Business Solutions Group was

recently awarded a significant multi-year agreement to provide

innovative technology solutions to a large provincial healthcare

services network as it transforms its clinical information systems to

become more integrated with enhanced automation tools. Key components to

be provided by DCM include scanners, printers, patient identification

solutions, consumables including labels, as well as ongoing support

services.

“This long-standing customer of DCM in our traditional business has

trusted DCM to consult, evaluate, recommend and execute a business

solutions platform which will dramatically modernize the way this

province delivers health care services to its customers,” said Mr.

Cochrane. “By recommending the appropriate technology and business

processes to this client, DCM is now seen as a total enterprise

solutions provider instead of a print production vendor. DCM began to

record revenue in the second quarter of 2019 under this agreement.”

DCM recently announced the sale of its loose-leaf binders and index tab

business to Southwest, which closed on May 2, 2019. The sale was made by

way of an asset purchase agreement in which certain assets were sold and

certain liabilities were assumed by Southwest in exchange for cash

proceeds to DCM. At the same time, DCM entered into a long-term supply

agreement with Southwest as a preferred vendor of binders, index tabs

and related products. DCM expects to incur restructuring costs of

approximately $0.4 million in connection with this initiative in the

second quarter of 2019 primarily related to a reduction in headcount.

This transaction aligns with DCM’s strategy to focus on products and

solutions that are critical to its top customers, and to source non-core

offerings from other leading providers where it makes strategic sense.

Consistent with this theme, in early March 2019, DCM initiated plans to

outsource its Brossard, Quebec stationery production to a long-standing

tier two supplier. DCM also expanded its pre-existing supply agreement

with this partner. Effective May 1, 2019, DCM closed the Brossard,

Quebec facility, which primarily produced stationery products including

business cards and letterhead and relocated the facility’s digital print

on demand production to other DCM sites. As a result of the Brossard

closure, DCM incurred restructuring costs of approximately $0.5 million

in the first quarter of 2019 for severance costs. While DCM does not

expect material changes in revenue or margins from this initiative, it

allows DCM to better serve its customers with a seamless offering, and

to avoid additional investment in what it sees as a declining business

segment.

In the first quarter of 2019, DCM also initiated direct and indirect

labour savings across a number of its facilities as part of its

strategic focus on improving overall profitability. DCM incurred

restructuring costs of $1.2 million in the first quarter of 2019 for

severance costs associated with this reduction of employees. Total

annualized savings from these reduced labour costs are estimated to be

$1.2 million.

EXTENSION OF BANK CREDIT FACILITY

On March 5, 2019, DCM entered

into a second amendment to its credit agreement with a Canadian

chartered bank in relation to its revolving credit facility (“Bank

Credit Facility”). Significant terms of the amendment made to the credit

facility include an extension of the maturity date to January 31, 2023,

from its original maturity date of March 31, 2020; a reduction in the

prime rate margin on advances by 15 basis points from 0.75% per annum to

0.60% per annum; the elimination of an early termination fee in the

event the credit facility is terminated or repaid prior to maturity; and

amendments related to the calculation of certain financial covenants as

a result of the adoption of IFRS 16 effective for reporting periods on

or after January 1, 2019. The amendments related to IFRS 16 include

clarification that the calculation of DCM’s fixed charge coverage ratio

under the Bank Credit Facility will be completed on a basis that

substantially has the same effect as the results prior to the adoption

of IFRS 16 whereby lease payments will also be deducted from EBITDA, in

addition to all other adjustments previously allowed per the credit

agreement. As a result, definitions of certain terms related to IFRS 16

were added to the credit agreement. DCM’s financial covenant ratio with

the bank remains unchanged. On April 29, 2019, DCM entered into a lease

agreement with the bank pursuant to a master lease agreement dated July

31, 2018 in connection with the Gallus hybrid label press which was

fully commissioned earlier in the month.

RESULTS OF OPERATIONS

All financial information in this

press release is presented in Canadian dollars and in accordance with

International Financial Reporting Standards (“IFRS”), as issued by the

International Accounting Standards Board (“IASB”).

Table 1 The following table sets out selected historical

consolidated financial information for the periods noted.

| For the periods ended March 31, 2019 and 2018 |

Jan. 1 to |

Jan. 1 to |

||||||

|

(in thousands of Canadian dollars, except share and per share amounts, unaudited) |

