/home/grassnews/public_html/wp-content/themes/zox-news/parts/post-single.php on line 153

">

Warning: Undefined array key 0 in /home/grassnews/public_html/wp-content/themes/zox-news/parts/post-single.php on line 153

Warning: Attempt to read property "cat_name" on null in /home/grassnews/public_html/wp-content/themes/zox-news/parts/post-single.php on line 153

Graham Corporation Reports Fiscal 2019 Fourth Quarter and Full Year Results

Reading Time: 14 minutes

Reading Time: 14 minutes

-

Revenue grew 18% to $92 million for fiscal 2019; loss per share

was $0.03, adjusted EPS was $0.51 -

Backlog remains strong at $132 million; Fiscal 2019 book-to-bill

ratio was 1.1x -

Expecting fiscal 2020 revenue between $95 million and $100

million; represents 14% to 20% growth, excluding commercial nuclear

utility business which is for sale

BATAVIA, N.Y.–(BUSINESS WIRE)–Graham

Corporation (NYSE: GHM), a global business that designs,

manufactures and sells critical equipment for the oil refining,

petrochemical, power and defense industries, today reported financial

results for its fourth quarter and year ended March 31, 2019 (“fiscal

2019”).

Net sales in the fourth quarter of fiscal 2019 were $23.6 million, up 7%

compared with the fourth quarter of the fiscal year ended March 31, 2018

(“fiscal 2018”). Net loss in the fiscal 2019 fourth quarter was $4.6

million, or $0.46 loss per diluted share. Excluding non-cash charges for

goodwill and intangible and other long-lived asset impairments, adjusted

net income and adjusted EPS, both of which are non-GAAP measures, for

the fourth quarter of fiscal 2019 were $0.8 million, and $0.08,

respectively. Net income and earnings per share (“EPS”) in the fiscal

2018 fourth quarter were $0.8 million and $0.09, respectively. Excluding

the impact of the U.S. Tax Cuts and Jobs Act tax reform legislation

passed in December 2017, adjusted net income and adjusted EPS, both of

which are non-GAAP measures, for the fourth quarter of fiscal 2018 were

$0.6 million and $0.07, respectively. Refer to the Company’s disclosures

regarding the use of non-GAAP measures later in this release.

Net sales for fiscal 2019 were $91.8 million, up 18% compared with $77.5

million in fiscal 2018. Fiscal 2019 net loss was $0.3 million, or a loss

of $0.03 per diluted share, compared with a net loss of $9.8 million, or

$1.01 per diluted share, in fiscal 2018. Excluding unusual charges,

adjusted net income for fiscal 2019 was $5.0 million, or $0.51 per

diluted share, compared with adjusted net income of $1.8 million, or

$0.18 per diluted share, in fiscal 2018, all on a non-GAAP basis. Refer

to the Company’s disclosures regarding the use of non-GAAP measures

later in this release.

James R. Lines, Graham’s President and Chief Executive Officer,

commented, “We had solid revenue growth in the quarter and the year, as

expected. However, the mix of projects and performance of our commercial

nuclear utility business dampened gross margins throughout the year.

While disappointing, we remain focused on solid execution and quality

service for our customers, and strong cost discipline to strengthen our

earnings potential. Likewise, we will continue to invest in our business

in line with our strategy to drive our long-term future.”

He added, “Our investments in personnel for our strategy are affecting

margins in the near term but remain important as we identify and capture

opportunities to achieve our growth and profitability goals. We are

encouraged by our solid order activity and strong backlog, which give us

confidence in a healthy outlook for the coming fiscal year and beyond.”

Fourth Quarter Fiscal 2019 Sales Summary

(See

accompanying financial tables for a breakdown of sales by industry and

region)

Consolidated net sales were up $1.4 million, or 7%, driven by $3.8

million and $1.7 million increases in sales to the

chemical/petrochemical and refining industries, respectively. These

increases were partially offset by $2.8 million and $1.2 million of

lower sales to the Company’s other commercial, industrial and defense

markets, and the power industry, respectively.

From a geographic perspective, U.S. sales represented 70% of

consolidated sales in the fiscal 2019 fourth quarter compared with 66%

in the fourth quarter of fiscal 2018. International sales were 30% of

consolidated sales in the fiscal 2019 quarter, compared with 34% in the

prior-year comparable period. U.S. based sales were driven by the

chemical/petrochemical and refining markets noted above.

Fluctuations in Graham’s sales among geographic locations and

industries can vary measurably from quarter-to-quarter based on the

timing and magnitude of projects. Graham does not believe that

such quarter-to-quarter fluctuations are indicative of business trends,

which it believes are more apparent on a trailing twelve month basis.

Fourth Quarter Fiscal 2019 Operating Performance Review

| ($ in millions except per share data) | Q4 FY19 | Q4 FY18 | Change | |||||||||

| Net sales | $ | 23.6 | $ | 22.2 | $ | 1.4 | ||||||

| Gross profit | $ | 4.8 | $ | 5.0 | $ | (0.1 | ) | |||||

| Gross margin | 20.3 | % | 22.4 | % | ||||||||

| Operating (loss) profit | $ | (5.8 | ) | $ | 0.7 | $ | (6.5 | ) | ||||

| Operating margin | (24.7 | %) | 3.3 | % | ||||||||

| Net (loss) income | $ | (4.6 | ) | $ | 0.8 | $ | (5.4 | ) | ||||

| Diluted EPS | $ | (0.46 | ) | $ | 0.09 | $ | (0.55 | ) | ||||

| Non-GAAP financial measures: | ||||||||||||

| Adjusted operating profit | $ | 0.6 | $ | 0.7 | $ | (0.1 | ) | |||||

| Adjusted operating margin | 2.6 | % | 3.3 | % | ||||||||

| Adjusted net income | $ | 0.8 | $ | 0.6 | $ | 0.2 | ||||||

| Adjusted diluted EPS | $ | 0.08 | $ | 0.07 | $ | 0.01 | ||||||

| Adjusted EBITDA | $ | 1.4 | $ | 1.4 | $ | (0.0 | ) | |||||

| Adjusted EBITDA margin | 5.8 | % | 6.3 | % | ||||||||

Refer to pages 11 and 12 of this press release.

