Cannabis Law

StateHouse Holdings Announces New Distribution Partnership with Nabis StateHouse Holdings Inc. Logo (CNW Group/StateHouse Holdings Inc.)

Photo Source: https://www.statehouseholdings.com/

Outsourcing distribution enables the Company to reduce costs and focus on optimizing retail and wholesale operations –

StateHouse Holdings Inc. (“StateHouse” or the “Company”) (CSE: STHZ) (OTCQX: STHZF), a California-focused, vertically integrated cannabis enterprise, today announced that it has entered into a strategic partnership (the “Partnership”) with Nabis, California’s largest cannabis distributor, under which the Company is outsourcing all of its cannabis distribution.

Under the terms of the Partnership, Nabis has assumed all of StateHouse’s distribution obligations effective today. Nabis has a leading cannabis wholesale platform in California and is the state’s single largest distributor of cannabis. It is the ideal partner to ensure broad and efficient distribution of StateHouse’s products. Given the scale of the Nabis platform, StateHouse expects the Partnership to expand the reach of its brands across the state(1).

The Partnership is expected to create millions of dollars of cost savings(1) for the Statehouse. Savings are expected to be achieved through lower headcount and through reduced costs related to insurance, fuel, truck leasing, banking fees, and overtime pay.

Outsourcing distribution also enables the Company to put greater focus on optimizing its leading retail and wholesale operations in California to further expand margins and market share.

“We are very pleased to enter this strategic partnership with Nabis, a strong and reliable distribution partner that has extensive reach across California,” said Ed Schmults, Chief Executive Officer. “The cost reductions and expanded distribution footprint that we anticipate(1) from this partnership will be highly beneficial as we work to build a business that we expect will be EBITDA(2) positive next year.”

(1) This is forward-looking information and based on a number of assumptions. See “Cautionary Note Regarding Forward-Looking Information” below.

(2) This is a non-IFRS reporting measure. For a reconciliation of this to the nearest IFRS measure, see “Use of Non-IFRS Measures” and “Non-IFRS Measures” in the Company’s management discussion and analysis for the period ending June 30, 2022. See “Non-IFRS Measures, Reconciliation and Discussion”.

StateHouse, a vertically integrated enterprise with cannabis licenses covering retail, major brands, distribution, cultivation, nursery, and manufacturing, is one of the oldest and most respected cannabis companies in California. Founded in 2006, its predecessor company Harborside was awarded one of the first six medical cannabis licenses granted in the United States. Today, the Company operates 13 dispensaries covering Northern and Southern California and one in Oregon, distribution facilities in San Jose and Los Angeles, California, and integrated cultivation/production facilities in Salinas and Greenfield, California. StateHouse is a publicly listed company, currently trading on the Canadian Securities Exchange (“CSE”) under the ticker symbol “STHZ” and the OTCQX under the ticker symbol “STHZF”. The Company continues to play an instrumental role in making cannabis safe and accessible to a broad and diverse community of California and Oregon consumers.

This news release contains “forward-looking information” and “forward-looking statements” (collectively, “forward-looking statements”) within the meaning of the applicable Canadian and United States securities legislation. To the extent, any forward-looking information in this news release constitutes “financial outlooks” or “future-oriented financial information” within the meaning of applicable Canadian securities laws, the reader is cautioned not to place undue reliance on such information. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates, and projections as at the date of this news release. Any statement that involves discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements. In this news release, forward-looking statements include, among other things, statements relating to the ability of Nabis to manage the Company’s distribution and achieve cost reductions due to the outsourcing of distribution operations.