$ | $ | ||||||

| Revenues | 78,549 | 88,516 | ||||||

| Cost of revenues | 57,787 | 67,041 | ||||||

| Gross profit | 20,762 | 21,475 | ||||||

| Selling, general and administrative expenses | 17,158 | 17,672 | ||||||

| Restructuring expenses | 1,682 | 64 | ||||||

| Acquisition costs | — | 43 | ||||||

| Income before finance costs and income taxes | 1,922 | 3,696 | ||||||

| Finance costs | ||||||||

| Interest expense, net | 2,132 | 1,137 | ||||||

| Amortization of transaction costs | 137 | 143 | ||||||

| 2,269 | 1,280 | |||||||

| (Loss) income before income taxes | (347 | ) | 2,416 | |||||

| Income tax (recovery) expense | ||||||||

| Current | 32 | 843 | ||||||

| Deferred | (56 | ) | (190 | ) | ||||

| (24 | ) | 653 | ||||||

| Net (loss) income for the period | (323 | ) | 1,763 | |||||

| Basic and diluted (loss) earnings per share | (0.02 | ) | 0.09 | |||||

|

Weighted average number of common shares outstanding, basic and diluted |

21,523,515 | 20,039,159 | ||||||

| As at March 31, 2019 and December 31, 2018 |

As at Mar. 31, |

As at Dec. 31, |

||||||

| (in thousands of Canadian dollars, unaudited) | $ | $ | ||||||

| Current assets | 85,810 | 85,455 | ||||||

| Current liabilities | 72,756 | 64,716 | ||||||

| Total assets | 202,879 | 142,231 | ||||||

| Total non-current liabilities | 123,013 | 70,003 | ||||||

| Shareholders’ equity | 7,110 | 7,512 | ||||||

| (1) |

2019 results include the impact of the adoption of new accounting standard IFRS 16. Refer to note 3 of the condensed interim consolidated financial statements for the three months ended March 31, 2019 and related management’s discussion & analysis for further details of the impact of the adoption of new accounting standards. |

||

Table 2 The following table provides reconciliations of

net (loss) income to EBITDA and of net (loss) income to Adjusted EBITDA

for the periods noted. See “Non-IFRS Measures”.

|

EBITDA and Adjusted EBITDA Reconciliation |

||||||||||||||||||||

| For the periods ended March 31, 2019 and 2018 | January 1 to March 31, 2019 |

January 1 to |

||||||||||||||||||

| (in thousands of Canadian dollars, unaudited) | ||||||||||||||||||||

|

Proforma |

IFRS 16 |

As reported | As reported | |||||||||||||||||

| Net (loss) income for the period (1) | $ | 178 | $ | (501 | ) | $ | (323 | ) | $ | 1,763 | ||||||||||

| Interest expense, net (1) | 1,231 | 901 | 2,132 | 1,137 | ||||||||||||||||

| Amortization of transaction costs | 137 | — | 137 | 143 | ||||||||||||||||

| Current income tax expense | 32 | — | 32 | 843 | ||||||||||||||||

| Deferred income tax recovery | (56 | ) | — | (56 | ) | (190 | ) | |||||||||||||

| Depreciation of property, plant and equipment | 1,119 | — | 1,119 | 1,148 | ||||||||||||||||

| Amortization of intangible assets | 647 | — | 647 | 1,069 | ||||||||||||||||

| Depreciation of ROU Asset (1) | — | 2,077 | 2,077 | — | ||||||||||||||||

| EBITDA | $ | 3,288 | $ | 2,477 | $ | 5,765 | $ | 5,913 | ||||||||||||

| Restructuring expenses | 1,682 | — | 1,682 | 64 | ||||||||||||||||

| One-time business reorganization costs (2) | 412 | — | 412 | 332 | ||||||||||||||||

| Acquisition costs | — | — | — | 43 | ||||||||||||||||

| Adjusted EBITDA | $ | 5,382 | $ | 2,477 | $ | 7,859 | $ | 6,352 | ||||||||||||

| (1) |

2019 results include the impact of the adoption of new accounting standard IFRS 16. Refer to note 3 of the condensed interim consolidated financial statements for the three months ended March 31, 2019 and related management’s discussion & analysis for further details of the impact of the adoption of new accounting standards. |

||

| (2) |

One-time business reorganization costs include non-recurring headcount reduction expenses for employees that did not qualify as restructuring costs. |

||

Table 3 The following table provides reconciliations of

net (loss) income to Adjusted net income and a presentation of Adjusted

net income per share for the periods noted. See “Non-IFRS Measures”.

|

Adjusted Net Income Reconciliation |

|||||||||||||||||||||

| For the periods ended March 31, 2019 and 2018 | January 1 to March 31, 2019 |

January 1 to |

|||||||||||||||||||

|

(in thousands of Canadian dollars, except share and per share amounts, unaudited) |

|||||||||||||||||||||

|

Proforma |

IFRS 16 |

As reported | As reported | ||||||||||||||||||

| Net (loss) income for the period (1) | $ | 178 | $ | (501 | ) | $ | (323 | ) | $ | 1,763 | |||||||||||

| Restructuring expenses | 1,682 | — | 1,682 | 64 | |||||||||||||||||

| One-time business reorganization costs (2) | 412 | — | 412 | 332 | |||||||||||||||||

| Acquisition costs | — | — | — | 43 | |||||||||||||||||

| Tax effect of the above adjustments | (546 | ) | — | (546 | ) | (103 | ) | ||||||||||||||

| Adjusted net income | $ | 1,726 | $ | (501 | ) | $ | 1,225 | $ | 2,099 | ||||||||||||

| Adjusted net income per share, basic and diluted | $ | 0.08 | $ | (0.02 | ) | $ | 0.06 | $ | 0.09 | ||||||||||||

|

Weighted average number of common shares outstanding, basic and diluted |

21,523,515 | 21,523,515 | 21,523,515 | 20,039,159 | |||||||||||||||||

| Number of common shares outstanding, basic and diluted | 21,523,515 | 21,523,515 | 21,523,515 | 20,039,159 | |||||||||||||||||