Graham believes that, when used in conjunction with measures prepared in

accordance with GAAP, adjusted operating profit, adjusted operating

margin (adjusted operating profit as a percentage of sales), adjusted

net income, adjusted diluted EPS, adjusted EBITDA and adjusted EBITDA

margin (adjusted EBITDA as a percentage of sales), which are non-GAAP

measures, help in the understanding of its operating performance.

Moreover, Graham’s credit facility also contains ratios based on EBITDA. See

the attached tables for additional important disclosures regarding

Graham’s use of adjusted operating profit, adjusted operating margin,

adjusted net income, adjusted diluted EPS, adjusted EBITDA and

adjusted EBITDA margin as well as reconciliations of operating (loss)

profit to adjusted operating profit and reconciliations of net (loss)

income to adjusted net income and adjusted EBITDA. This

disclosure regarding Graham’s use of non-GAAP measures for the fourth

quarters also applies to fiscal year data reflected later in this

release.

The results for the fiscal 2019 and 2018 fourth quarters were relatively

comparable on a non-GAAP basis, with adjusted EPS of $0.08 in the fiscal

2019 fourth quarter compared with $0.07 in the fiscal 2018 fourth

quarter. While gross margin was lower in the fiscal 2019 quarter, net

income benefited from higher interest and other income.

Fourth quarter fiscal 2019 gross profit and margin were unfavorably

impacted by project mix, including the commercial nuclear utility

business.

Selling, general and administrative (“SG&A”) expenses were $4.2 million

in the fourth quarters of both fiscal 2019 and 2018. SG&A as a percent

of sales was approximately 18% and 19% in the fourth quarters of fiscal

2019 and fiscal 2018, respectively.

Given ongoing challenges in the nuclear industry faced by relatively

small market participants, during the fourth quarter of fiscal 2019 the

Company decided to divest its commercial nuclear utility business,

Energy Steel. Upon evaluating the potential market value of the Energy

Steel business, Graham determined that the intangible assets, goodwill,

and other long-lived assets were impaired. Accordingly, the Company

recorded a $6.4 million impairment charge, $5.3 million net of tax, in

the fiscal 2019 fourth quarter.

Jeffrey Glajch, Graham’s Vice President and Chief Financial Officer,

noted, “While Energy Steel was successful in prior years, the changes in

the commercial nuclear utility industry over the last several years have

caused significant erosion of this business. Accordingly, we have

decided that it has more potential with a different partner and we are

in discussions to sell the business.”

During the fourth quarter of fiscal 2019, Graham’s effective tax rate

was not meaningful due to the non-deductibility of the goodwill portion

of the commercial nuclear utility business write down. The prior year’s

fourth quarter effective tax rate benefited from the impact of adopting

the 2017 U.S. Tax Cuts and Jobs Act.

Fourth quarter fiscal 2019 adjusted net income and adjusted diluted EPS

excluded $5.3 million of net-of-tax impairment charges. Fourth quarter

fiscal 2018 adjusted net income and adjusted diluted EPS excluded a $0.2

million tax benefit for adoption of the new federal tax rates as a

result of the tax reform legislation adopted in December 2017.

Adjusted EBITDA (defined as consolidated net (loss) income before net

interest income, income taxes, depreciation and amortization, goodwill

and other impairments and other charges associated with the revaluation

of the commercial nuclear utility business, and a nonrecurring

restructuring charge, where applicable) was approximately the same

during the fiscal 2019 and fiscal 2018 fourth quarters.

Full Year Fiscal 2019 Review

| ($ in millions except per share data) | FY19 | FY18 | Change | ||||||||

| Net sales | $ | 91.8 | $ | 77.5 | $ | 14.3 | |||||

| Gross profit | $ | 21.9 | $ | 17.0 | $ | 4.9 | |||||

| Gross margin | 23.9 | % | 21.9 | % | |||||||

| Operating loss | $ | (2.4 | ) | $ | (13.9 | ) | $ | 11.5 | |||

| Operating margin | (2.6 | %) | (18.0 | %) | |||||||

| Net loss | $ | (0.3 | ) | $ | (9.8 | ) | $ | 9.5 | |||

| Diluted EPS | $ | (0.03 | ) | $ | (1.01 | ) | $ | 0.98 | |||

| Non-GAAP financial measures: | |||||||||||

| Adjusted operating profit | $ | 4.0 | $ | 1.5 | $ | 2.5 | |||||

| Adjusted operating margin | 4.4 | % | 1.9 | % | |||||||

| Adjusted net income | $ | 5.0 | $ | 1.8 | $ | 3.2 | |||||

| Adjusted diluted EPS | $ | 0.51 | $ | 0.18 | $ | 0.33 | |||||

| Adjusted EBITDA | $ | 7.1 | $ | 4.2 | $ | 2.9 | |||||

| Adjusted EBITDA margin | 7.7 | % | 5.4 | % | |||||||

Refer to pages 11 and 12 of this press release.

The improvement in operating loss, operating margin, net loss and

diluted EPS during fiscal 2019 compared with fiscal 2018 was primarily

driven by the change in impairment charges for goodwill and intangible

and other long-lived assets. Adjusted net income and adjusted EPS

exclude such charges as well as other items, resulting in a $3.2 million

and $0.33 improvement over the prior year, respectively, driven by

higher sales and improved operating performance.

International sales grew 27% to $32.4 million in fiscal 2019 and

represented 35% of total sales, compared with $25.6 million, or 33% of

sales in the prior year. Sales to the U.S. grew 14% to $59.4 million, or

65% of fiscal 2019 net sales, compared with $51.9 million, or 67% of

fiscal 2018 net sales.

The increase in gross profit and margin were driven by higher volume

stemming from the 18% increase in sales when compared with the prior

year, as well as ongoing improvement to backlog quality and project mix,

partially offset by higher production costs.

SG&A in fiscal 2019 was $17.9 million, up 13%, or $2.1 million. The

increase in SG&A was primarily due to higher compensation costs for new

personnel, higher sales-related costs, and higher performance-based

compensation. As a percent of sales, SG&A was 20% for both fiscal 2019

and 2018.