These forward-looking statements are based on reasonable assumptions and estimates of management of the Company at the time such statements were made. Actual future results may differ materially as forward-looking statements involve known and unknown risks, uncertainties, and other factors which may cause the actual results, performance, or achievements of the Company to materially differ from any future results, performance, or achievements expressed or implied by such forward-looking statements. Such factors, among other things, include: implications of the COVID-19 pandemic on the Company’s operations; fluctuations in general macroeconomic conditions; fluctuations in securities markets; expectations regarding the size of the cannabis markets where the Company operates; changing consumer habits; the ability of the Company to successfully achieve its business objectives; plans for expansion and acquisitions; political and social uncertainties; inability to obtain adequate insurance to cover risks and hazards; employee relations; the presence of laws and regulations that may impose restrictions on cultivation, production, distribution, and sale of cannabis and cannabis-related products in the markets where the Company operates; and the risk factors set out in the Company’s management’s discussion and analysis for the period ended March 31, 2022, and the Company’s listing statement dated May 30, 2019, which are available under the Company’s profile on www.sedar.com. Although the forward-looking statements contained in this news release are based upon what management of the Company believes, or believed at the time, to be reasonable assumptions, the Company cannot assure shareholders that actual results will be consistent with such forward-looking statements, as there may be other factors that cause results not to be as anticipated, estimated or intended. Readers should not place undue reliance on the forward-looking statements and information contained in this news release. The Company assumes no obligation to update the forward-looking statements of beliefs, opinions, projections, or other factors, should they change, except as required by law.

The Company, through several of its subsidiaries, is directly involved in the manufacture, possession, use, sale, and distribution of cannabis in the recreational and medicinal cannabis marketplace in the United States. Local state laws where the Company operates permit such activities however, investors should note that there are significant legal restrictions and regulations that govern the cannabis industry in the United States. Cannabis remains a Schedule I drug under the United States Controlled Substances Act, making it illegal under federal law in the United States to, among other things, cultivate, distribute or possess cannabis in the United States. Financial transactions involving proceeds generated by, or intended to promote, cannabis-related business activities in the United States may form the basis for prosecution under applicable United States federal money laundering legislation.

While the approach to enforcement of such laws by the federal government in the United States has trended toward non-enforcement against individuals and businesses that comply with recreational and medicinal cannabis programs in states where such programs are legal, strict compliance with state laws with respect to cannabis will neither absolve the Company of liability under United States federal law nor will it provide a defense to any federal proceeding which may be brought against the Company. The enforcement of federal laws in the United States is a significant risk to the business of the Company and any proceedings brought against the Company thereunder may adversely affect the Company’s operations and financial performance.

This news release does not constitute an offer to sell, or a solicitation of an offer to buy, any securities in the United States. The Company’s securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”) or any state securities laws and may not be offered or sold within the United States or to U.S. Persons unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available.

The CSE has neither approved nor disapproved the contents of this news release. Neither the CSE nor its Market Regulator (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: StateHouse Holdings Inc.

Cannabis Law

WSWA Announces Commitment to Federal Legalization and Regulation of Adult-Use Cannabis

Wine & Spirits Wholesalers of America (WSWA) today announced a commitment to advocating for the federal legalization and regulation of adult-use cannabis by applying regulations similar to those implemented for alcohol, making them the first alcohol industry trade association to do so. In a letter shared yesterday with members of Congress, the association presented a comprehensive and robust federal regulatory framework along with warnings that addressing the issue in a “piecemeal manner” will result in de facto federal legalization that does nothing to address product safety, trade practices, or interstate sales and enforcement.

“The time has come for Congress to legalize and regulate adult-use cannabis at the federal level,” said WSWA CEO and President Francis Creighton. “The success of our alcohol regulatory system offers a proven model for cannabis regulation, one that will promote public health and safety as well as a fair and competitive marketplace.”

WSWA’s framework is built on four principles drawing on long-established federal laws governing the alcohol industry. With an emphasis on public safety and accountability, this system will provide a transparent and effective framework for adult-use cannabis production, testing, distribution and tax collecting. First released in 2021, the association updated its Principles for Comprehensive Federal Legalization and Oversight of the Adult-use Cannabis Supply Chain, alongside the announced commitment to actively advocate on the issue.

WSWA’s Principles for Comprehensive Federal Legalization and Oversight of the Adult-use Cannabis Supply Chain are rooted in four pillars:

- The federal permitting of cannabis producers, importers, testing facilities and distributors.

- The federal approval and regulation of “cannabis products and product labels”

- The efficient and effective collection of federal excise tax.

- Effective federal measures to ensure public safety.

“States have successfully regulated the alcohol market for their citizens for nearly 90 years — they should retain the authority to regulate cannabis in the manner that best suits their local needs, including being able to choose not to legalize the product in their state,” said Creighton. “Federal regulation of cannabis should focus on issues of public health and safety and interstate commerce, such as standard potency measurements, labeling and marketing guidelines, the licensing of producers, testing facilities and distributors, collecting excise taxes, and properly funding impaired driving prevention and enforcement.”