| (1) |

2019 results include the impact of the adoption of new accounting standard IFRS 16. Refer to note 3 of the condensed interim consolidated financial statements for the three months ended March 31, 2019 and related management’s discussion & analysis for further details of the impact of the adoption of new accounting standards. |

||

| (2) |

One-time business reorganization costs include non-recurring headcount reduction expenses for employees that did not qualify as restructuring costs. |

||

Revenues

For the three months ended March 31, 2019,

DCM recorded revenues of $78.5 million, a decrease of $10.0 million or

11.3% compared with the same period in 2018. The first quarter of 2018

included significantly higher volume than normal from one particular

customer, by approximately $4.9 million compared to this year. The

decrease in relative revenues for the three months ended March 31, 2019

was also due to (i) the loss of a lower margin customer, (ii) the timing

of orders, (iii) some softness in spend from certain customers, and (iv)

certain non-recurring work. The decrease was partially offset by (i) an

increase in revenues from new customers in the Cannabis industry, (ii)

year over year growth from a large customer in the financial services

industry which was onboarded in late 2017, (iii) gains in wallet share

from existing customers with new applications and (iv) the acquisition

of Perennial which was not reflected in the comparative period as the

acquisition was completed in the second quarter of 2018.

Cost of Revenues and Gross Profit

For the three

months ended March 31, 2019, cost of revenues decreased to $57.8 million

from $67.0 million for the same period in 2018, resulting in a $9.2

million or 13.8% decrease over the same period last year. Excluding the

effects of adopting IFRS 16, cost of revenues for the three months ended

March 31, 2019 was $58.1 million.

Gross profit for the three months ended March 31, 2019 was

$20.8 million, which represented a decrease of $0.7 million or 3.3% from

$21.5 million for the same period in 2018. Gross profit as a percentage

of revenues increased to 26.4% for the three months ended March 31,

2019, compared to 24.3% for the same period in 2018. Excluding the

effects of adopting IFRS 16, gross profit for the three months ended

March 31, 2019 was $20.4 million or 26.0% as a percentage of revenues.

The increase in gross profit as a percentage of revenues for the three

months ended March 31, 2019 was positively impacted by (i) higher

margins attributed to the acquisition of Perennial which was not

reflected in the comparative period, (ii) continued refinement of DCM’s

pricing discipline, (iii) cost reductions realized from prior cost

savings initiatives, and (iv) improvements in product mix compared to

last year. The increase in gross profit as a percentage of revenues was,

however, partially offset by the impact of paper and other raw materials

price increases leading to somewhat compressed margins on contracts with

certain existing customers.

Selling, General and Administrative Expenses (“SG&A”)

SG&A

expenses for the three months ended March 31, 2019 decreased

$0.5 million or 2.9% to $17.2 million, or 21.8% of total revenues,

compared to $17.7 million, or 20.0% of total revenues, for the same

period of 2018. After deducting one-time business reorganization costs,

SG&A expenses were $16.8 million, or 21.3% of total revenues compared to

$17.4 million or 19.7% of revenues in the prior period. The decrease in

SG&A expenses for the three months ended March 31, 2019 was primarily

attributable to (i) benefits from the cost saving initiatives

implemented in the last two quarters of 2018, and (ii) reduction of

amortization expense of intangible assets that were fully amortized in

the fourth quarter of 2018. The decrease was partially offset by an

increase in SG&A from the acquisition of Perennial which was not

reflected in the comparative period, and an increase in non-recurring

headcount reduction expenses for employees that did not qualify as

restructuring costs.

Restructuring Expenses

Cost reductions and

enhancement of operating efficiencies have been an area of focus for DCM

over the past four years in order to improve margins and better align

costs with the declining revenues experienced by the Company in its

traditional business, a trend being faced by the traditional printing

industry for several years now.

For the three months ended March 31, 2019, DCM incurred restructuring

expenses of $1.7 million compared to $0.1 million in the same period in

2018. In 2019, the restructuring costs related to (i) headcount

reductions due to the closure of the Brossard, Quebec facility, and (ii)

headcount reductions to direct and indirect labour from various

facilities across DCM as cost savings initiatives to improve gross

margin.

DCM will continue to evaluate its operating costs for further

efficiencies as part of its commitment to improving its gross margins

and lowering its selling, general and administration expenses.

Adjusted EBITDA

For the three months ended March 31,

2019, Adjusted EBITDA increased by $1.5 million to $7.9 million, or

10.0% of revenues, after adjusting EBITDA for the $1.7 million in

restructuring charges and $0.4 million of one-time business

reorganization costs. The adoption of IFRS 16 resulted in a higher

Adjusted EBITDA for the first quarter of 2019 due to changes in the

recognition and classification of lease payments from cost of sales and

SG&A expenses to depreciation of $2.1 million and interest expense of

$0.9 million, respectively. Excluding the effects of adopting IFRS 16,

Adjusted EBITDA for the three months ended March 31, 2019 was $5.4

million, or 6.9% of revenues. The decrease of $1.0 million in Adjusted

EBITDA for the three months ended March 31, 2019 over the same period

last year excluding IFRS 16 was attributable to a decrease in revenues,

with a corresponding decrease in gross profit. The decline was offset

due to the acquisition of Perennial which was not reflected in the

comparative period, and a reduction in SG&A.