Similar to the fourth quarter, Graham’s effective tax rate for fiscal

2019 was not meaningful due to the non-deductibility of the goodwill

portion of the commercial nuclear utility business write down. Fiscal

2018 results were impacted by a $0.8 million favorable adjustment to

income taxes upon implementation of the 2017 U.S. Tax Cuts and Jobs Act,

which also had a beneficial impact on the fiscal 2019 overall effective

tax rate.

Fiscal 2019 adjusted net income and adjusted diluted EPS excluded $5.3

million of net-of-tax impairment charges. Fiscal 2018 adjusted net

income and adjusted diluted EPS excluded $12.0 million of net-of-tax

impairment charges, $0.2 million of net-of-tax bad debt charges

associated with the revaluation of the Company’s commercial nuclear

utility business, $0.2 million for a net-of-tax nonrecurring

restructuring charge and a $0.8 million tax benefit for adoption of the

new federal tax rates as a result of the 2017 U.S. Tax Cuts and Jobs Act.

Adjusted EBITDA for fiscal 2019 benefited from higher revenue and gross

margin improvement, partially offset by investments in SG&A.

Balance Sheet Strength Supports Growth

Cash, cash equivalents and investments at March 31, 2019 were $77.8

million, up from $76.5 million at March 31, 2018.

Fiscal 2019 cash provided by operations was $7.9 million, compared with

$8.5 million in fiscal 2018. The decrease was primarily the result of

timing of changes in working capital, partially offset by higher

adjusted net income.

Capital expenditures were $2.1 million in fiscal 2019, approximately the

same level as the prior year. The Company expects capital expenditures

for fiscal 2020 to be between $2.5 million and $2.8 million, the

majority of which are expected to be used for productivity enhancements.

Dividend payments were $3.8 million and $3.5 million in fiscal 2019 and

fiscal 2018, respectively.

Graham had neither borrowings under its credit facility, nor any

long-term debt outstanding, at March 31, 2019.

Backlog Level Indicates Continued Growth

Backlog at the end of fiscal 2019 was $132.1 million, near its record

level of $133.6 million at the end of the third quarter, and up 12% from

$117.9 million at the end of the prior fiscal year. Excluding the

commercial nuclear utility business which is held for sale, backlog at

the end of fiscal 2019 was $124.1 million.

The Company believes that its backlog mix by industry highlights the

success of its diversification strategy to increase sales to the U.S.

Navy. Backlog by industry at March 31, 2019 was approximately:

- 49% for U.S. Navy projects

- 22% for refinery projects

- 19% for chemical/petrochemical projects

-

7% for power projects, including commercial nuclear utility (of which

89% is for the business held for sale) - 3% for other industrial applications

The expected timing for the Company’s backlog to convert to sales is as

follows:

- Within next 12 months: 55% to 60%

- Within 12 to 24 months: 10% to 15%

- Beyond 24 months: 25% to 35%

Orders were $21.6 million in the fourth quarter of fiscal 2019, driven

by the refining and chemical/petrochemical industries in North America.

In the fiscal 2019 fourth quarter, orders from U.S. and international

customers were nearly evenly split with $11.1 million from the U.S and

$10.5 million from international markets. This compares with total

orders of $43.5 million in the fourth quarter of fiscal 2018, of which

81% were from the U.S. and 19% were from international markets. The

fiscal 2018 fourth quarter orders included $24.5 million, or 56% of the

total, from other commercial, industrial and defense markets, which

includes the U.S. Navy.

Orders for fiscal 2019 were $101.2 million, compared with $112.2 million

in fiscal 2018. Excluding orders from the Company’s other commercial,

industrial and defense markets which benefited from significant U.S.

Navy orders in fiscal 2018, orders from the Company’s other markets

increased by $15.9 million in fiscal 2019, driven by orders from the

chemical/petrochemical industry which were up $20.8 million. Orders from

U.S. customers were $62.2 million, or 61% of the total, and orders from

international markets were $39 million, or 39% of the total, in fiscal

2019. Approximately 35% of international orders were from the Middle

East, 27% were from Canada and 27% were from Asia. In fiscal 2018, 69%

of orders were from U.S. customers and 31% were international. The

fiscal 2019 book-to-bill ratio was 1.1x.

Graham expects that the balance between domestic and international

orders, as well as orders by industry, will continue to be variable

between quarters.

Introducing FY 2020 Guidance

Graham is also announcing its fiscal 2020 guidance, as follows:

-

Revenue anticipated to be between $95 million and $100 million,

excluding the commercial nuclear utility business which is held for

sale. For fiscal 2019, consolidated revenue excluding that business

was $83.5 million. - Gross margin expected to be between 23% and 24%

- SG&A expense expected to be between $17 million and $18 million

- Effective tax rate anticipated to be approximately 20%

Mr. Lines concluded, “I believe that the energy cycle continues to show

signs of recovery, which is embedded in our fiscal 2020 expectation for

14% to 20% revenue growth for our ongoing business. Our strong pipeline

of projects combined with the Navy work currently in backlog provides us

solid confidence in our outlook for the year. Additionally, we remain

very active in the pursuit of strategic opportunities to put our capital

to work and complement our organic growth initiatives.”

Webcast and Conference Call

Graham’s management will host a conference call and live webcast today

at 11:00 a.m. Eastern Time to review its financial condition and

operating results for the fourth quarter and full year fiscal 2019, as

well as its strategy and outlook. The review will be accompanied by a

slide presentation which will be made available immediately prior to the

conference call on Graham’s website at www.graham-mfg.com

under the heading “Investor Relations.” A question-and-answer session

will follow the formal presentation.

Graham’s conference call can be accessed by calling (201) 689-8560.

Alternatively, the webcast can be monitored on Graham’s website at www.graham-mfg.com

under the heading “Investor Relations.”

A telephonic replay will be available from 2:00 p.m. ET today through

Thursday, June 6, 2019. To listen to the archived call, dial (412)

317-6671 and enter conference ID number 13689951. A transcript of the

call will be placed on Graham’s website, once available.