“Efforts that fail to include these critical regulatory provisions risk exposing consumers, communities, and industry businesses nationwide to the widening negative impacts of legalization already being seen in the marketplace without adequate federal oversight,” added Creighton.

WSWA is actively briefing members of Congress and staff on the importance of a strong regulatory structure based on the alcohol industry regulatory framework as the model of public safety, responsible distribution and retail practices.

As reported by POLITICO’s Natalie Fertig, “What WSWA feels they can bring to the conversation — besides the strength of their lobbying experience and network — is knowledge of how the Alcohol and Tobacco Tax and Trade Bureau regulates an industry producing and selling an intoxicating product. Most proposals for cannabis decriminalization, like Senate Majority Leader Chuck Schumer’s Cannabis Administration and Opportunity Act, divide oversight and regulation of the industry between the Food and Drug Administration and the TTB, which is part of the Treasury Department.”

Those interested in joining WSWA as a coalition partner as well as to stay up to date on the latest policy news should visitwww.wswa.org/cannabis-legalization-regulation.

Cannabis Law

CANOPY GROWTH ANNOUNCES US$150 MILLION REGISTERED DIRECT OFFERING

Canopy Growth Corporation (“Canopy Growth” or the “Company“) (TSX: WEED) (NASDAQ: CGC) announced today that it has entered into an agreement (the “Agreement“) with an institutional investor (the “Institutional Investor“) for the purchase and sale of up to US$150,000,000 aggregate principal amount of senior unsecured convertible debentures (the “Convertible Debentures“).

Pursuant to the terms of the Agreement, the Institutional Investor purchased an initial US$100,000,000 of the Convertible Debentures and an additional US$50,000,000 of the Convertible Debentures will be purchased in the event that certain conditions outlined in the Indenture (as defined below) are satisfied or waived. As further described below, no cash will be payable by Canopy Growth in any circumstances in respect of principal, interest or any other amounts owing pursuant to the terms of the Convertible Debentures.

“Canopy Growth is executing a strategy focused on accelerating growth and profitability by transforming our Canadian operations and fast-tracking entry into the U.S. market,” said Judy Hong, Chief Financial Officer of Canopy Growth. “Building on other recent actions taken to enhance cash flow, this attractive capital immediately adds to Canopy Growth’s cash on hand and provides additional flexibility to continue advancing strategic priorities”.

The Convertible Debentures were purchased pursuant to a registration statement on Form S-3ASR with the United States Securities and Exchange Commission with respect to the offer and sale of the Convertible Debentures and the common shares of the Company (the “Common Shares“) underlying the Convertible Debentures. The Convertible Debentures were sold at US$1,000 per Convertible Debenture and bear interest at a rate of 5.0% per annum, payable in Common Shares at the earlier of (i) the time of conversion of the Convertible Debentures; or (ii) February 28, 2028 (the “Maturity Date“). No cash payment will be payable by Canopy Growth in any circumstances in respect of principal, interest or any other amounts owing pursuant to the terms of the indenture dated February 21, 2023 between the Company and Computershare Trust Company of Canada (the “Indenture“), as trustee, governing the Convertible Debentures. The Convertible Debentures are convertible into Common Shares at the option of the Institutional Investor at a conversion price equal to 92.5% of the three-day volume-weighted average price of the Common Shares ending on the trading day prior to conversion. On the Maturity Date, the principal amount of the Convertible Debentures, including any accrued but unpaid interest, will also be paid in Common Shares.

The Company intends to use the proceeds from the offering for working capital and general corporate purposes.

Additionally, the Company does not plan to list the Convertible Debentures on the NASDAQ, or any other securities exchange or other trading system.

ATB Capital Markets Inc. acted as sole placement agent in connection with this offering.

Cannabis Law

Mystic Medicinal in High Demand, Rapidly Becoming Oklahoma’s go-to Dispensary for True Topshelf Craft Cannabis

Since the switch was flipped for all dispensaries in Oklahoma to exclusively sell Metrc compliant medical marijuana, demand for Mystic Medicinal’s product has skyrocketed. Mystic flower can already be found in Tulsa, Norman, Broken Arrow, Sapulpa, Catoosa, Glenpool, Jenks, Del City, Muskogee, Hominy and Cleveland. Over 36 dispensaries and counting throughout Oklahoma now carry Mystic’s pungent as it is potent, sticky as it is stinky bud brand. Budtenders, dispensary owners, and patients alike have all fallen in love with Mystic Medicinal’s flower, calling it the best they’ve seen in the state.