Interest Expense

Interest expense including interest

on debt outstanding under DCM’s credit facilities, interest accretion

expense related to certain debt obligations recorded at fair value, and

interest expense on lease liabilities under IFRS 16 was $2.1 million for

the three months ended March 31, 2019 compared to $1.1 million for the

same period in 2018. Excluding the effects of adopting IFRS 16, interest

expense for the three months ended March 31, 2019 was $1.2 million.

Interest expense for the three months ended March 31, 2019 was

relatively consistent with the same period in the prior year excluding

IFRS 16. The slight increase was primarily due to the Crown facility,

secured in 2018 to fund the acquisition of Perennial and repay the

outstanding balance on its subordinated debt facility with Bridging

Financing Inc. (“Bridging Credit Facility”), which was not reflected in

the comparative period as the facility was obtained in the second

quarter of 2018. The increase was offset by a reduction in the unwinding

of discount which was included in interest expense of the Eclipse and

Thistle VTBs that were repaid during the current period.

Income Taxes

DCM reported a loss before income taxes

of $0.3 million and a net income tax recovery of $24 thousand for the

three months ended March 31, 2019 compared to income before income taxes

of $2.4 million and a net income tax expense of $0.7 million for the

three months ended March 31, 2018. The decrease in the current income

tax expense to a recovery position was due to the reduction of DCM’s

estimated taxable income for the three months ended March 31, 2019. The

deferred income tax recovery for the three months ended March 31, 2019

primarily relates to changes in estimates of future reversals of

temporary differences.

Net Loss

Net loss for the three months ended March

31, 2019 was $0.3 million compared to a net income of $1.8 million for

the same period in 2018. Excluding the effects of adopting IFRS 16, net

income for the three months ended March 31, 2019 was $0.2 million. The

decrease in comparable profitability for the three months ended March

31, 2019 was primarily due to (i) the decrease in revenues, with a

corresponding decline in the gross profit, and (ii) an increase in

restructuring expenses. This decrease was partially offset by (i)

continued implementation of the refined discipline in DCM’s pricing

strategy resulting in an increase in gross margin as a percentage of

revenues, (ii) cost benefits as a result of the restructuring efforts

implemented in the last two quarters of 2018, and (iii) a reduction in

SG&A expense.

Adjusted Net Income

Adjusted net income for the three

months ended March 31, 2019 was $1.2 million compared to Adjusted net

income of $2.1 million for the same period in 2018. The adoption of IFRS

16 resulted in a lower Adjusted net income for the first quarter of 2019

by $0.5 million due to changes in net income as discussed in Table 1.

Excluding the effects of adopting IFRS16, Adjusted net income for the

three months ended March 31, 2019 was $1.7 million. The decrease in

comparable profitability for the three months ended March 31, 2019 was

primarily due to the decrease in revenues, with a corresponding decline

in the gross margin. This decrease was partially offset by (i) continued

implementation of the refined discipline in DCM’s pricing strategy

resulting in an increase in the gross margin as a percentage of

revenues, (ii) cost benefits as a result of the restructuring efforts

implemented in the last two quarters of 2018, and (iii) a reduction in

SG&A expense.

CASH FLOW FROM OPERATIONS

During the three months ended

March 31, 2019, cash flows generated by operating activities were $10.1

million compared to cash flows generated by operating activities of $6.1

million during the same period in 2018. Current period cash flow from

operations, after adjusting for non-cash items, generated a total of

$6.7 million compared with $5.5 million for the same period last year.

As a result of the adoption of IFRS 16, $2.5 million in lease payments

are now presented as cash used for financing activities in the condensed

interim consolidated statement of cash flow for the period ended March

31, 2019. In the prior year comparative period, this was classified as a

reduction of operating activities thereby contributing to the variance

in cash flow from operations year over year. In addition, current period

cash flows from operations were negatively impacted by the decrease in

revenues however this was slightly offset by an improvement in gross

margin and a decline in SG&A expenses.

Changes in working capital during the three months ended March 31, 2019

generated $6.0 million in cash compared with $3.7 million of cash

generated in the prior year. $6.8 million of the increase in current

period working capital was primarily a result of DCM’s continued efforts

to better align the timing of payments to its suppliers with collections

on outstanding receivables from its customers. This was slightly offset

by higher volumes in inventory purchases thereby reducing working

capital by $1.2 million.

Lastly, there were lower payments for severances and lease termination

payments related to DCM’s restructuring initiatives totaling $1.4

million during the current period compared with $2.2 million for the

same period last year.

INVESTING ACTIVITIES

For the three months ended March 31,

2019, $2.3 million in cash flows were used for investing activities

compared with $1.4 million during the same period in 2018. In the

current period, $0.5 million of cash was primarily used to invest in IT

equipment and costs related to leasehold improvements to set up

production equipment compared with $0.

Contacts

Mr. Gregory J. Cochrane

Chief Executive Officer

DATA

Communications Management Corp.

Tel: (905) 791-3151

Mr. James E. Lorimer

Chief Financial Officer

DATA

Communications Management Corp.