ABOUT GRAHAM CORPORATION

Graham is a global business that designs, manufactures and sells

critical equipment for the energy, defense and chemical/petrochemical

industries. Energy markets include oil refining, cogeneration, and

alternative power. For the defense industry, the Company’s equipment is

used in nuclear propulsion power systems for the U.S. Navy. Graham’s

global brand is built upon world-renowned engineering expertise in

vacuum and heat transfer technology, responsive and flexible service and

unsurpassed quality. Graham designs and manufactures custom-engineered

ejectors, vacuum pumping systems, surface condensers and vacuum systems.

Graham’s equipment can also be found in other diverse applications such

as metal refining, pulp and paper processing, water heating,

refrigeration, desalination, food processing, pharmaceutical, heating,

ventilating and air conditioning. Graham’s reach spans the globe and its

equipment is installed in facilities from North and South America to

Europe, Asia, Africa and the Middle East.

Graham routinely posts news and other important information on its

website, www.graham-mfg.com,

where additional comprehensive information on Graham Corporation and its

subsidiaries can be found.

Safe Harbor Regarding Forward Looking Statements

This news release contains forward-looking statements within the meaning

of Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended.

Forward-looking statements are subject to risks, uncertainties and

assumptions and are identified by words such as “expects,” “estimates,”

“confidence,” “projects,” “typically,” “outlook,” “anticipates,”

“believes,” “appears,” “could,” “opportunities,” “seeking,” “plans,”

“aim,” “pursuit,” “look towards” and other similar words. All statements

addressing operating performance, events, or developments that Graham

Corporation expects or anticipates will occur in the future, including

but not limited to, expected expansion and growth opportunities within

its domestic and international markets, anticipated revenue, the timing

of conversion of backlog to sales, market presence, profit margins, tax

rates, foreign sales operations, its ability to improve cost

competitiveness, customer preferences, changes in market conditions in

the industries in which it operates, changes in commodities prices, the

effect on its business of volatility in commodities prices, changes in

general economic conditions and customer behavior, forecasts regarding

the timing and scope of the economic recovery in its markets, its

acquisition and growth strategy and the expected performance of Energy

Steel & Supply Co. and its operations in China and other international

locations, are forward-looking statements. Because they are

forward-looking, they should be evaluated in light of important risk

factors and uncertainties. These risk factors and uncertainties are more

fully described in Graham Corporation’s most recent Annual Report filed

with the Securities and Exchange Commission, included under the heading

entitled “Risk Factors.”

Should one or more of these risks or uncertainties materialize, or

should any of Graham Corporation’s underlying assumptions prove

incorrect, actual results may vary materially from those currently

anticipated. In addition, undue reliance should not be placed on Graham

Corporation’s forward-looking statements. Except as required by law,

Graham Corporation disclaims any obligation to update or publicly

announce any revisions to any of the forward-looking statements

contained in this news release.

FINANCIAL TABLES FOLLOW.

| Graham Corporation | |||||||||||||||||||||||

| Fourth Quarter Fiscal 2019 | |||||||||||||||||||||||

| Consolidated Statements of Operations | |||||||||||||||||||||||

|

(Amounts in thousands, except per share data) |

|||||||||||||||||||||||

| Three Months Ended | Year Ended | ||||||||||||||||||||||

| March 31, | March 31, | ||||||||||||||||||||||

| 2019 | 2018 | % Change | 2019 | 2018 | % Change | ||||||||||||||||||

| Net sales | $ | 23,641 | $ | 22,178 | 7 | % | $ | 91,831 | $ | 77,534 | 18 | % | |||||||||||

| Cost of products sold | 18,843 | 17,218 | 9 | % | 69,922 | 60,559 | 15 | % | |||||||||||||||

| Gross profit | 4,798 | 4,960 | (3 | %) | 21,909 | 16,975 | 29 | % | |||||||||||||||

| Gross margin | 20.3 | % | 22.4 | % | 23.9 | % | 21.9 | % | |||||||||||||||

| Other expenses and income: | |||||||||||||||||||||||

| Selling, general and administrative | 4,123 | 4,171 | (1 | %) | 17,641 | 15,533 | 14 | % | |||||||||||||||

| Selling, general and administrative – amortization | 59 | 59 | 0 | % | 237 | 236 | 0 | % | |||||||||||||||

| Goodwill and other impairments | 6,449 | – | N/A | 6,449 | 14,816 | (56 | %) | ||||||||||||||||

| Restructuring charge | – | – | N/A | – | 316 | (100 | %) | ||||||||||||||||

| Operating (loss) profit | (5,833 | ) | 730 | N/A | (2,418 | ) | (13,926 | ) | (83 | %) | |||||||||||||

| Operating margin | (24.7 | %) | 3.3 | % | (2.6 | %) | (18.0 | %) | |||||||||||||||

| Other income | (205 | ) | (120 | ) | N/A | (823 | ) | (478 | ) | 72 | % | ||||||||||||

| Interest income | (418 | ) | (151 | ) | 177 | % | (1,462 | ) | (606 | ) | 141 | % | |||||||||||

| Interest expense | 4 | 4 | 0 | % | 12 | 12 | 0 | % | |||||||||||||||

| (Loss) income before provision for income taxes | (5,214 | ) | 997 | N/A | (145 | ) | (12,854 | ) | (99 | %) | |||||||||||||

| (Benefit) provision for income taxes | (661 | ) | 164 | N/A | 163 | (3,010 | ) | N/A | |||||||||||||||

| Net (loss) income | $ | (4,553 | ) | $ | 833 | N/A | $ | (308 | ) | $ | (9,844 | ) | (97 | %) | |||||||||

| Per share data: | |||||||||||||||||||||||

| Basic: | |||||||||||||||||||||||

| Net (loss) income | $ | (0.46 | ) | $ | 0.09 | N/A | $ | (0.03 | ) | $ | (1.01 | ) | (97 | %) | |||||||||

| Diluted: | |||||||||||||||||||||||

| Net (loss) income | $ | (0.46 | ) | $ | 0.09 | N/A | $ | (0.03 | ) | $ | (1.01 | ) | (97 | %) | |||||||||