“This is TRUE medicine.” Vance Young, Purchasing Manager and Processor, Barn 66 Dispensary, Catoosa, OK

Lemon Granita, Knuckle Sandwich, Pineapple Trainwreck, Grease Monkey, Papaya Punch, Purple Punch, Durban Poison, Blue Dream, and Kashmir Cookies were the first Mystic strains introduced. Chocolate Gelato, Sour Lemon Cake, and Super Silver Haze are all coming soon, with strain exclusivity partnership opportunities available for market-savvy dispensaries.

“I can’t wait for the Chocolate Gelato and Durban Poison. The Mystic Medicinal’s Knuckle Sandwich is the best Knuckle Sandwich that I’ve ever seen by a long shot!” Jared Pendergraft, Product Manager, Nature’s Kiss, Tulsa, OK

Between all of Mystic Medicinal’s sativa, sativa dominant hybrid, indica dominant hybrid, and hybrid strains, Mystic is giving dispensaries and patients what they want. Craft cannabis strains grown to their full potential, rare Mystic exclusive strains, old school favorite Mystic classic strains, and a large menu with a variety of strains to ensure a strain favorite for every medical marijuana patient’s distinct tastes and needs.

“Really enjoyed the bud structure, smell and terps.” Mel, Owner Exotic M&M Dispensary, Tulsa, OK

Labs have come back showing THC levels ranging from 32% to 18%, total cannabinoid weight from 38.5% to 22.2%, and terpene mass from 2.82% to 1.23%. A robust variety of terpene profiles are present throughout the lineup that include myrcene, limonene, terpinolene, linalool, caryophyllene, nerolidol, bisabolol, ocimene, pinene, humulene, and cedrene; and while THCA consistently remains the primary cannabinoid found in all Mystic strains, Δ9-THC, CBG, CBGA, and CBD are all strong secondary contributors.

“Mystic Medicinal has set the bar at my shop for quality and patient-driven products. The Durban poison is my personal favorite for daily use!” Stephanie Pate, Manager, 918 Elevate, Tulsa, OK

-

Cannabis2 weeks ago

Cannabis2 weeks agoIM Cannabis Shares Commence Trading on 6:1 Consolidated Basis

-

Cannabis2 weeks ago

Cannabis2 weeks agoFractional Flow Reserve Market growing at a CAGR of 15.56% during the forecast period [2024-2030] – Exactitude Consultancy

-

Cannabis1 week ago

Cannabis1 week agoBlank Rome Bolsters Energy Industry Team in Houston and Pittsburgh with Leading Transactional Group

-

Cannabis1 week ago

Cannabis1 week agoManitoba Harvest Hemp Foods and Brightseed® Introduce New Coffee and Chocolate Flavors in Organic Bioactive Fiber Supplement for Gut Health

-

Cannabis5 days ago

Cannabis5 days agoEurope Medical Cannabis Oil Market Set to Reach Valuation of USD 2,395.83 Million by 2032 | Astute Analytica

-

Cannabis4 days ago

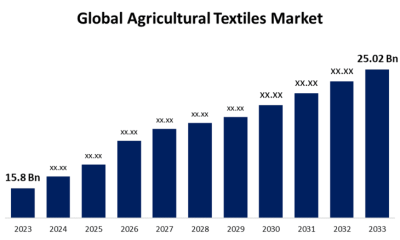

Cannabis4 days agoGlobal Agricultural Textiles Market Size To Worth USD 25.02 Billion By 2033 | CAGR of 4.70%

-

Cannabis2 days ago

Cannabis2 days agoUnlocking New Horizons in Health: TNR, The Niche Research Reveals the Transformative Power of Minor Cannabinoids

-

Cannabis20 hours ago

Cannabis20 hours agoVerano Announces the Opening of Zen Leaf Fairless Hills, the Company’s Newest Affiliated Dispensary in Pennsylvania, in Prime New Location