Tel: (905) 791-3151

ir@datacm.com

Warning: Undefined array key 0 in /home/grassnews/public_html/wp-content/themes/zox-news/parts/post-single.php on line 493

Warning: Attempt to read property "cat_ID" on null in /home/grassnews/public_html/wp-content/themes/zox-news/parts/post-single.php on line 493

Innocan

Innocan Pharma Submits Investigational New Animal Drug Application to FDA’s Veterinary Center

HERZLIYA, Israel and CALGARY, AB, July 26, 2024 /PRNewswire/ — Innocan Pharma Corporation (CSE: INNO) (FSE: IP4) (OTCQB: INNPF) (“Innocan” or the “Company”), a pioneer in the pharmaceutical and biotechnology industries, is pleased to announce that the FDA’s Center for Veterinary Medicine (CVM) has granted the Company a sponsor fee waiver and assigned an Investigational New Animal Drug (INAD) number for its LPT-CBD (Liposome Platform Technology-Cannabidiol) product. This represents a significant step for the Company, as an INAD designation facilitates correspondence and data exchange with CVM to support LPT-CBD development as a new veterinary drug.

The Company further announced that following the assessment of LPT-CBD’s scientific package, the CVM recognized Innocan’s contribution to pursuing innovative animal drug products and technology and granted the company a sponsor fee waiver for fiscal year 2024.

Innocan’s LPT-CBD is a proprietary drug delivery platform designed to provide prolonged-release CBD for chronic pain and well-being management in animals. Over the past year, repeated administration of LPT-CBD in dogs and other animals has demonstrated both efficacy and tolerability, providing sufficient evidence for the INAD application.

“We are thrilled by CVM’s response,” said Prof. Chezy Barenholz, CSO of Innocan Pharma. “The granted INAD will allow us to advance the investigational studies of LPT-CBD and share knowledge to support future discussions with CVM on LPT-CBD’s development plan. Moreover, the fee waiver, granted by CVM, supports our development and pursuit of innovative animal drug products and technology, further validating our approach and potential impact in veterinary medicine.”

Dr. Eyal Kalo, R&D Director at Innocan, added, “LPT-CBD is a unique technology that has proven itself worthy of the INAD fee waiver granted by CVM. This will streamline our efforts to deliver a unique solution for chronic pain management to the animal market.”

About Innocan Pharma:

Innocan is a pharmaceutical tech company that operates under two main segments: Pharmaceuticals and Consumer Wellness. In the Pharmaceuticals segment, Innocan focuses on developing innovative drug delivery platform technologies comprises with cannabinoids science, to treat various conditions to improve patients’ quality of life. This segment involves two drug delivery technologies: (i) LPT CBD-loaded liposome platform facilitating exact dosing and the prolonged and controlled release of CBD into the blood stream. The LPT delivery platform research is in the preclinical trial phase for two indications: Epilepsy and Pain Management. In the Consumer Wellness segment, Innocan develops and markets a wide portfolio of innovative and high-performance self-care products to promote a healthier lifestyle. Under this segment Innocan has established a Joint Venture by the name of BI Sky Global Ltd. that focuses developing on advanced targeted online sales. https://innocanpharma.com/

Contact Information:

For Innocan Pharma Corporation:

Iris Bincovich, CEO

+1 5162104025

+972-54-3012842

+442037699377

info@innocanpharma.com

NEITHER THE CANADIAN SECURITIES EXCHANGE NOR ITS REGULATION SERVICES PROVIDER HAVE REVIEWED OR ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

Caution Regarding Forward-Looking Information

Certain information set forth in this news release, including, without limitation, the Company’s plans for human trials of its LPT-CBD platform, is forward-looking information within the meaning of applicable securities laws. By its nature, forward-looking information is subject to numerous risks and uncertainties, some of which are beyond Innocan’s control. . The forward-looking information contained in this news release is based on certain key expectations and assumptions made by Innocan, including expectations and assumptions concerning the anticipated benefits of the products, satisfaction of regulatory requirements in various jurisdictions and satisfactory completion of production and distribution arrangements.

Forward-looking information is subject to various risks and uncertainties that could cause actual results and experience to differ materially from the anticipated results or expectations expressed in this news release. The key risks and uncertainties include but are not limited to: global and local (national) economic, political, market and business conditions; governmental and regulatory requirements and actions by governmental authorities; and potential disruption of relationships with suppliers, manufacturers, customers, business partners and competitors. There are also risks that are inherent in the nature of product distribution, including import/export matters and the failure to obtain any required regulatory and other approvals (or to do so in a timely manner). The anticipated timeline for entry to markets may change for a number of reasons, including the inability to secure necessary regulatory requirements, or the need for additional time to conclude and/or satisfy the manufacturing and distribution arrangements. As a result of the foregoing, readers should not place undue reliance on the forward-looking information contained in this news release. A comprehensive discussion of other risks that impact Innocan can be found in Innocan’s public reports and filings which are available under Innocan’s profile at www.sedarplus.ca.

Readers are cautioned that undue reliance should not be placed on forward-looking information as actual results may vary materially from the forward-looking information. Innocan does not undertake to update, correct or revise any forward-looking information as a result of any new information, future events or otherwise, except as may be required by applicable law.