| Weighted average common shares outstanding: | |||||||||||||||||||||||

| Basic | 9,837 | 9,772 | 9,823 | 9,764 | |||||||||||||||||||

| Diluted | 9,837 | 9,781 | 9,823 | 9,764 | |||||||||||||||||||

| Dividends declared per share | $ | 0.10 | $ | 0.09 | $ | 0.39 | $ | 0.36 | |||||||||||||||

| N/A: Not Applicable | |||||||||||||||||||||||

| Graham Corporation | |||||||

| Fourth Quarter Fiscal 2019 | |||||||

| Consolidated Balance Sheets | |||||||

|

(Amounts in thousands, except per share data) |

|||||||

| March 31, | |||||||

| 2019 | 2018 | ||||||

| Assets | |||||||

| Current assets: | |||||||

| Cash and cash equivalents | $ | 15,021 | $ | 40,456 | |||

| Investments | 62,732 | 36,023 | |||||

| Trade accounts receivable, net of allowances ($33 and $339 | |||||||

| at March 31, 2019 and 2018, respectively) | 17,582 | 17,026 | |||||

| Unbilled revenue | 7,522 | 8,079 | |||||

| Inventories | 24,670 | 11,566 | |||||

| Prepaid expenses and other current assets | 1,333 | 772 | |||||

| Income taxes receivable | 1,073 | 1,478 | |||||

| Assets held for sale | 4,850 | – | |||||

| Total current assets | 134,783 | 115,400 | |||||

| Property, plant and equipment, net | 17,071 | 17,052 | |||||

| Prepaid pension asset | 4,267 | 4,369 | |||||

| Goodwill | – | 1,222 | |||||

| Permits | – | 1,700 | |||||

| Other intangible assets, net | – | 3,388 | |||||

| Other assets | 149 | 202 | |||||

| Total assets | $ | 156,270 | $ | 143,333 | |||

| Liabilities and stockholders’ equity | |||||||

| Current liabilities: | |||||||

| Current portion of capital lease obligations | $ | 51 | $ | 88 | |||

| Accounts payable | 12,405 | 16,151 | |||||

| Accrued compensation | 5,126 | 4,958 | |||||

| Accrued expenses and other current liabilities | 2,933 | 2,885 | |||||

| Customer deposits | 30,847 | 13,213 | |||||

| Liabilities held for sale | 3,525 | – | |||||

| Total current liabilities | 54,887 | 37,295 | |||||

| Capital lease obligations | 95 | 55 | |||||

| Deferred income tax liability | 1,056 | 1,427 | |||||

| Accrued pension liability | 662 | 565 | |||||

| Accrued postretirement benefits | 604 | 642 | |||||

| Total liabilities | 57,304 | 39,984 | |||||

| Stockholders’ equity: | |||||||

| Preferred stock, $1.00 par value, 500 shares authorized | – | – | |||||

| Common stock, $.10 par value, 25,500 shares authorized | |||||||

|

10,650 and 10,579 shares issued and 9,843 and 9,772 shares |

|||||||

| respectively | 1,065 | 1,058 | |||||

| Capital in excess of par value | 25,277 | 23,826 | |||||

| Retained earnings | 93,847 | 99,011 | |||||

| Accumulated other comprehensive loss | (8,833 | ) | (8,250 | ) | |||

| Treasury stock (807 shares at each of March 31, 2019 and 2018) | (12,390 | ) | (12,296 | ) | |||

| Total stockholders’ equity | 98,966 | 103,349 | |||||

| Total liabilities and stockholders’ equity | $ | 156,270 | $ | 143,333 | |||

Contacts

For more information:

Jeffrey F. Glajch

Vice

President – Finance and CFO

Phone: (585) 343-2216

jglajch@graham-mfg.com

Deborah K. Pawlowski / Karen L. Howard

Kei Advisors LLC

Phone:

(716) 843-3908 / (716) 843-3942

dpawlowski@keiadvisors.com

/ khoward@keiadvisors.com

Warning: Undefined array key 0 in /home/grassnews/public_html/wp-content/themes/zox-news/parts/post-single.php on line 493

Warning: Attempt to read property "cat_ID" on null in /home/grassnews/public_html/wp-content/themes/zox-news/parts/post-single.php on line 493

Innocan

Innocan Pharma Submits Investigational New Animal Drug Application to FDA’s Veterinary Center

HERZLIYA, Israel and CALGARY, AB, July 26, 2024 /PRNewswire/ — Innocan Pharma Corporation (CSE: INNO) (FSE: IP4) (OTCQB: INNPF) (“Innocan” or the “Company”), a pioneer in the pharmaceutical and biotechnology industries, is pleased to announce that the FDA’s Center for Veterinary Medicine (CVM) has granted the Company a sponsor fee waiver and assigned an Investigational New Animal Drug (INAD) number for its LPT-CBD (Liposome Platform Technology-Cannabidiol) product. This represents a significant step for the Company, as an INAD designation facilitates correspondence and data exchange with CVM to support LPT-CBD development as a new veterinary drug.

The Company further announced that following the assessment of LPT-CBD’s scientific package, the CVM recognized Innocan’s contribution to pursuing innovative animal drug products and technology and granted the company a sponsor fee waiver for fiscal year 2024.

Innocan’s LPT-CBD is a proprietary drug delivery platform designed to provide prolonged-release CBD for chronic pain and well-being management in animals. Over the past year, repeated administration of LPT-CBD in dogs and other animals has demonstrated both efficacy and tolerability, providing sufficient evidence for the INAD application.

“We are thrilled by CVM’s response,” said Prof. Chezy Barenholz, CSO of Innocan Pharma. “The granted INAD will allow us to advance the investigational studies of LPT-CBD and share knowledge to support future discussions with CVM on LPT-CBD’s development plan. Moreover, the fee waiver, granted by CVM, supports our development and pursuit of innovative animal drug products and technology, further validating our approach and potential impact in veterinary medicine.”

Dr. Eyal Kalo, R&D Director at Innocan, added, “LPT-CBD is a unique technology that has proven itself worthy of the INAD fee waiver granted by CVM. This will streamline our efforts to deliver a unique solution for chronic pain management to the animal market.”

About Innocan Pharma:

Innocan is a pharmaceutical tech company that operates under two main segments: Pharmaceuticals and Consumer Wellness. In the Pharmaceuticals segment, Innocan focuses on developing innovative drug delivery platform technologies comprises with cannabinoids science, to treat various conditions to improve patients’ quality of life. This segment involves two drug delivery technologies: (i) LPT CBD-loaded liposome platform facilitating exact dosing and the prolonged and controlled release of CBD into the blood stream. The LPT delivery platform research is in the preclinical trial phase for two indications: Epilepsy and Pain Management. In the Consumer Wellness segment, Innocan develops and markets a wide portfolio of innovative and high-performance self-care products to promote a healthier lifestyle. Under this segment Innocan has established a Joint Venture by the name of BI Sky Global Ltd. that focuses developing on advanced targeted online sales. https://innocanpharma.com/

Contact Information:

For Innocan Pharma Corporation:

Iris Bincovich, CEO

+1 5162104025

+972-54-3012842

+442037699377

info@innocanpharma.com

NEITHER THE CANADIAN SECURITIES EXCHANGE NOR ITS REGULATION SERVICES PROVIDER HAVE REVIEWED OR ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

Caution Regarding Forward-Looking Information

Certain information set forth in this news release, including, without limitation, the Company’s plans for human trials of its LPT-CBD platform, is forward-looking information within the meaning of applicable securities laws. By its nature, forward-looking information is subject to numerous risks and uncertainties, some of which are beyond Innocan’s control. . The forward-looking information contained in this news release is based on certain key expectations and assumptions made by Innocan, including expectations and assumptions concerning the anticipated benefits of the products, satisfaction of regulatory requirements in various jurisdictions and satisfactory completion of production and distribution arrangements.

Forward-looking information is subject to various risks and uncertainties that could cause actual results and experience to differ materially from the anticipated results or expectations expressed in this news release. The key risks and uncertainties include but are not limited to: global and local (national) economic, political, market and business conditions; governmental and regulatory requirements and actions by governmental authorities; and potential disruption of relationships with suppliers, manufacturers, customers, business partners and competitors. There are also risks that are inherent in the nature of product distribution, including import/export matters and the failure to obtain any required regulatory and other approvals (or to do so in a timely manner). The anticipated timeline for entry to markets may change for a number of reasons, including the inability to secure necessary regulatory requirements, or the need for additional time to conclude and/or satisfy the manufacturing and distribution arrangements. As a result of the foregoing, readers should not place undue reliance on the forward-looking information contained in this news release. A comprehensive discussion of other risks that impact Innocan can be found in Innocan’s public reports and filings which are available under Innocan’s profile at www.sedarplus.ca.

Readers are cautioned that undue reliance should not be placed on forward-looking information as actual results may vary materially from the forward-looking information. Innocan does not undertake to update, correct or revise any forward-looking information as a result of any new information, future events or otherwise, except as may be required by applicable law.

Logo: https://mma.prnewswire.com/media/2046271/3968398/Innocan_Pharma_Corporation_Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/innocan-pharma-submits-investigational-new-animal-drug-application-to-fdas-veterinary-center-302207435.html

View original content:https://www.prnewswire.co.uk/news-releases/innocan-pharma-submits-investigational-new-animal-drug-application-to-fdas-veterinary-center-302207435.html

Cannabis

Verano Announces the Opening of Zen Leaf Fairless Hills, the Company’s Newest Affiliated Dispensary in Pennsylvania, in Prime New Location

- Zen Leaf Fairless Hills, the Company’s newest affiliated dispensary in Pennsylvania, relocated from its former home in Chester to 203 Lincoln Highway, a busy thoroughfare with daily traffic of over 17,000 vehicles per day1

- As the first medical cannabis dispensary in the city, Zen Leaf Fairless Hills will offer an elevated experience for area patients, including increased convenience and accessibility with numerous point-of-sale stations and kiosks for seamless in-store browsing and ordering

- Verano’s active operations span 13 states, comprised of 142 dispensaries and 13 cultivation and processing facilities with more than 1 million square feet of cultivation capacity

CHICAGO, July 26, 2024 (GLOBE NEWSWIRE) — Verano Holdings Corp. (Cboe CA: VRNO) (OTCQX: VRNOF) (“Verano” or the “Company”), a leading multi-state cannabis company, today announced the opening of Zen Leaf Fairless Hills in Pennsylvania on Friday, July 26th, following a ceremonial ribbon cutting at 11 a.m. local time. Zen Leaf Fairless Hills is located at 203 Lincoln Highway and will be open Monday through Saturday from 9 a.m. to 8 p.m. and Sunday from 10 a.m. to 6 p.m. local time.

The dispensary is located in Bucks County, the fourth largest county in the Commonwealth with a total population of over 630,0002 residents. To increase accessibility and convenience, Zen Leaf Fairless Hills features large in-store kiosks and numerous point-of-sale stations to enhance the browsing and ordering experience for patients. To celebrate the grand opening of Zen Leaf Fairless Hills and following a ceremonial ribbon cutting, patients will be greeted with complimentary deals and doorbusters on featured branded products.

“We are excited to bring the Zen Leaf experience to local patients in Fairless Hills, where our talented team members will continue to deliver hospitality-driven care and top-quality products for local patients,” said George Archos, Verano Founder and Chief Executive Officer. “As the Pennsylvania medical cannabis patient population continues to grow, we are grateful for the opportunity to deepen our roots in Bucks County at our newest Zen Leaf location in the Commonwealth, and look forward to providing a warm and welcoming environment for current and future patients.”

Zen Leaf Fairless Hills adds another convenient outlet for Philadelphia area patients, and solidifies Verano’s footprint in the state as one of the Company’s 18 affiliated Pennsylvania dispensaries. Verano’s Pennsylvania operations also include a state-of-the-art 62,000 square foot cultivation and processing facility in Chester, where the Company produces its signature Verano Reserve flower and Troches, concentrates and vapes; (the) Essence and Savvy flower and extracts; and Avexia RSO cannabis oil and topicals. For additional convenience and accessibility, patients can choose to order ahead at ZenLeafDispensaries.com for express in-store pickup.