Logo: https://mma.prnewswire.com/media/2046271/3968398/Innocan_Pharma_Corporation_Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/innocan-pharma-submits-investigational-new-animal-drug-application-to-fdas-veterinary-center-302207435.html

View original content:https://www.prnewswire.co.uk/news-releases/innocan-pharma-submits-investigational-new-animal-drug-application-to-fdas-veterinary-center-302207435.html

Cannabis

Verano Announces the Opening of Zen Leaf Fairless Hills, the Company’s Newest Affiliated Dispensary in Pennsylvania, in Prime New Location

- Zen Leaf Fairless Hills, the Company’s newest affiliated dispensary in Pennsylvania, relocated from its former home in Chester to 203 Lincoln Highway, a busy thoroughfare with daily traffic of over 17,000 vehicles per day1

- As the first medical cannabis dispensary in the city, Zen Leaf Fairless Hills will offer an elevated experience for area patients, including increased convenience and accessibility with numerous point-of-sale stations and kiosks for seamless in-store browsing and ordering

- Verano’s active operations span 13 states, comprised of 142 dispensaries and 13 cultivation and processing facilities with more than 1 million square feet of cultivation capacity

CHICAGO, July 26, 2024 (GLOBE NEWSWIRE) — Verano Holdings Corp. (Cboe CA: VRNO) (OTCQX: VRNOF) (“Verano” or the “Company”), a leading multi-state cannabis company, today announced the opening of Zen Leaf Fairless Hills in Pennsylvania on Friday, July 26th, following a ceremonial ribbon cutting at 11 a.m. local time. Zen Leaf Fairless Hills is located at 203 Lincoln Highway and will be open Monday through Saturday from 9 a.m. to 8 p.m. and Sunday from 10 a.m. to 6 p.m. local time.

The dispensary is located in Bucks County, the fourth largest county in the Commonwealth with a total population of over 630,0002 residents. To increase accessibility and convenience, Zen Leaf Fairless Hills features large in-store kiosks and numerous point-of-sale stations to enhance the browsing and ordering experience for patients. To celebrate the grand opening of Zen Leaf Fairless Hills and following a ceremonial ribbon cutting, patients will be greeted with complimentary deals and doorbusters on featured branded products.

“We are excited to bring the Zen Leaf experience to local patients in Fairless Hills, where our talented team members will continue to deliver hospitality-driven care and top-quality products for local patients,” said George Archos, Verano Founder and Chief Executive Officer. “As the Pennsylvania medical cannabis patient population continues to grow, we are grateful for the opportunity to deepen our roots in Bucks County at our newest Zen Leaf location in the Commonwealth, and look forward to providing a warm and welcoming environment for current and future patients.”

Zen Leaf Fairless Hills adds another convenient outlet for Philadelphia area patients, and solidifies Verano’s footprint in the state as one of the Company’s 18 affiliated Pennsylvania dispensaries. Verano’s Pennsylvania operations also include a state-of-the-art 62,000 square foot cultivation and processing facility in Chester, where the Company produces its signature Verano Reserve flower and Troches, concentrates and vapes; (the) Essence and Savvy flower and extracts; and Avexia RSO cannabis oil and topicals. For additional convenience and accessibility, patients can choose to order ahead at ZenLeafDispensaries.com for express in-store pickup.

About Verano

Verano Holdings Corp. (Cboe CA: VRNO) (OTCQX: VRNOF), one of the U.S. cannabis industry’s leading companies based on historical revenue, geographic scope and brand performance, is a vertically integrated, multi-state operator embracing a mission of saying Yes to plant progress and the bold exploration of cannabis. Verano provides a superior cannabis shopping experience in medical and adult use markets under the Zen Leaf™ and MÜV™ dispensary banners, including Cabbage Club™, an innovative annual membership program offering exclusive benefits for cannabis consumers. Verano produces a comprehensive suite of high-quality, regulated cannabis products sold under its diverse portfolio of trusted consumer brands including Verano™, (the) Essence™, MÜV™, Savvy™, BITS™, Encore™, and Avexia™. Verano’s active operations span 13 U.S. states, comprised of 13 production facilities with over 1,000,000 square feet of cultivation capacity. Learn more at Verano.com.

Contacts:

Media

Verano

Steve Mazeika

VP, Communications

Steve.Mazeika@verano.com

Investors

Verano

Julianna Paterra, CFA

VP, Investor Relations

Julianna.Paterra@verano.com

Forward Looking Statements

This press release contains “forward-looking statements” within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. Such forward-looking statements are not representative of historical facts or information or current condition, but instead represent only the Company’s beliefs regarding future events, plans, strategies, or objectives, many of which, by their nature, are inherently uncertain and outside of the Company’s control. Generally, such forward-looking statements can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “future”, “scheduled”, “estimates”, “forecasts”, “projects,” “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases, or may contain statements that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “will continue”, “will occur” or “will be achieved”. Forward-looking statements involve and are subject to assumptions and known and unknown risks, uncertainties, and other factors which may cause actual events, results, performance, or achievements of the Company to be materially different from future events, results, performance, and achievements expressed or implied by forward-looking statements herein, including, without limitation, the risk factors described in the Company’s annual report on Form 10-K for the year ended December 31, 2023, its quarterly report on Form 10-Q for the quarter ended March 31, 2024 and any subsequent quarterly reports on Form 10-Q, in each case, filed with the U.S. Securities and Exchange Commission at www.sec.gov. The Company makes no assurances and cannot predict the outcome of all or any part of the on-going litigation with Goodness Growth referenced in this press release, including whether the Company will prevail on its Notice of Application and its counterclaim, or whether Goodness Growth will prevail on its claim for damages against the Company. The forward-looking statements contained in this press release are made as of the date of this press release, and the Company does not undertake to update any forward-looking information or forward-looking statements that are contained or referenced herein, except as may be required in accordance with applicable securities laws. All subsequent written and oral forward-looking information and statements attributable to the Company or persons acting on its behalf is expressly qualified in its entirety by this notice regarding forward-looking information and statements.

###

1 Pennsylvania Department of Transportation

2 United States Census Bureau

Cannabis

Unlocking New Horizons in Health: TNR, The Niche Research Reveals the Transformative Power of Minor Cannabinoids

Wilmington, Delaware, July 25, 2024 (GLOBE NEWSWIRE) — Minor cannabinoids refer to the lesser-known compounds found in the cannabis plant, distinct from the well-known THC (tetrahydrocannabinol) and CBD (cannabidiol). While THC and CBD dominate the market, minor cannabinoids such as CBG (cannabigerol), CBC (cannabichromene), and CBN (cannabinol) are gaining attention for their potential therapeutic benefits. These compounds are extracted from both marijuana and hemp plants, with varying legal restrictions depending on their THC content. The minor cannabinoids market is poised for significant growth, driven by increasing consumer awareness and demand for alternative health and wellness products. As regulatory environments around cannabis products evolve, companies are exploring the potential of minor cannabinoids in various applications, including pharmaceuticals, nutraceuticals, cosmetics, and food and beverages.

Minor cannabinoids are being researched for their potential therapeutic effects, including anti-inflammatory, analgesic, and neuroprotective properties. This versatility facilitates product diversification in various industries. Companies are investing in research and development to create novel formulations and delivery methods for minor cannabinoids. This includes nano-emulsions, encapsulation technologies, and controlled-release systems to enhance bioavailability and efficacy. For example, in January 2022, CBDA + CBGA Tincture a new product was launched by Hometown Hero CBD. This 30ml tincture contains 600mg each of CBGA, CBDA, CBG, and CBD. Derived from hemp, the cannabinoids in this tincture comply with legal requirements across all 50 states in the USA. There is an increasing consumer preference for natural as well as plant-based remedies, which in turn is driving the demand for cannabinoid-infused products. This trend is particularly strong among younger demographics seeking alternatives to traditional pharmaceuticals. Evolving regulatory frameworks, particularly in regions like North America and Europe, are creating opportunities for legal market expansion. Regulatory clarity is crucial for market participants to navigate compliance and market entry.

Global Minor Cannabinoids Market: Key Datapoints

|

Market Value in 2023 |

US$ 17.8 Bn |

|

Market Value Forecast by 2034 |

US$ 42.3 Bn |

|

Growth Rate

|

8.2% |

|

Historical Data

|

2016 – 2022 |

|

Base Year

|

2023 |

|

Forecast Data

|

2024 – 2034 |

Increasing consumer interest in health and wellness products, coupled with the perceived therapeutic benefits of cannabinoids, is a major driver of market growth. Progressive cannabis legalization in various parts of the world, including the United States and parts of Europe, is expanding the addressable market for minor cannabinoids. Significant investments in research and development by pharmaceutical and biotechnology companies are accelerating product innovation and clinical trials. The market remains fragmented with opportunities for new entrants and niche players to introduce specialized products catering to specific consumer needs.

The COVID-19 pandemic initially disrupted supply chains and retail channels for minor cannabinoids products. However, the crisis also underscored the importance of health and wellness, leading to increased interest in natural remedies, including cannabinoids. As economies recover, the market is expected to rebound stronger.

The geopolitical tensions, such as the Russia-Ukraine conflict, have also affected global markets, including the minor cannabinoids sector. Fluctuating currency values, supply chain disruptions, and geopolitical uncertainty have impacted production and distribution channels. However, the long-term impact will depend on geopolitical developments and their influence on global trade and regulatory environments.

The minor cannabinoids market presents significant opportunities for growth and innovation, driven by evolving consumer preferences, regulatory advancements, and expanding research initiatives. Companies that can navigate regulatory complexities, invest in research and development, and respond to shifting consumer trends are well-positioned to capitalize on this emerging market. As the market matures, collaboration across sectors and regions will be crucial in unlocking the full potential of minor cannabinoids in various industries worldwide.

Global Minor Cannabinoids Market: Key Takeaways of the Report

- Cannabigerol (CBG) segment by product type is expected to grow at a CAGR of 6.7% in the minor cannabinoids market due to increasing research highlighting its potential therapeutic benefits, including anti-inflammatory, antimicrobial, and neuroprotective properties. As consumer awareness grows and regulatory environments become more favorable, there is heightened interest in CBG-based products for their diverse health applications, ranging from skincare to pharmaceutical formulations, driving sustained market demand and expansion.