About Verano

Verano Holdings Corp. (Cboe CA: VRNO) (OTCQX: VRNOF), one of the U.S. cannabis industry’s leading companies based on historical revenue, geographic scope and brand performance, is a vertically integrated, multi-state operator embracing a mission of saying Yes to plant progress and the bold exploration of cannabis. Verano provides a superior cannabis shopping experience in medical and adult use markets under the Zen Leaf™ and MÜV™ dispensary banners, including Cabbage Club™, an innovative annual membership program offering exclusive benefits for cannabis consumers. Verano produces a comprehensive suite of high-quality, regulated cannabis products sold under its diverse portfolio of trusted consumer brands including Verano™, (the) Essence™, MÜV™, Savvy™, BITS™, Encore™, and Avexia™. Verano’s active operations span 13 U.S. states, comprised of 13 production facilities with over 1,000,000 square feet of cultivation capacity. Learn more at Verano.com.

Contacts:

Media

Verano

Steve Mazeika

VP, Communications

Steve.Mazeika@verano.com

Investors

Verano

Julianna Paterra, CFA

VP, Investor Relations

Julianna.Paterra@verano.com

Forward Looking Statements

This press release contains “forward-looking statements” within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. Such forward-looking statements are not representative of historical facts or information or current condition, but instead represent only the Company’s beliefs regarding future events, plans, strategies, or objectives, many of which, by their nature, are inherently uncertain and outside of the Company’s control. Generally, such forward-looking statements can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “future”, “scheduled”, “estimates”, “forecasts”, “projects,” “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases, or may contain statements that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “will continue”, “will occur” or “will be achieved”. Forward-looking statements involve and are subject to assumptions and known and unknown risks, uncertainties, and other factors which may cause actual events, results, performance, or achievements of the Company to be materially different from future events, results, performance, and achievements expressed or implied by forward-looking statements herein, including, without limitation, the risk factors described in the Company’s annual report on Form 10-K for the year ended December 31, 2023, its quarterly report on Form 10-Q for the quarter ended March 31, 2024 and any subsequent quarterly reports on Form 10-Q, in each case, filed with the U.S. Securities and Exchange Commission at www.sec.gov. The Company makes no assurances and cannot predict the outcome of all or any part of the on-going litigation with Goodness Growth referenced in this press release, including whether the Company will prevail on its Notice of Application and its counterclaim, or whether Goodness Growth will prevail on its claim for damages against the Company. The forward-looking statements contained in this press release are made as of the date of this press release, and the Company does not undertake to update any forward-looking information or forward-looking statements that are contained or referenced herein, except as may be required in accordance with applicable securities laws. All subsequent written and oral forward-looking information and statements attributable to the Company or persons acting on its behalf is expressly qualified in its entirety by this notice regarding forward-looking information and statements.

###

1 Pennsylvania Department of Transportation

2 United States Census Bureau

Cannabis

Unlocking New Horizons in Health: TNR, The Niche Research Reveals the Transformative Power of Minor Cannabinoids

Wilmington, Delaware, July 25, 2024 (GLOBE NEWSWIRE) — Minor cannabinoids refer to the lesser-known compounds found in the cannabis plant, distinct from the well-known THC (tetrahydrocannabinol) and CBD (cannabidiol). While THC and CBD dominate the market, minor cannabinoids such as CBG (cannabigerol), CBC (cannabichromene), and CBN (cannabinol) are gaining attention for their potential therapeutic benefits. These compounds are extracted from both marijuana and hemp plants, with varying legal restrictions depending on their THC content. The minor cannabinoids market is poised for significant growth, driven by increasing consumer awareness and demand for alternative health and wellness products. As regulatory environments around cannabis products evolve, companies are exploring the potential of minor cannabinoids in various applications, including pharmaceuticals, nutraceuticals, cosmetics, and food and beverages.

Minor cannabinoids are being researched for their potential therapeutic effects, including anti-inflammatory, analgesic, and neuroprotective properties. This versatility facilitates product diversification in various industries. Companies are investing in research and development to create novel formulations and delivery methods for minor cannabinoids. This includes nano-emulsions, encapsulation technologies, and controlled-release systems to enhance bioavailability and efficacy. For example, in January 2022, CBDA + CBGA Tincture a new product was launched by Hometown Hero CBD. This 30ml tincture contains 600mg each of CBGA, CBDA, CBG, and CBD. Derived from hemp, the cannabinoids in this tincture comply with legal requirements across all 50 states in the USA. There is an increasing consumer preference for natural as well as plant-based remedies, which in turn is driving the demand for cannabinoid-infused products. This trend is particularly strong among younger demographics seeking alternatives to traditional pharmaceuticals. Evolving regulatory frameworks, particularly in regions like North America and Europe, are creating opportunities for legal market expansion. Regulatory clarity is crucial for market participants to navigate compliance and market entry.

Global Minor Cannabinoids Market: Key Datapoints

|

Market Value in 2023 |

US$ 17.8 Bn |

|

Market Value Forecast by 2034 |

US$ 42.3 Bn |

|

Growth Rate

|

8.2% |

|

Historical Data

|

2016 – 2022 |

|

Base Year

|

2023 |

|

Forecast Data

|

2024 – 2034 |

Increasing consumer interest in health and wellness products, coupled with the perceived therapeutic benefits of cannabinoids, is a major driver of market growth. Progressive cannabis legalization in various parts of the world, including the United States and parts of Europe, is expanding the addressable market for minor cannabinoids. Significant investments in research and development by pharmaceutical and biotechnology companies are accelerating product innovation and clinical trials. The market remains fragmented with opportunities for new entrants and niche players to introduce specialized products catering to specific consumer needs.

The COVID-19 pandemic initially disrupted supply chains and retail channels for minor cannabinoids products. However, the crisis also underscored the importance of health and wellness, leading to increased interest in natural remedies, including cannabinoids. As economies recover, the market is expected to rebound stronger.

The geopolitical tensions, such as the Russia-Ukraine conflict, have also affected global markets, including the minor cannabinoids sector. Fluctuating currency values, supply chain disruptions, and geopolitical uncertainty have impacted production and distribution channels. However, the long-term impact will depend on geopolitical developments and their influence on global trade and regulatory environments.

The minor cannabinoids market presents significant opportunities for growth and innovation, driven by evolving consumer preferences, regulatory advancements, and expanding research initiatives. Companies that can navigate regulatory complexities, invest in research and development, and respond to shifting consumer trends are well-positioned to capitalize on this emerging market. As the market matures, collaboration across sectors and regions will be crucial in unlocking the full potential of minor cannabinoids in various industries worldwide.

Global Minor Cannabinoids Market: Key Takeaways of the Report

- Cannabigerol (CBG) segment by product type is expected to grow at a CAGR of 6.7% in the minor cannabinoids market due to increasing research highlighting its potential therapeutic benefits, including anti-inflammatory, antimicrobial, and neuroprotective properties. As consumer awareness grows and regulatory environments become more favorable, there is heightened interest in CBG-based products for their diverse health applications, ranging from skincare to pharmaceutical formulations, driving sustained market demand and expansion.

- Pharmaceutical segment by application, leads the minor cannabinoids market with a significant revenue share of 35.8% owing to growing recognition of cannabinoids’ potential in therapeutic applications. Cannabinoids like CBD, CBG, and others show promise in treating conditions such as epilepsy, chronic pain, and anxiety disorders, backed by increasing clinical research and favorable regulatory developments. Pharmaceutical companies are investing heavily in cannabinoid-based drug development, driving market growth as they seek to capitalize on these compounds’ efficacy and market potential in addressing unmet medical needs.

- In 2023, Latin America is anticipated as fastest growing region in the global minor cannabinoids market due to evolving regulatory landscapes favoring cannabis legalization and cultivation. This shift is fostering a burgeoning industry infrastructure for cannabis extraction and product development. Additionally, increasing consumer acceptance of cannabinoid-based products for medicinal and wellness purposes is driving market expansion. With a vast potential consumer base and supportive regulatory frameworks, Latin America presents significant growth opportunities for companies seeking to enter or expand within the minor cannabinoids market.

Key Development:

- In December 2023, Rare Cannabinoid Company introduced Uplift Gummies infused with THC and THCV. These gummies combine the relaxing properties of Delta-9-THC with the energizing and appetite-controlling effects of CBD and THCV.

- In October 2022, High Tide Inc., a cannabis retailer, announced that its Colorado-based subsidiary, NuLeaf Naturals, had launched plant-based softgels and full-spectrum multicannabinoid oil in Manitoba. The products feature CBC, CBD, CBG, Delta-9 tetrahydrocannabinol (Delta 9), and CBN.

Browse Related Category Reports

Global Minor Cannabinoids Market:

- Aurora Europe GmbH

- BulKanna

- CBD. INC.

- Fresh Bros Hemp Company

- GCM Holdings, LLC (Global Cannabinoids)

- GenCanna.

- High Purity Natural Products.

- Laurelcrest

- Mile High Labs

- PBG Global

- Rhizo Sciences

- ZERO POINT EXTRACTION, LLC

- Other Industry Participants

Global Minor Cannabinoids Market

By Product Type

- Cannabigerol (CBG)

- Cannabichromene (CBC)

- Cannabinol (CBN)

- Cannabidivarin (CBDV)

- Tetrahydrocannabutol (THCB)

- Tetrahydrocannabivarin (THCV)

- Tetrahydrocannabiphorol (THCP)

- Others

By Application

- Pharmaceutical

- Pain Management

- Mental Health

- Sleep Disorders

- Anti-inflammatory

- Others

- Nutraceuticals

- Cosmetics and Personal Care

- Food and Beverages

- Others

By Region

- North America (U.S., Canada, Mexico, Rest of North America)

- Europe (France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe)

- Asia Pacific (China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific)

- Middle East & Africa (Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa)

- Latin America (Brazil, Argentina, Rest of Latin America)

Consult with Our Expert:

Jay Reynolds

The Niche Research

Japan (Toll-Free): +81 663-386-8111

South Korea (Toll-Free): +82-808- 703-126

Saudi Arabia (Toll-Free): +966 800-850-1643

United Kingdom: +44 753-710-5080

United States: +1 302-232-5106

Email: askanexpert@thenicheresearch.com

Website: www.thenicheresearch.com

-

Cannabis2 weeks ago

Cannabis2 weeks agoIM Cannabis Shares Commence Trading on 6:1 Consolidated Basis

-

Cannabis2 weeks ago

Cannabis2 weeks agoFractional Flow Reserve Market growing at a CAGR of 15.56% during the forecast period [2024-2030] – Exactitude Consultancy

-

Cannabis1 week ago

Cannabis1 week agoBlank Rome Bolsters Energy Industry Team in Houston and Pittsburgh with Leading Transactional Group

-

Cannabis1 week ago

Cannabis1 week agoManitoba Harvest Hemp Foods and Brightseed® Introduce New Coffee and Chocolate Flavors in Organic Bioactive Fiber Supplement for Gut Health

-

Cannabis4 days ago

Cannabis4 days agoEurope Medical Cannabis Oil Market Set to Reach Valuation of USD 2,395.83 Million by 2032 | Astute Analytica

-

Cannabis4 days ago

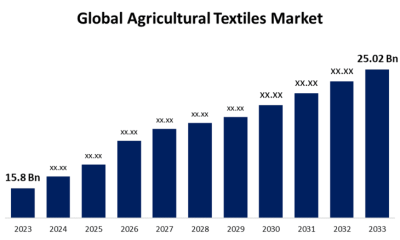

Cannabis4 days agoGlobal Agricultural Textiles Market Size To Worth USD 25.02 Billion By 2033 | CAGR of 4.70%

-

Cannabis1 day ago

Cannabis1 day agoUnlocking New Horizons in Health: TNR, The Niche Research Reveals the Transformative Power of Minor Cannabinoids

-

Cannabis15 hours ago

Cannabis15 hours agoVerano Announces the Opening of Zen Leaf Fairless Hills, the Company’s Newest Affiliated Dispensary in Pennsylvania, in Prime New Location