- Pharmaceutical segment by application, leads the minor cannabinoids market with a significant revenue share of 35.8% owing to growing recognition of cannabinoids’ potential in therapeutic applications. Cannabinoids like CBD, CBG, and others show promise in treating conditions such as epilepsy, chronic pain, and anxiety disorders, backed by increasing clinical research and favorable regulatory developments. Pharmaceutical companies are investing heavily in cannabinoid-based drug development, driving market growth as they seek to capitalize on these compounds’ efficacy and market potential in addressing unmet medical needs.

- In 2023, Latin America is anticipated as fastest growing region in the global minor cannabinoids market due to evolving regulatory landscapes favoring cannabis legalization and cultivation. This shift is fostering a burgeoning industry infrastructure for cannabis extraction and product development. Additionally, increasing consumer acceptance of cannabinoid-based products for medicinal and wellness purposes is driving market expansion. With a vast potential consumer base and supportive regulatory frameworks, Latin America presents significant growth opportunities for companies seeking to enter or expand within the minor cannabinoids market.

Key Development:

- In December 2023, Rare Cannabinoid Company introduced Uplift Gummies infused with THC and THCV. These gummies combine the relaxing properties of Delta-9-THC with the energizing and appetite-controlling effects of CBD and THCV.

- In October 2022, High Tide Inc., a cannabis retailer, announced that its Colorado-based subsidiary, NuLeaf Naturals, had launched plant-based softgels and full-spectrum multicannabinoid oil in Manitoba. The products feature CBC, CBD, CBG, Delta-9 tetrahydrocannabinol (Delta 9), and CBN.

Browse Related Category Reports

Global Minor Cannabinoids Market:

- Aurora Europe GmbH

- BulKanna

- CBD. INC.

- Fresh Bros Hemp Company

- GCM Holdings, LLC (Global Cannabinoids)

- GenCanna.

- High Purity Natural Products.

- Laurelcrest

- Mile High Labs

- PBG Global

- Rhizo Sciences

- ZERO POINT EXTRACTION, LLC

- Other Industry Participants

Global Minor Cannabinoids Market

By Product Type

- Cannabigerol (CBG)

- Cannabichromene (CBC)

- Cannabinol (CBN)

- Cannabidivarin (CBDV)

- Tetrahydrocannabutol (THCB)

- Tetrahydrocannabivarin (THCV)

- Tetrahydrocannabiphorol (THCP)

- Others

By Application

- Pharmaceutical

- Pain Management

- Mental Health

- Sleep Disorders

- Anti-inflammatory

- Others

- Nutraceuticals

- Cosmetics and Personal Care

- Food and Beverages

- Others

By Region

- North America (U.S., Canada, Mexico, Rest of North America)

- Europe (France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe)

- Asia Pacific (China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific)

- Middle East & Africa (Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa)

- Latin America (Brazil, Argentina, Rest of Latin America)

Consult with Our Expert:

Jay Reynolds

The Niche Research

Japan (Toll-Free): +81 663-386-8111

South Korea (Toll-Free): +82-808- 703-126

Saudi Arabia (Toll-Free): +966 800-850-1643

United Kingdom: +44 753-710-5080

United States: +1 302-232-5106

Email: askanexpert@thenicheresearch.com

Website: www.thenicheresearch.com

-

Cannabis2 weeks ago

Cannabis2 weeks agoIM Cannabis Shares Commence Trading on 6:1 Consolidated Basis

-

Cannabis2 weeks ago

Cannabis2 weeks agoFractional Flow Reserve Market growing at a CAGR of 15.56% during the forecast period [2024-2030] – Exactitude Consultancy

-

Cannabis1 week ago

Cannabis1 week agoBlank Rome Bolsters Energy Industry Team in Houston and Pittsburgh with Leading Transactional Group

-

Cannabis1 week ago

Cannabis1 week agoManitoba Harvest Hemp Foods and Brightseed® Introduce New Coffee and Chocolate Flavors in Organic Bioactive Fiber Supplement for Gut Health

-

Cannabis4 days ago

Cannabis4 days agoEurope Medical Cannabis Oil Market Set to Reach Valuation of USD 2,395.83 Million by 2032 | Astute Analytica

-

Cannabis4 days ago

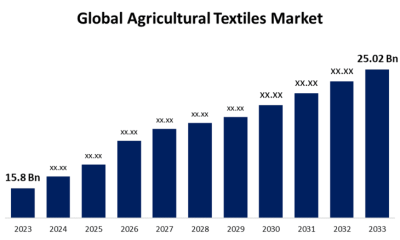

Cannabis4 days agoGlobal Agricultural Textiles Market Size To Worth USD 25.02 Billion By 2033 | CAGR of 4.70%

-

Cannabis1 day ago

Cannabis1 day agoUnlocking New Horizons in Health: TNR, The Niche Research Reveals the Transformative Power of Minor Cannabinoids

-

Cannabis14 hours ago

Cannabis14 hours agoVerano Announces the Opening of Zen Leaf Fairless Hills, the Company’s Newest Affiliated Dispensary in Pennsylvania, in Prime New Location